Good Evening, The market continues to ebb and flow on five core issues. #1. The pandemic (new cases and deaths from Covid-19, reports on a vaccine) #2. The ongoing recovery from the economic shutdown as reflected through corporate and economic reports. #3 Stimulus efforts by the Government and the Federal reserve to support the economy. #3 Ongoing tensions with China over their handling of the Corona Virus outbreak as well as trade #4 Ongoing protests related to the Black Lives Matter movement and #5 Political unrest do to the US Elections to be held in less than 100 days. Each of these issues inject a fresh dose of uncertainty into the market with every new press release and if there’s one thing the market doesn’t handle well it’s uncertainty! I heard one of the analysts describe the market as news driven recently and I really can’t disagree. Today the big concerns were a continued spike in cases of corona virus with Florida reporting a record one day rise in cases of the virus, wrangling in the US congress over a new stimulus package, and an economic report showing a drop in consumer confidence during the month of July. I’ll also throw one in that the media didn’t talk a lot about and the was McDonald’s quarterly report which showed a 27% drop in revenue. They usually do better during economic downturns due to their affordable menu but not this time. The Micky D’s report is a direct reflection of how hard the restaurant business is getting hit by the pandemic. On the flip side it also reflects an american consumer that’s holding back and that’s not a good thing for recovery. Folks this thing is far from over we could easily see another significant downturn with the right news. In my humble opinion everything hinges on continued reports on the many vaccine candidates that are being developed. Each good report on those brings us one step closer to a sustained and lasting recovery. Just as one bad piece of news could send us down for the count, one good piece on news such as a completed vaccine could lead us higher, much higher…… and that’s why I’m still in the market……I continue to give my worry to the Lord and seek His guidance as we move forward. Moving into the fall it is extremely clear that the market will be molded by two main issues. Who wins the elections and if there will be a vaccine. Of course the latter issue has the greatest weight. Let me put it to you like this. Plain and simple. If you don’t believe we will have a vaccine before the end of January then get out of the market…..If you are in the market then you are betting that we will have a vaccine.

The days trading left us with the following results: Our TSP allotment fell back -1.00%. For comparison, the Dow fell -0.77%, the Nasdaq -1.27%, and the S&P 500 -0.65%.

