Good Afternoon, When I describe a market like this I like to use the old adage “A lot of smoke and no fire”. This is not a market where you should expect to make any money. So why are you invested then Scott??? First let me say as I always do that no one knows the future. While you may forecast some outcomes you will never be able to anticipate everything the market will throw at you. It is just impossible to accurately predict the future of the market when there are so many paths that it can take. Just when you think you’ve got it nailed down there comes along that surprise piece of news to mess it all up! We like to refer to those as landmines. Anyway you’ve all heard it before. We are trend followers. We react to the trend as we see it on the charts through the use of technical analysis. Now the answer to your question. The most recent buy signal allowed us to reenter equities. However, while we did have a buy signal some of our indictors told us that the market would remain volatile and that we would see big swings both higher and lower. This type of action usually produces only small overall moves in the direction that your signal indicates, be it higher or lower. So again, why invest? Why not be safe, stay in the G Fund and at least capture what little momentum it has to offer? The reason is that our charts show solid support at the lows set in June and July. While it is possible the market could retest those lows based on what we see on the charts we do not think those lows will be breached. So investing right now is not about making money right now. It’s about being positioned to make money in the future. It’s about being ready for the next big move higher when it comes. Even as the volatility decreases the next move higher will likely leave you behind if you are not already positioned to take advantage of it. So to answer your question definitively. We are investing now to be positioned for the next move higher. We do not know when that will be but we are pretty sure that support at the June and July lows will hold should the market move lower. Thus we think this is a good entry point and we are willing to wait for the next move higher as long as our charts will allow us to do so. We anticipate that the market will remain choppy and some what range bound for a period of months until the rate of inflation approaches 2%. Until then the market will continue to swing both lower and higher in response to each piece of news that is released related to the rate of inflation. In particular, the focus of investors will be on the Feds efforts to bring inflation under control which include raising interest rates and unwinding their balance sheet of previously purchased bonds and mortgage backed securities. You can expect the market to settle down as these Fed policies and inflation decrease. That said there is one thing I want to make clear. I will not hesitate to move back out of equites yet again if I get the signal to do so. While I do not anticipate that being the case you never know what will take place out there that could produce a new sell signal. So you enter every trade with the expectation that you may possibly have to unwind it at some point. Being well positioned for each new trend is how we have made our money over the years and while we are having a rough year this year, we are well ahead of where we would have been had we had a set it and forget it mentality. In the end you can stay invested in the basically the same thing for your entire career and take what the market gives you or you can try to improve it. Nothing ventured nothing gained. You have to be in it to win it. So keep praying and investing and watch what God does for you! Give Him all the praise for He is worthy!!

The days trading left us with the following results: our TSP allotment slipped -0.22%. For comparison the Dow dropped -0.47%, the Nasdaq -0.00%, and the S&P 500 -0.22%.

Dow falls 100 points after Wall Street suffers worst day since June

The days action left us with the following signals: C-Hold, S-Hold. I-Sell, F-Sell. We are currently invested at 100/C. Our allocation is now -24.68% on the year not including the days results. Here are the latest posted results.

| 08/22/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.0025 | 18.8485 | 63.0968 | 67.1784 | 32.6154 |

