Good Evening, It’s certainly been an interesting week hasn’t it. I don’t often make investment decisions based on fundamentals. I am for the most part a technical analyst and stick to what I know best. However, occasionally when the fundamentals strongly agree with a trend I am starting to see on my charts I have learned at great cost a time or two not to ignore it. This past week was one of those times when I made a decision based on fundamentals. At the time I said I was 99.9% sure my move was a good one. Well as it turned out I was indeed 99.9%! Wrong that is!!! So lets break it down. We were faced with a situation where our charts and the fundamentals where calling for a sell off and as we noted repeatedly we are way overdue for a correction which is a pullback of 10% or more. By the matter of fact we haven’t even had a pullback of 5% in the past 8 months! So we sold and things looked promising for a day and then the market rallied into the fundamental even we were concerned with which was Fed Chairman Jerome Powell’s speech at the Jackson Hole Economic Symposium. We correctly anticipated that J. Powell would announce a plan for the Fed to start tapering the monthly bond purchases that they have been making as economic stimulus since the financial crisis in 2009. The Fed had made plans to taper bond purchases once earlier before the pandemic (I don’t remember the exact date) and when they did the market sold off hard in what is now known as the taper tantrum. It happened so quickly that pretty much all of us got caught holding the bag. Fortunately the Fed back walked their statement and the market went on the recover quickly. At the time the selling was quick and deep and had the tapering actually took place would have been only the start leaving most of us with sizeable long lasting losses. Folks, those are the kind we try to avoid. I know that recent markets seem to pop back quickly giving the buy and hold crowd a bit a false confidence but the truth of the matter is that those that have held like that in what ultimately turned into bear markets lost a lot of time. In some cases years. A more recent case that I love to use as an example was when the dot com bubble crashed in 2000. Folks then lost about half the value of their portfolios and there were a great many of them who were scheduled to retire and could not because their IRA’s and Thrift accounts were just too low. It ended up being March of 2006 before they were able to make their money back. Not saying that was going to happen this time but one never knows. Most bear markets started out as a small sell off. Bear markets don’t scare you out they wear you out!! Your in over your head before you know it! So anyway, we decided to sell. After all, any sell off is a chance to make extra money if you can buy back close enough to the bottom. That’s always the strategy that we use, but that is not the main reason that we do it (Sell). The main reason we do it is to protect our precious capital. One of the buy and holders I know pointed out to me “See that never works! Look at the money you lost!” What he actually should have said was look at the gains you missed because I didn’t lose anything which brings me to a point. A lot of investing is a psychological thing. How you look at things can determine how successful you are as an investor. In other words how many good vs bad decisions you make. You shoot for making mostly good ones but one thing is for sure nobody gets them all right. You just don’t hear them talk about it when their wrong. Well I guess except for me and Jim Cramer…. So how do I look at this then?? Not a loss, perhaps a missed opportunity but not as a loss. Case in point: When you pay an insurance premium on your house insurance do you view it as a loss? How could you? At least most of us have some type of mortgage so it’s really not a choice. It’s something we have to do!!! But even it we didn’t it would be stupid not to do it. Do we always need it? No we seldom need it. However, when we do it’s everything!!!! EVERYTHING!!!! So why then do we view investing any different? Folks, when we sold last week we took out an insurance policy against catastrophic loss!!! How much did our insurance cost us? It cost us the few percent of gains that we missed. The moral of the story is this. If you want to accrue money then remember this if you don’t remember anything else I ever tell you. It’s our motto here. It’s who we are! “It’s not what you make that’s important. It’s what you keep!” You can spend your time making money or….you can spend your time making money back. Time is money and money is time! Now….where do we go from here. Jerome Powell’s speech changed the narrative on Tapering. He added an important statement near the end of his address. In it he said that there would not be interest rate increases at the end of tapering. In the view of investors that changed everything. At least for now anyway. Look for the market to accept tapering but be interest rate sensitive from here on out. For now (choppiness anticipated) it’s rally on!