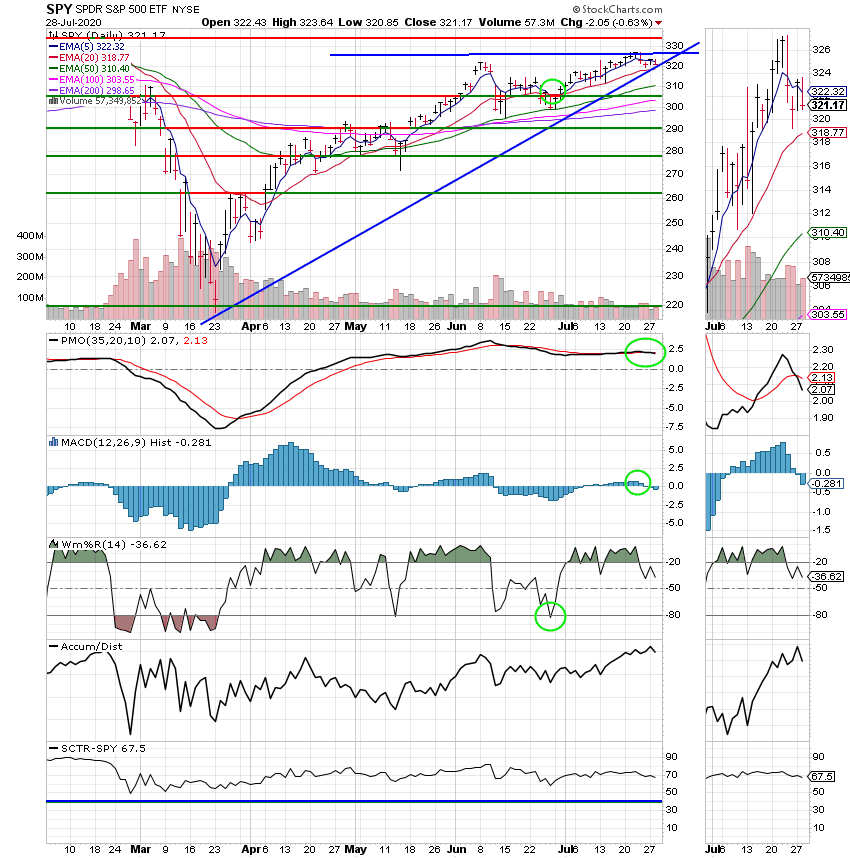

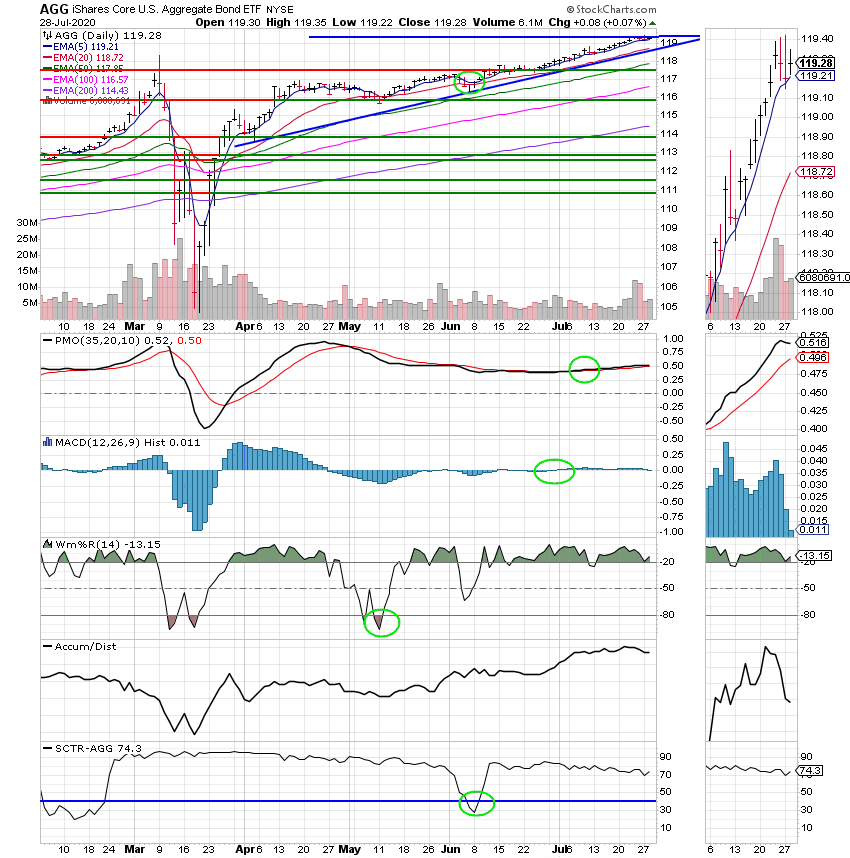

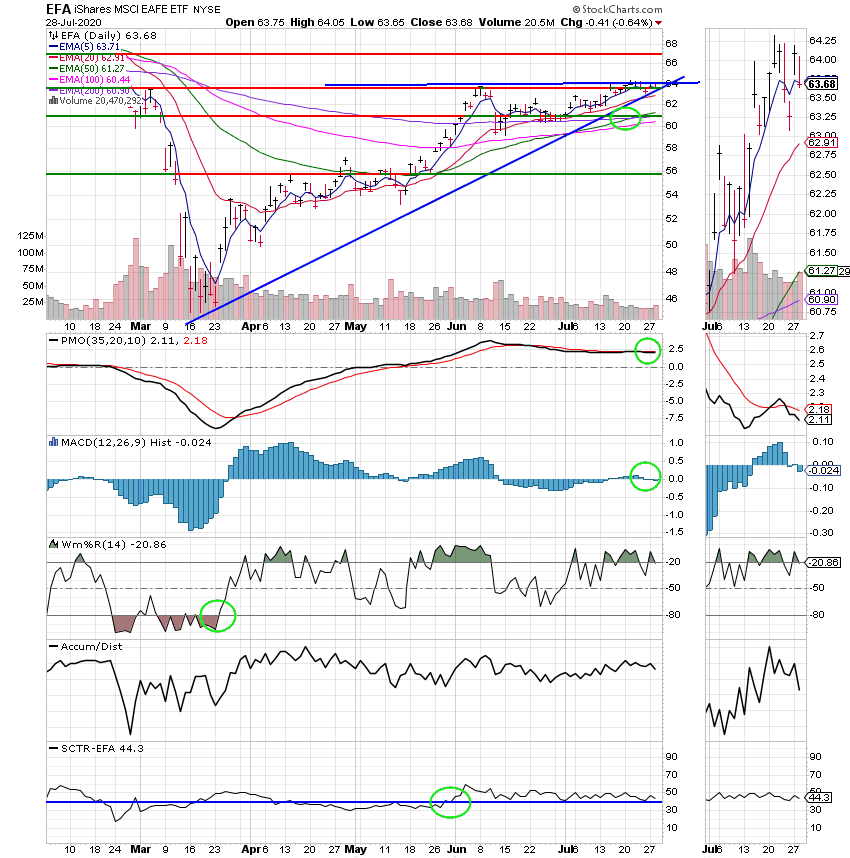

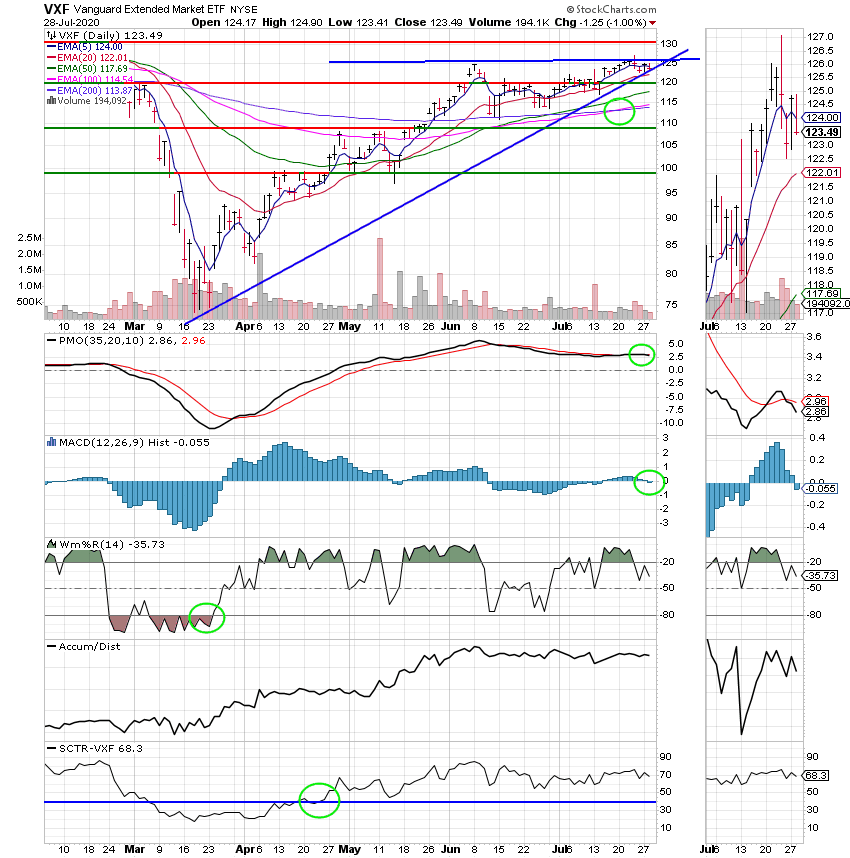

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/S. Our allocation is now +20.39% for the year not including the days results. Here are the latest posted results:

| 07/27/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4557 | 21.1516 | 47.87 | 55.8738 | 30.6782 |

| $ Change | 0.0010 | -0.0145 | 0.3519 | 0.7945 | 0.2681 |

| % Change day | +0.01% | -0.07% | +0.74% | +1.44% | +0.88% |

| % Change week | +0.01% | -0.07% | +0.74% | +1.44% | +0.88% |

| % Change month | +0.05% | +1.12% | +4.58% | +5.45% | +5.46% |

| % Change year | +0.64% | +7.27% | +1.29% | -0.71% | -6.23% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.3885 | 10.2411 | 34.9251 | 10.3172 | 38.3979 |

| $ Change | 0.0412 | 0.0449 | 0.1844 | 0.0599 | 0.2429 |

| % Change day | +0.19% | +0.44% | +0.53% | +0.58% | +0.64% |

| % Change week | +0.19% | +0.44% | +0.53% | +0.58% | +0.64% |

| % Change month | +1.19% | +2.41% | +3.10% | +3.17% | +3.69% |

| % Change year | +0.96% | +2.41% | +0.21% | +3.17% | +-0.08% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.3693 | 22.393 | 10.4653 | 10.4654 | 10.4655 |

| $ Change | 0.0705 | 0.1625 | 0.0926 | 0.0926 | 0.0925 |

| % Change day | +0.68% | +0.73% | +0.89% | +0.89% | +0.89% |

| % Change week | +0.68% | +0.73% | +0.89% | +0.89% | +0.89% |

| % Change month | +3.69% | +4.20% | +4.65% | +4.65% | +4.66% |

| % Change year | +3.69% | -0.40% | +4.65% | +4.65% | +4.66% |