| $ Change | 0.0040 | -0.0779 | -1.3730 | -1.5077 | -0.5453 |

| % Change day | +0.02% | -0.41% | -2.13% | -2.20% | -1.64% |

| % Change week | +0.02% | -0.41% | -2.13% | -2.20% | -1.64% |

| % Change month | +0.17% | -2.06% | +0.32% | +1.25% | -2.98% |

| % Change year | +1.59% | -9.76% | -12.30% | -19.49% | -17.31% |

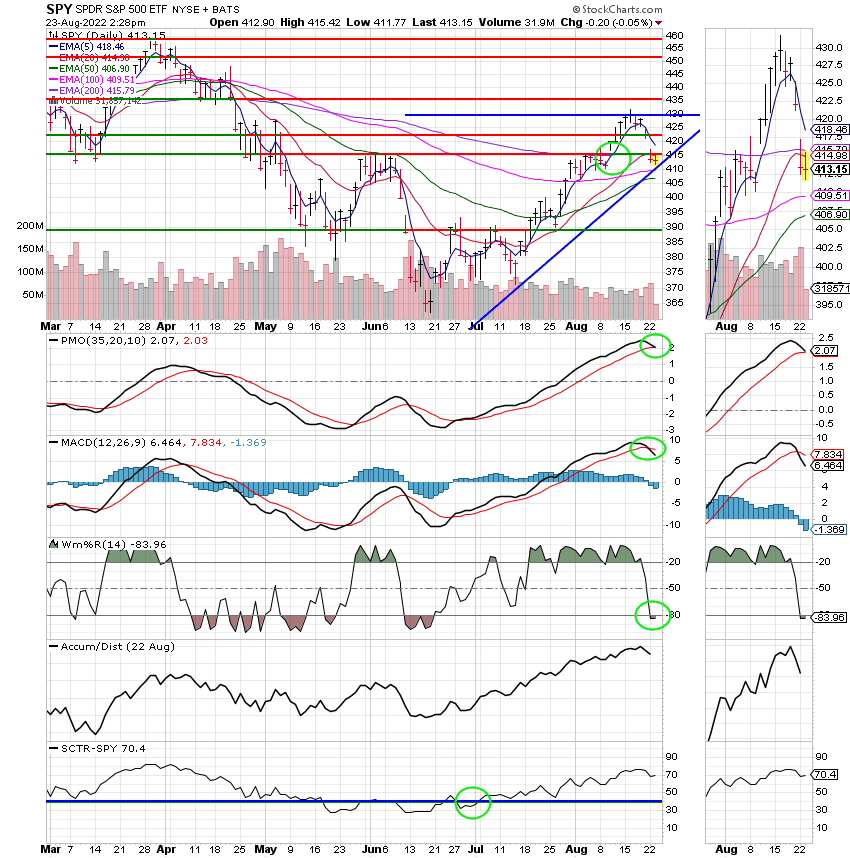

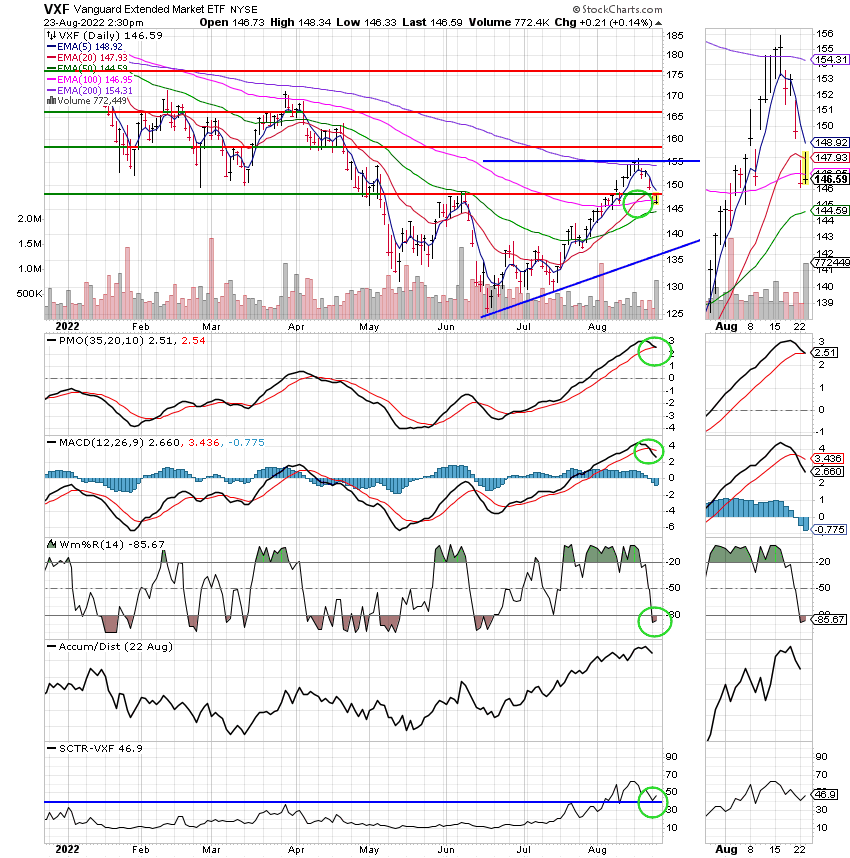

