Good Morning, I’d like to tell you that everything has changed and the market is now heading straight back up, but that’s just not that case. Have things improved? Yes. slightly. I do believe that the bottom of this bear market was established in the last month. So I have reinvested in equities both here and on the street with a reasonable confidence that the lows reached in the last month will not be broken. However, I do believe that the market could retest the lows set in June and July. We talked about this in previous blogs. This market is not the same market that it was from 2009 through 2021. It no longer has the stimulus applied by the Fed to fuel all those V Shaped recoveries. Current investors have been conditioned to believe that when the market recovers it will move straight back up just as it has most or all of their investing careers. It might do that in a perfect world but this world is not and never will be perfect until the return of our Lord and Savoir Jesus Christ. They will become increasingly frustrated as the market continues to move higher and lower while it (hopefully) sets new highs and new lows. That is the new normal. That is how things work now! Also as we said earlier, what used to take days and weeks will now take weeks and months. No quick bail outs!! You will have to closely study the charts to determine whether or not the market is making progress. In other words if it is setting higher lows and higher highs. While we got caught up in this bear market (our first one ever) we still understand from the past how much of an advantage it is to sidestep such selloffs. Let me chase one rabbit. Why did we get caught up in this selloff?? It was simply due to the lifting of various forms of fiscal stimulus. We ignored our indicators that were screaming at us to sell last September just as we had made a habit of ignored them since 2009. Quite frankly, when the stimulus was applied they quit working and when the stimulus was removed they started working again. Nonetheless, it was unprecedented when stimulus was removed so we really had no precedent to tell us when the indicators we had relied on before 2009 would start working again. So we did what most investors would do. We stuck with what was working until it no longer worked. This gave many the illusion that the buy and hold strategy was superior to what we do. The fact is those who bought and held over the same time period will never catch up to us in there entire careers. That is how much we have out performed the market over the past 25 years. Sure we had to make an adjustment and we did. So here we are. I have always told all of you to do what works best for you. The only thing I would caution you to do is to look closely at what your doing to make sure that it’s not just a flash in the pan. That it will indeed keep working. Buy and holding if you are as good as you can be at it will match the results of the major indices, but it will never beat them. Our investment system at My TSP Guide is not for everyone because it requires a little effort to understand. If you set it and forget it as our critics do you might you as well will be investing in the appropriate L Fund and spend your time elsewhere. After all time is money and money is time……… The bottom line is this. If you want to out perform the market it is going to take a little effort. It takes effort to make the correct investments and to know where your at. Here’s a case in point. If you look at the last month, two months, three months or even six months you get a picture of what you have done in that short time period. If you have done well then you will look very good. If you missed the mark then not so much. If you are trying to out perform the market there will be times like these. Your not going to win everyday. That said the important thing to know is you have to be in it to win it. If you want to out perform the market then you have to move your money around. If you think that the best you can do is match the market then you need to by and hold. The former takes a lot of skill and the latter takes little or none. The reason that the the majority of the buy and hold folks are so convinced that they are absolutely right and we are absolutely wrong is that they simply can’t do any better. They either don’t have the skill or they don’t want to put forth the effort. So they pick a small period of time when their system has done well and say look at this. Look what we’ve done! Then they say look at what the others have done and by doing so deceive many. The point I want to make is that your careers are not a few months or even just a few years. They are twenty or thirty years. You are in this for the long haul. The reason those buy and hold folks only point out what they did in short periods of time is that that they know if you look at their results over a long period of time it will show that their performance lagged every time the market sold off and they know that yours did not. The next thing they will say is that you were lucky when that happened. Well if that’s the case then why did some of you end of with six figures more than they did at the end of your career??? That’s what you have to look at. Once again, if you are satisfied with matching the market then you are better off investing in an L Fund. Don’t listen to these folks. They are a waste of time. Nothing good comes easy but never forget that all good things come from God!