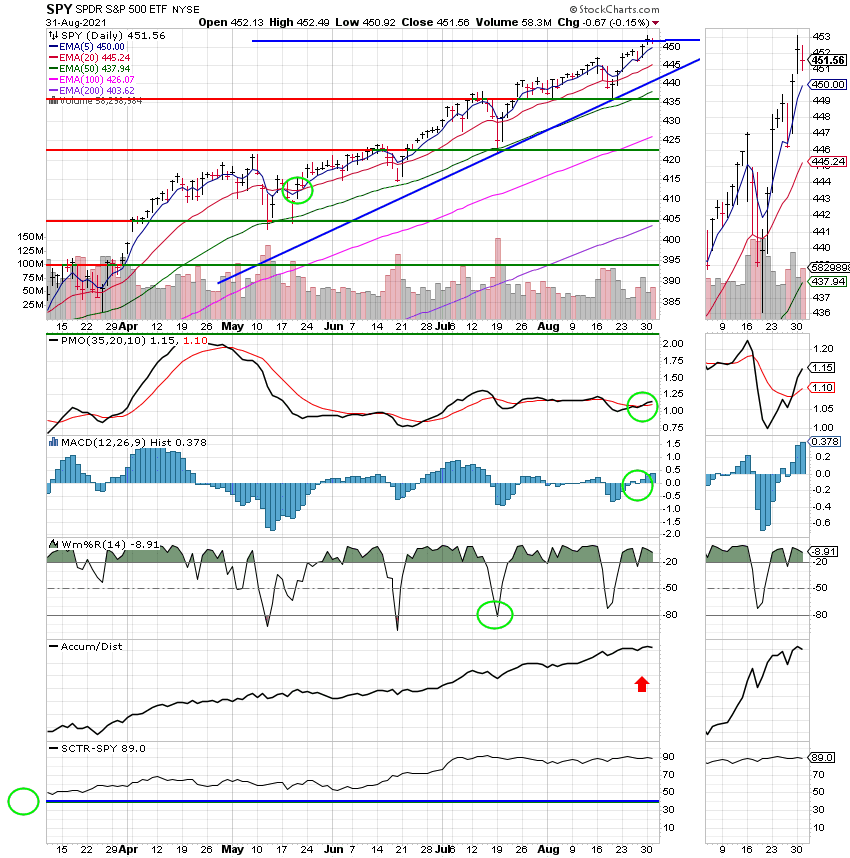

The days trading left us with the following results: Our TSP allotment slipped back -0.13%. For comparison, the Dow fell -0.11%, the Nasdaq -0.04%, and the S&P 500 -0.13%. Mostly a flat day, but a good month though and we praise God for that. It was in fact the 7th straight month of gains for the S&P 500.

