Good Morning, Just when you thought it was safe to go in the water again…….. This morning we got another hot inflation report demonstrating that impulsive traders were perhaps a little overzealous with their ‘goldilocks’ inflation report theory. They bet heavily that inflation had moderated and and as a result so would the Fed. They bet wrong!! My what a difference a week makes. Today all those geniuses are leaning the wrong way and make no mistake they are going to take it on the chin. Despite the fact that energy prices declined last month inflation still increased .1%. Just imagine what it would have been had energy prices (which have a great effect) had not dropped. So now we’ve gone from market players betting that the Fed will only increase rates by 50 points to a pretty good chance the they will increase by a 100 points. A full percent!! My my my what a difference a few days makes. We thought there was a strong possibility that we might see the lows of June retested and now that seems even more likely than it did before. Folks, the Fed has already made in clear that they intend to keep raising rates even if it damages the economy. Their priority is to stamp at inflation at all costs and by stamping out inflation I mean to lower it’s rate to their target of two percent. Yes it’s been a rough year do far. We’ve noted that several times as we’ve been repeatedly bad mouthed by other less than professional services. After all, they never had the chance to do so in close to thirty years before. So why not make the most of it while they can and that’s exactly what they did as they took take peoples money to do no more than what those folks could do on their own anyway. That’s what the L Funds are for!!! What’s our motivation here? It’s certainly not money. I can tell you that. So I ask this question? Where are those accusers today? The bottom line is this. We’ll have our day with God’s blessing and in his time! I should not have mentioned those other services again. I know that…but what their doing so much represents the world is doing these days. It just rubbed me wrong how viscous they were when all that took place a month or so ago. I guess in a way I should thank them for motivating us to double down on our charts. We know what has worked for us throughout the years and that is good solid technical analysis. Occasionally, we run into a situation like this that is unprecedented and we have to make some adjustments to what we are doing. That is to adjust some indicators, throw out some indicators, and add some new ones until we get it figured out. It took us a lot longer than usual to do that this time. Perhaps because I’m getting older…..but really probably more due to the fact that we had never seen the unwinding of fiscal stimulus before as we did this year. We simply didn’t have a model for what we had never seen. Add that to the pandemic and it was the perfect storm. Well I’m declaring and end to that storm in the mighty name of Jesus! Pressure makes diamonds and 2022 improved our system. I honestly did not think I could make it better than it was but with God’s guidance it is now better indeed. This is the best set of indicators we have had in thirty years. I am literally blown away be what the Holy Spirit has revealed to us and am excited to see how you all will be blessed them moving forward. Yes we retooled our system and it’s now better than ever. To God be the glory! Give Him all the praise for He and He alone is worthy!! So where are we now?? As I noted above we have this hot inflation report today and now we’ll wait and watch what the Fed does in their meeting next week which I believe will be a hefty rate increase that will likely result in more selling. I would not be surprised to see the bottom from June retested, but again, I don’t think that support will be broken. I fully expect that the market will continue to trade on a wide zone ranging from the lows of June to the highs of August until price eventually resolves upward. I can’t say how long that will take but what I can say is that the trading range will probably get smaller and the volatility will become less in direct correlation to the rate of inflation as it eventually moderates and drops to two percent. I don’t claim to predict the future. I leave that to the fortune tellers and market timers. They’ve had their day and now we’re going to have ours. My plan going forward is to respond to what I see on the charts. You see, it really doesn’t matter if I’m wrong or right about what I have said above. That is only an outline of how I expect it things to go. It will not change our results the least little bit, but whatever happens, I can say this. I am excited to see what God has for us moving forward both inside and outside of TSP…..

The days trading so far has left us with the following results: Our TSP allotment is still steady in the G Fund. For comparison, The Dow is in the red by -2.71%, the Nasdaq -4.04%, and the S&P 500 -3.13%. Wow, that’s ugly. Praise God for leading us into the G Fund!