As far as today nothing has changed. Inflation and interest rates are determining the path of the market. Today we are waiting for tomorrows CPI (Consumer Price index) and Friday’s PPI (Producer price index) for the current rate of inflation. These reports will the greatest influencers of next months Fed policy. Right now it is widely accepted that they will raise rates another 0.75%. Expectations are for CPI to rise 0.2% month over month, and for core CPI to rise 0.5%. That would be a slowdown from the increases 1.3% and 0.7%, respectively, in June. We will see tomorrow! “If you get good abatement of inflation, in combination with this historically strong labor market, you can make a case that the June 16 low was a bottom for the market,” Kevin Simpson of Capital Wealth Planning said on “Squawk Box.” “And I know it sounds crazy, but there’s even a possibility that the Fed could thread this needle.” So needless to say, there are a lot riding on these reports. We can make our best guess on where this is going but no one knows for sure. That’s the reason we stick to the charts……..

The day’s trading is currently giving us the following results. Our TSP allotment is off -0.56%,. For comparison, the Dow has dropped -0.26%, the Nasdaq -1.38%, and the S&P 500 -0.56%.

Nasdaq falls for third straight day as chip stocks weigh on market

The the action so far has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/C. Our allocation is now -24.72% not including the days results. Here are the latest posted results:

| 08/08/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.9838 | 19.1334 | 63.0627 | 68.4783 | 33.3922 |

