Good Afternoon, The latest catalyst to spur this rally was last weeks better than expected Consumer Price Index (CPI) and producer price index (PPI) reports showing inflation slowing just a bit. These reports led investors to think that the rate of inflation might finally be peeking. This in turn led to optimism that the Fed might not have to be as aggressive with interest rate increases as they indicated in the last published Fed minutes. We will see about that. My personal thoughts on that matter are that the Fed will probably move forward with a 0.75% (75 point) rate increase in September and take a more dovish tone in their post meeting statement. We will see…. As for today, positive earnings reports kept the rally rolling with Walmart (WMT) and Home Depot (HD) both exceeding expectations. Both Companies are considered bellwethers for the economy. The market has always been first and foremost about corporate reports as the corporations are what we are actually investing in. So in essence the overall health of the market is determined by how good or bad these reports are. A healthy market will usually have about 70% of corporate reports exceed analyst expectations. While we’re on the subject, for those of you that are new to investing and don’t know a lot about this, Corporations listed on the stock exchange are required by the SEC (Securities Exchange Committee that regulates the stock market) to report once per quarter on their company. The reports are lengthy documents that tell all about the companies that are listed, what they are doing, where they are going etc.. The parts of these reports that investors are most interested in are profit and guidance. Profit is usually described by investors as top and bottom line. The Top line is gross or total sales and the bottom line is net income or profit. These are project by the companies in their guidance and also by stock analysts following the company. Thus when a company does better than these figures it is referred to as exceeding expectations. When it is said that a company beat expectations on the top and bottom lines it means that they generated more total sales and profit than expected. If they exceeded on only the top line then they generated more income but less profit than anticipated. Inversely, if they fell short on the top line but beat on the bottom then they generated less sales but made more profit. For example a company could be going through hard times and cut jobs to make ends meet. So they had lower sales but still exceeded on profits. This may indicate a poor business climate but good management. There are many ways this information can be used and interpreted. This is just one example. Guidance is the part of the report that describes where the company projects that they are going. This is the part where they will project future business conditions or profit or describe such things as new acquisitions or products that they foresee. Usually though, when you hear that a company exceeded guidance it is referring to the fact that the company exceeded the amount of gross sales or profit that they forecasted in earlier guidance. The SEC has certain requirements for these reports. If you want to know what these are then click here. Oh yeah, have fun reading that…….. Whew, enough of that!!! You get the picture. We got some good reports and it kept the market moving forward. I will add one final thing on that subject. Investors are looking at these reports in a little different light at this time than they usually do. They are doing everything I said above, but they are also looking at the reports collectively to see how the overall economy is holding up as the Fed tightens rates to control inflation. They feel like it is ideal if the Fed can control inflation without driving the economy into a recession. That is often referred to in the media as a soft landing. That is to say that inflation was controlled without damaging the economy. Sometimes you need to know why investors are looking at a particular piece of data to determine how it will impact the market. It really depends on what they are looking at and how that information effects the psychology of the herd.

The days trading is currently generating the following results. Our TSP allotment is currently flat at -0.02%. For comparison, the Dow is currently up+0.52%, the Nasdaq is in the red -0.52%, and the S&P 500 is flat at -0.02%. Praise God for the recent rally though. It’s brought the market off it’s lows and appears to have put in a solid bottom.

Dow rises for fifth day, jumping 200 points after strong Walmart and Home Depot results

The recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/C. Our allocation is now -21.83% on the year not including the days results. Here are the latest posted results:

| 08/15/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.9932 | 19.1382 | 65.489 | 71.1147 | 33.9635 |