Stock sell-off deepens, Dow drops 800 points after hot inflation report

The days action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now -27.68% not including the days results. Here are the latest posted results:

| 09/12/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.0334 | 18.517 | 62.7347 | 67.6917 | 32.4496 |

| $ Change | 0.0048 | -0.0209 | 0.6573 | 0.7755 | 0.5070 |

| % Change day | +0.03% | -0.11% | +1.06% | +1.16% | +1.59% |

| % Change week | +0.03% | -0.11% | +1.06% | +1.16% | +1.59% |

| % Change month | +0.11% | -1.00% | +3.99% | +4.19% | +2.46% |

| % Change year | +1.77% | -11.35% | -12.80% | -18.87% | -17.73% |

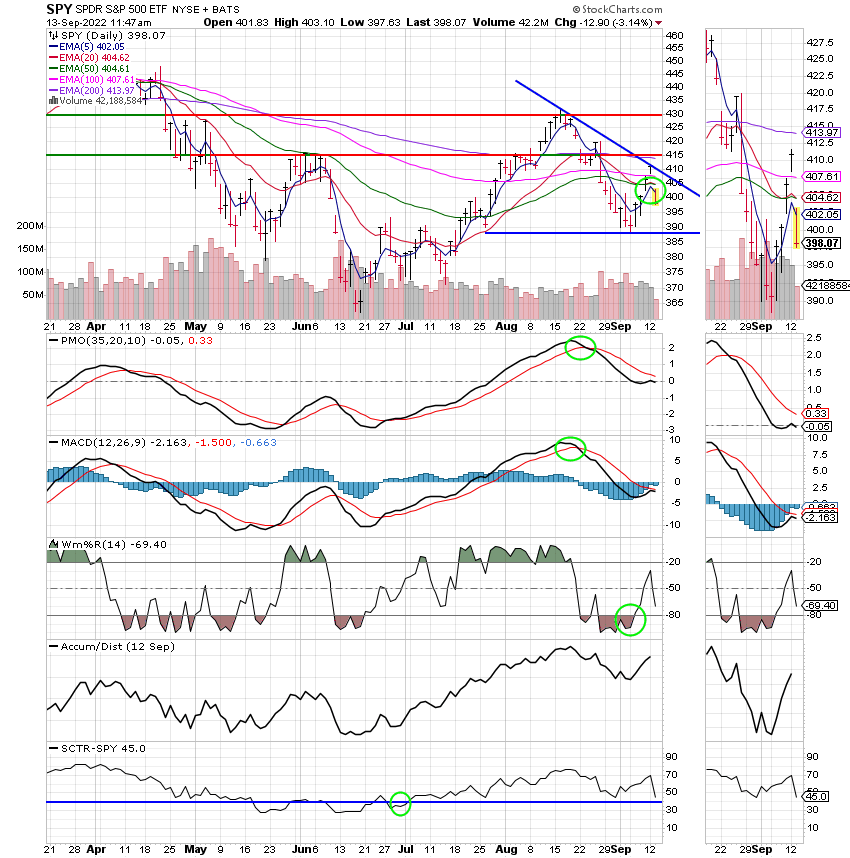

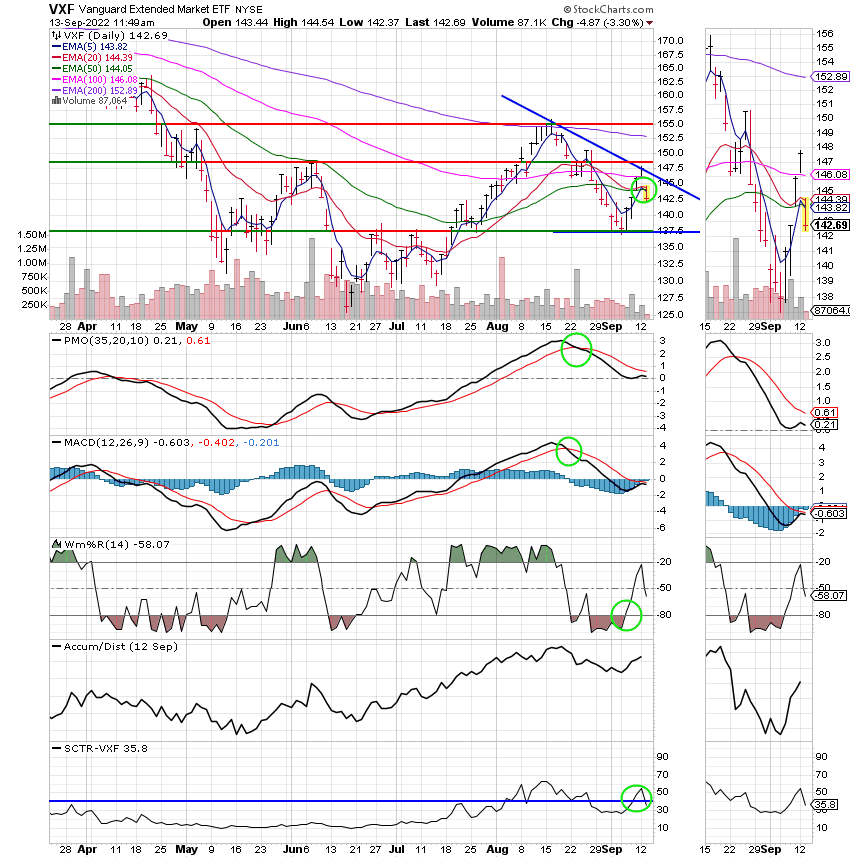

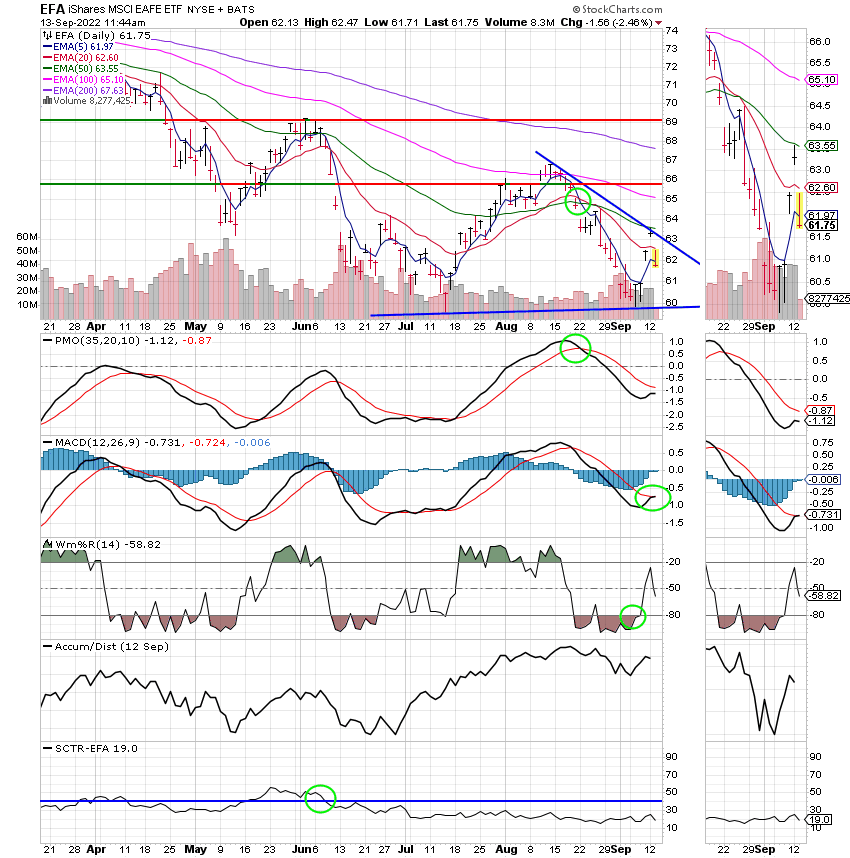

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Our task simply is to remain in the G Fund and watch our charts for a notable change. We must remain highly vigilant as things can change quickly. This is a volatile market and will remain so for the foreseeable future. That’s all for today. Have a great afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.