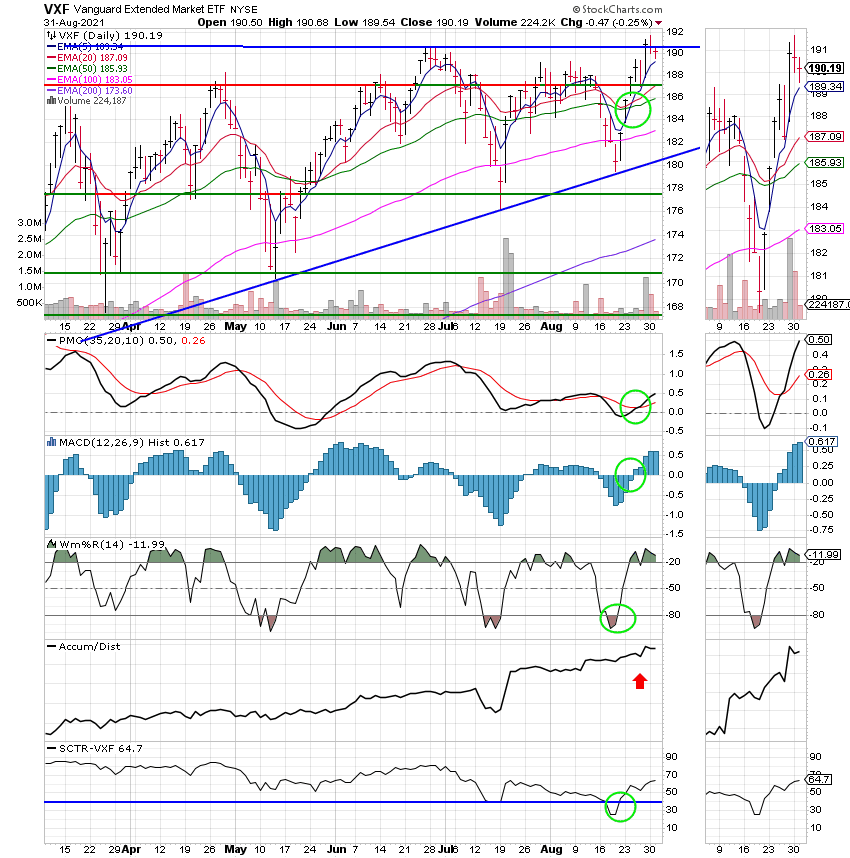

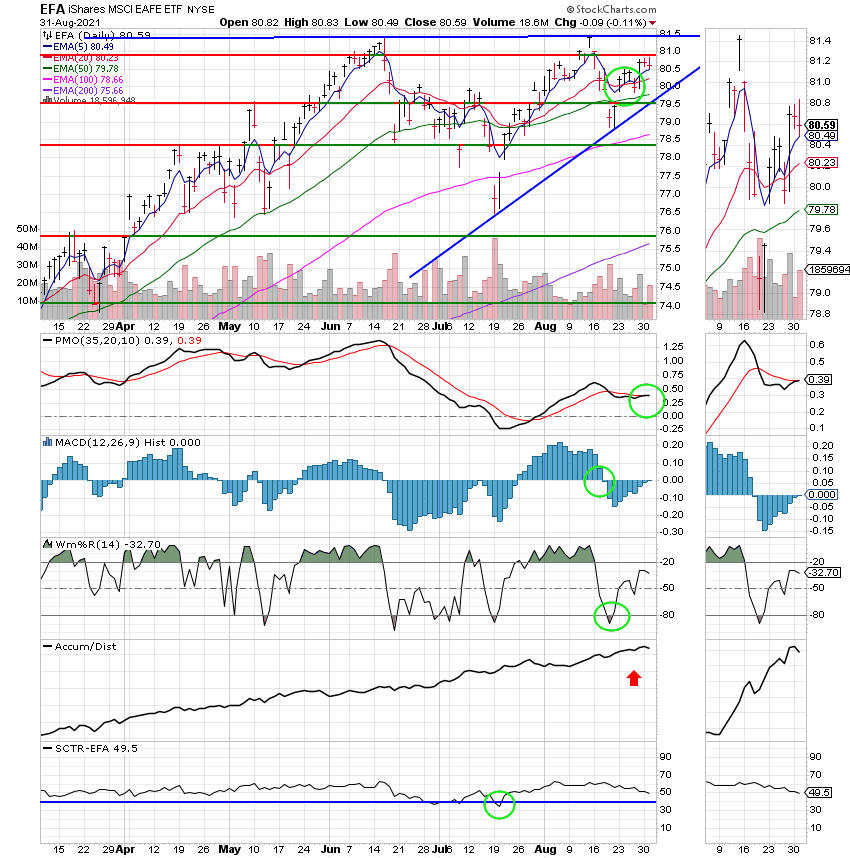

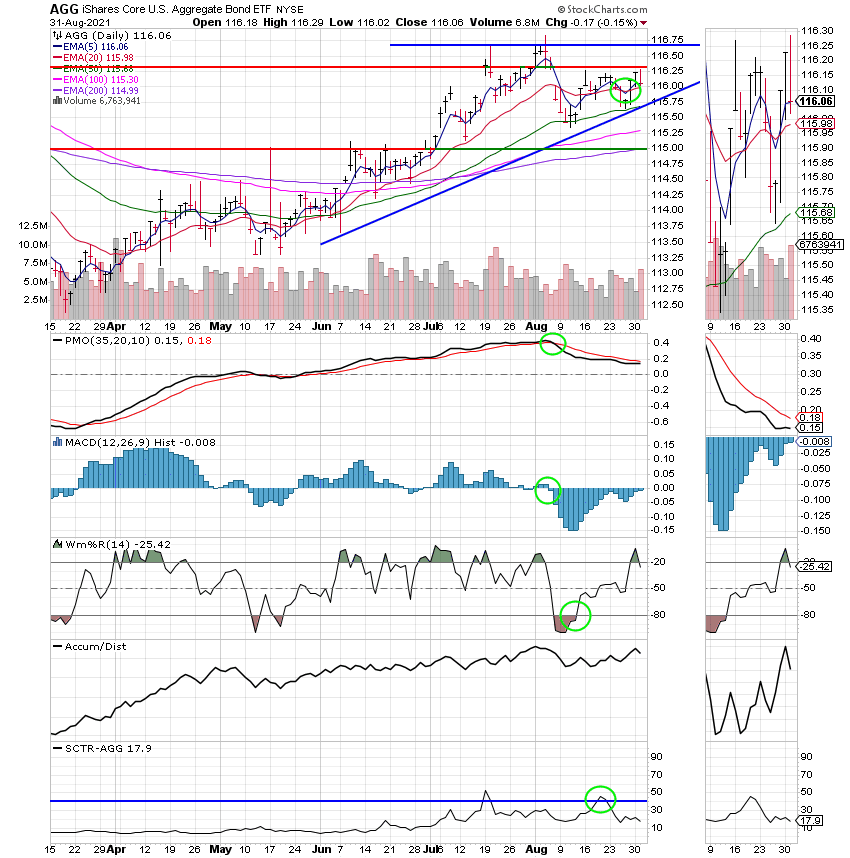

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/C. Our allocation is now +16.62% for the year not including the days results. Here are the latest posted results:

| 08/30/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6533 | 21.1064 | 68.0479 | 86.5045 | 39.5556 |

| $ Change | 0.0017 | 0.0285 | 0.2962 | -0.0863 | 0.1504 |

| % Change day | +0.01% | +0.14% | +0.44% | -0.10% | +0.38% |

| % Change week | +0.01% | +0.14% | +0.44% | -0.10% | +0.38% |

| % Change month | +0.10% | -0.06% | +3.16% | +2.23% | +1.83% |

| % Change year | +0.88% | -0.42% | +21.71% | +16.58% | +11.77% |