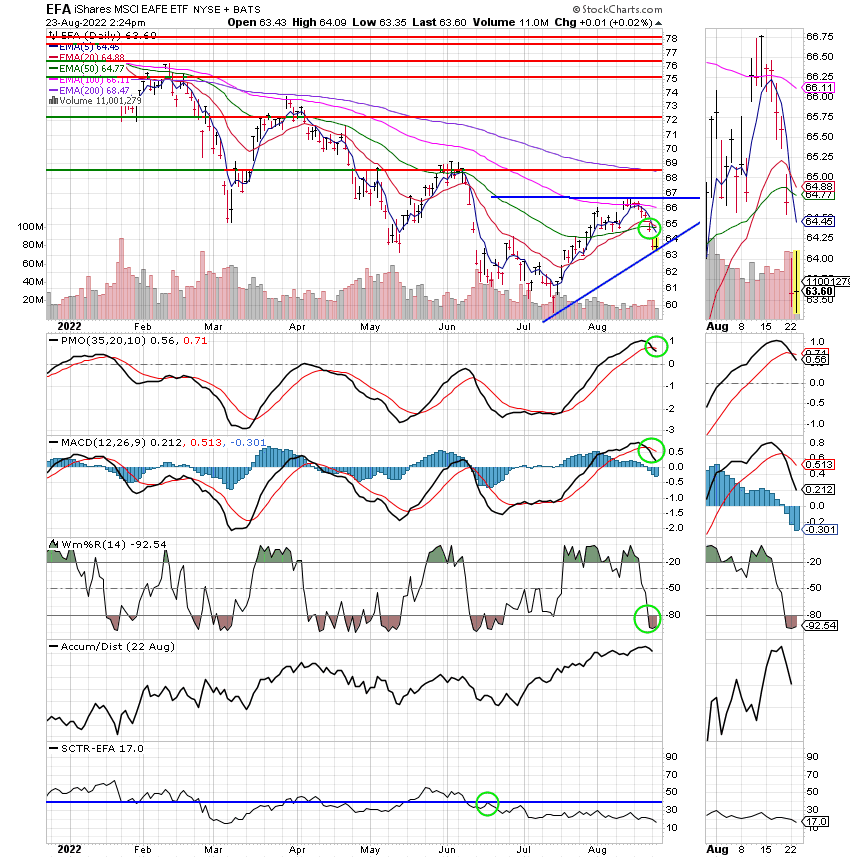

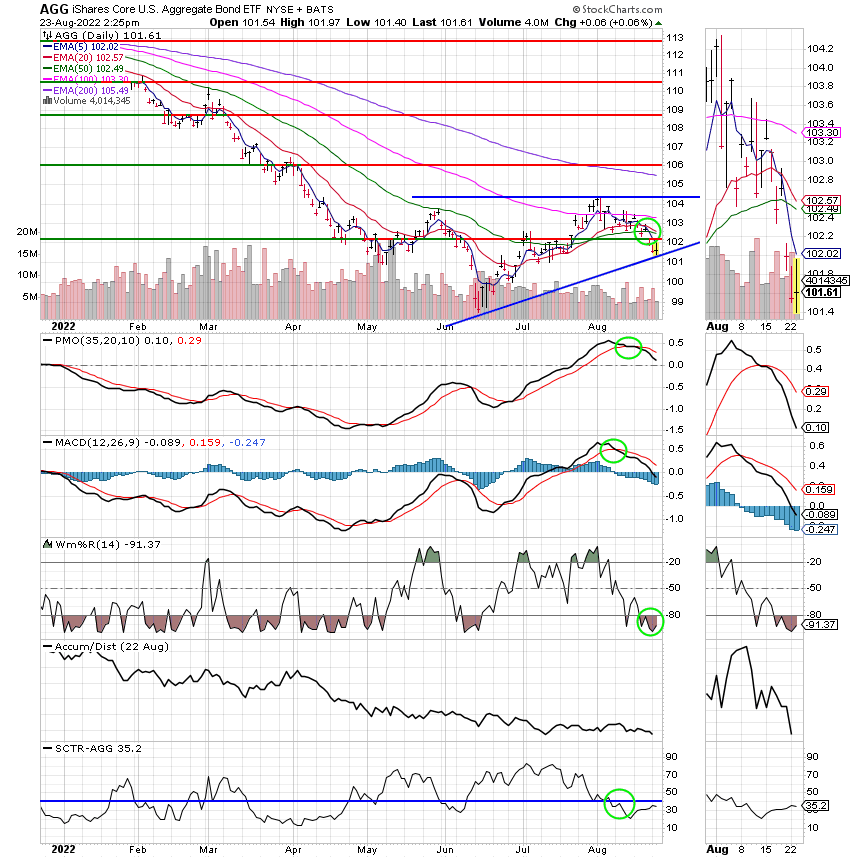

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I fund:

F Fund:

This is the kind of market where you just have to slog it out. I don’t see things changing until we see a meaningful move lower in the rate of inflation. That’s all for this afternoon. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.

a