| $ Change | 0.0041 | 0.0432 | 0.2609 | 0.1616 | -0.1979 |

| % Change day | +0.02% | +0.23% | +0.40% | +0.23% | -0.58% |

| % Change week | +0.02% | +0.23% | +0.40% | +0.23% | -0.58% |

| % Change month | +0.12% | -0.55% | +4.12% | +7.18% | +1.03% |

| % Change year | +1.53% | -8.37% | -8.98% | -14.77% | -13.89% |

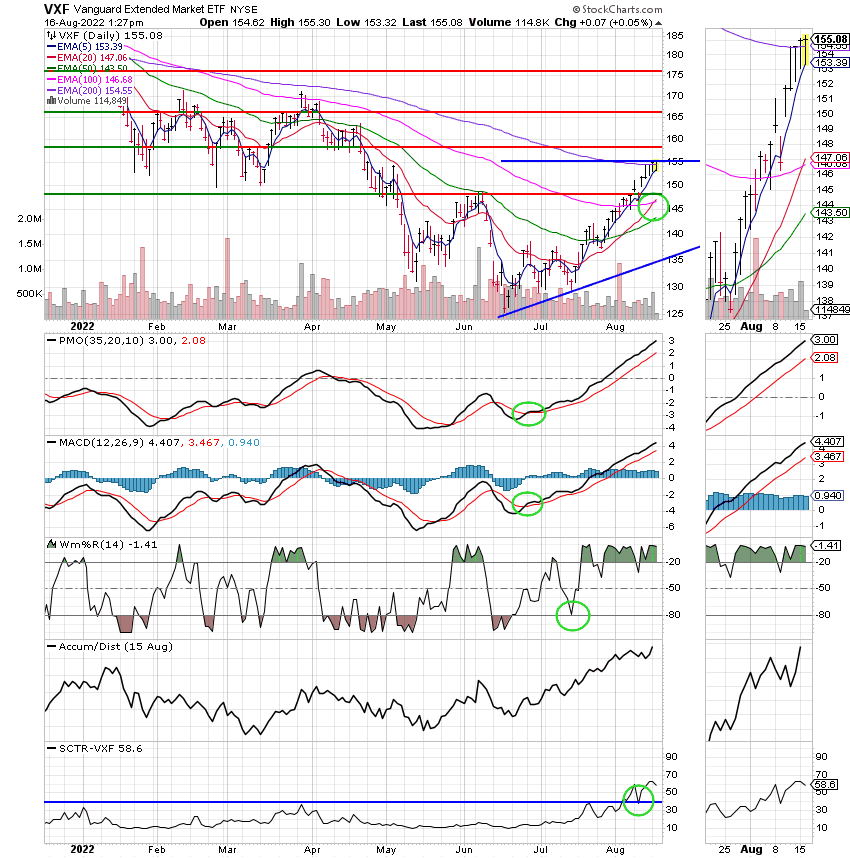

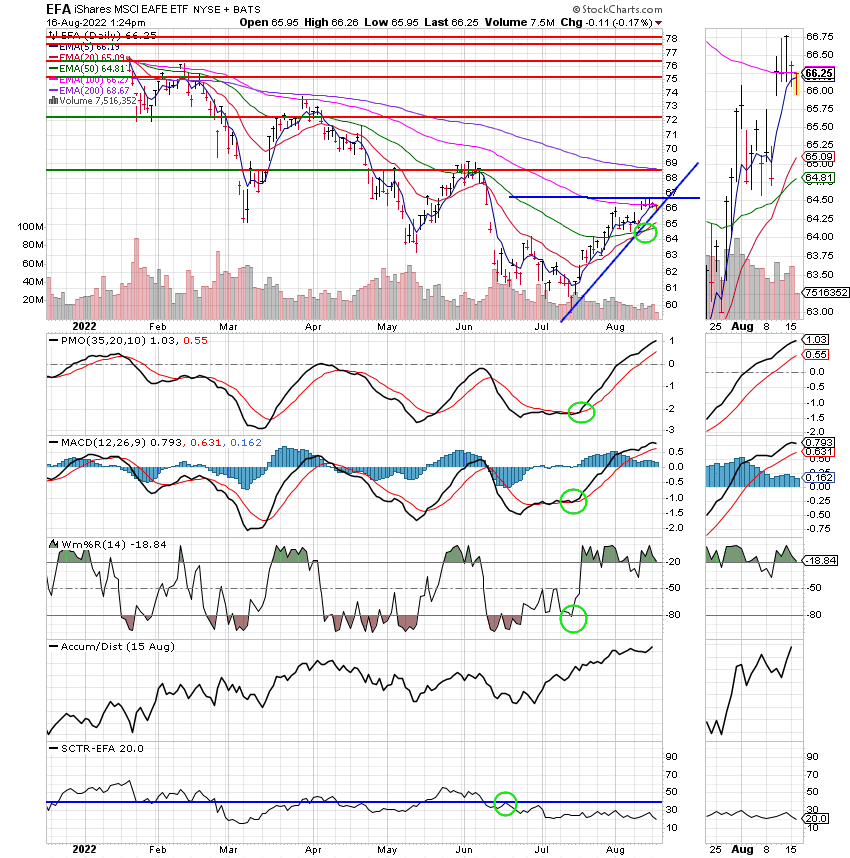

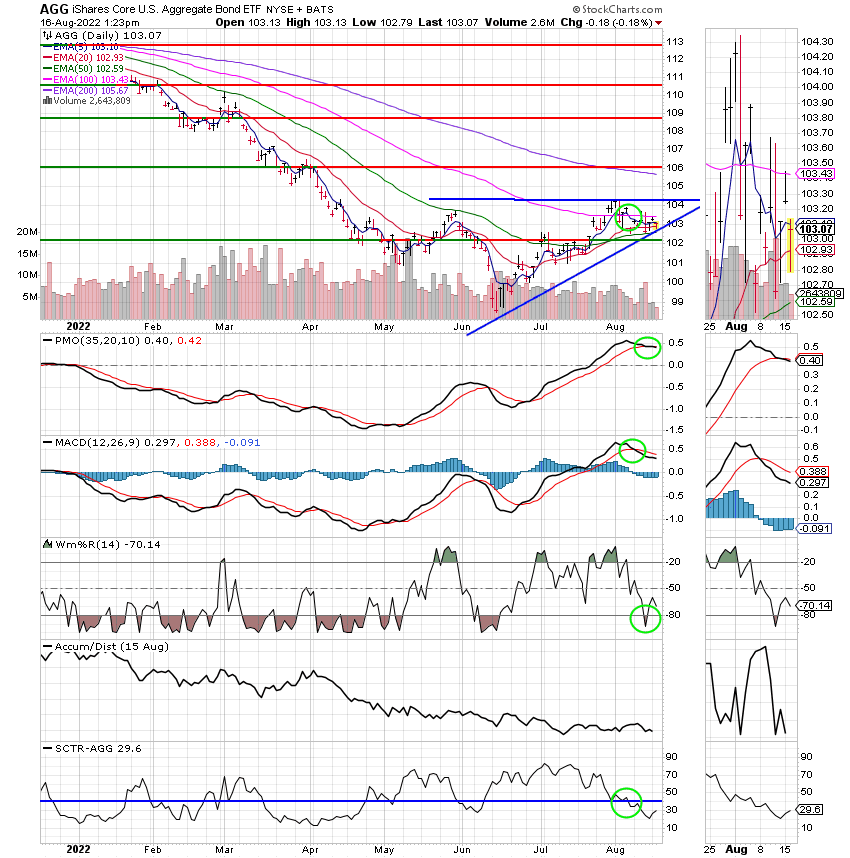

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Our task remains the same. To watch our charts for any change in the trend. Expect the level of market volatility to stay high while inflation remains at or near current levels. That’s all for today. Have a nice afternoon and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.