| $ Change | 0.0040 | 0.0854 | -0.0770 | 0.5497 | 0.0825 |

| % Change day | +0.02% | +0.45% | -0.12% | +0.81% | +0.25% |

| % Change week | +0.02% | +0.45% | -0.12% | +0.81% | +0.25% |

| % Change month | +0.06% | -0.58% | +0.26% | +3.20% | -0.67% |

| % Change year | +1.48% | -8.39% | -12.35% | -17.93% | -15.34% |

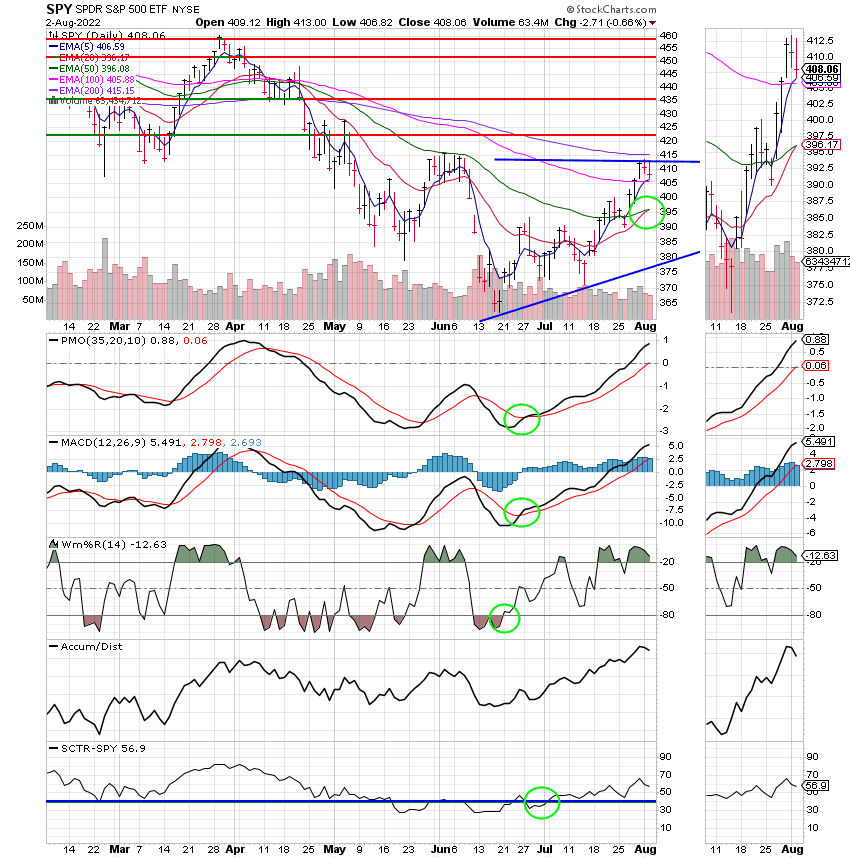

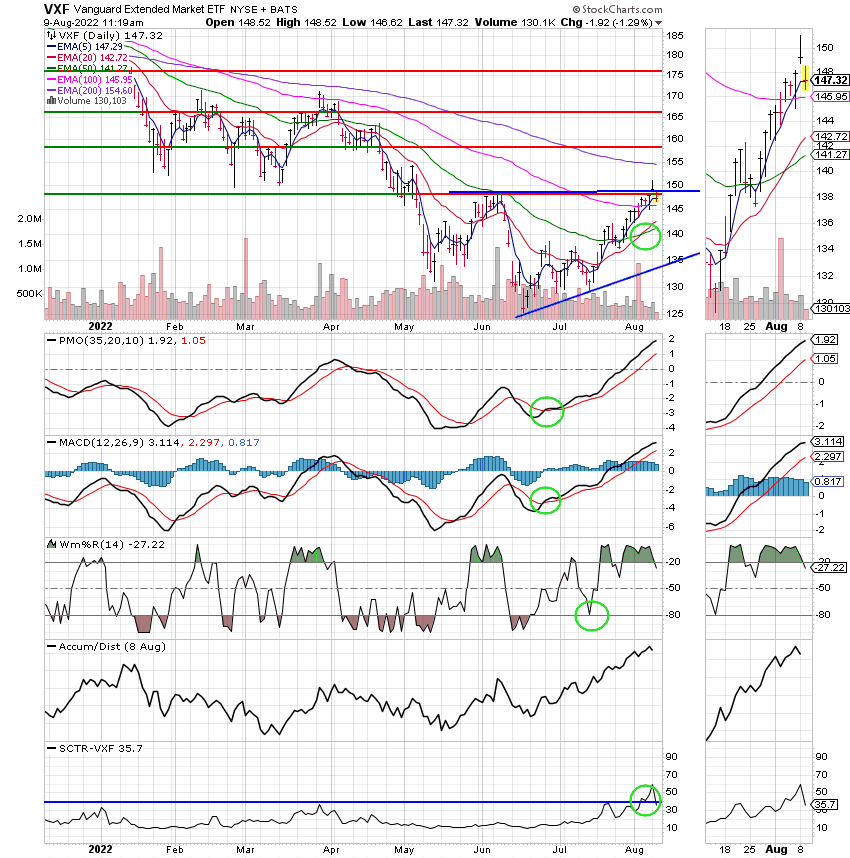

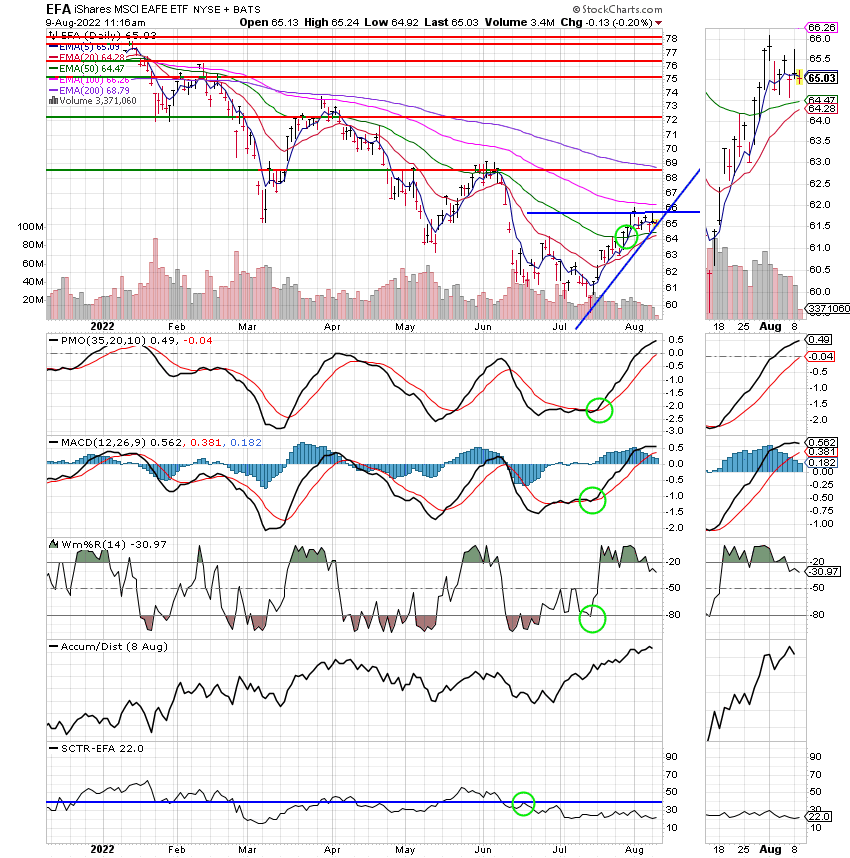

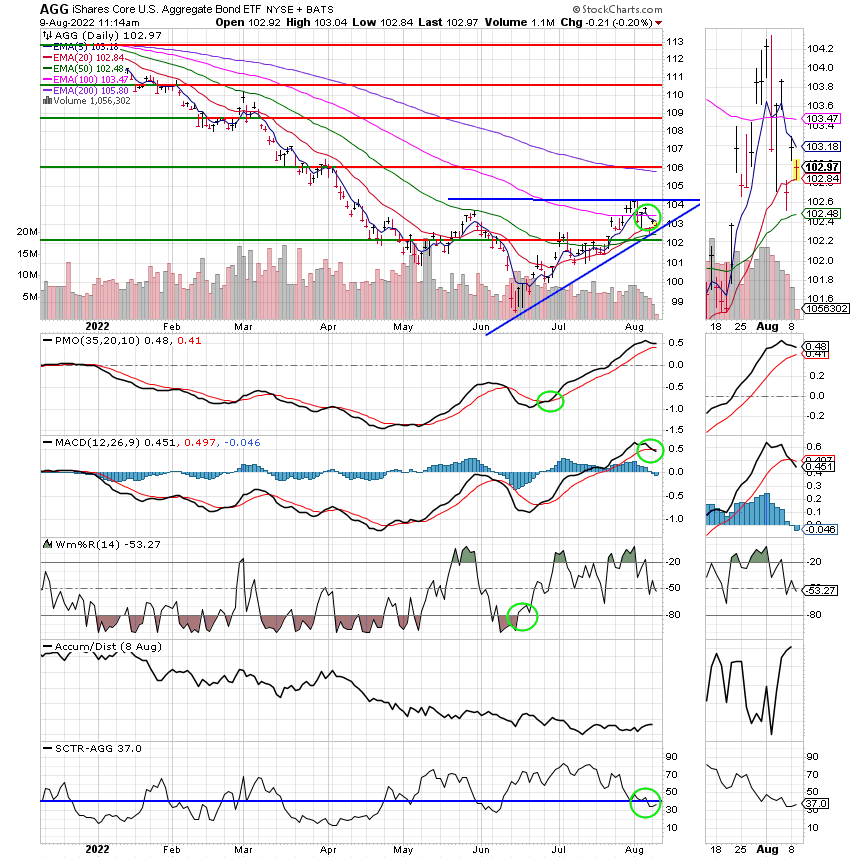

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Keep praying. God will deliver us from this bear! That’s all for today. Have a nice afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.