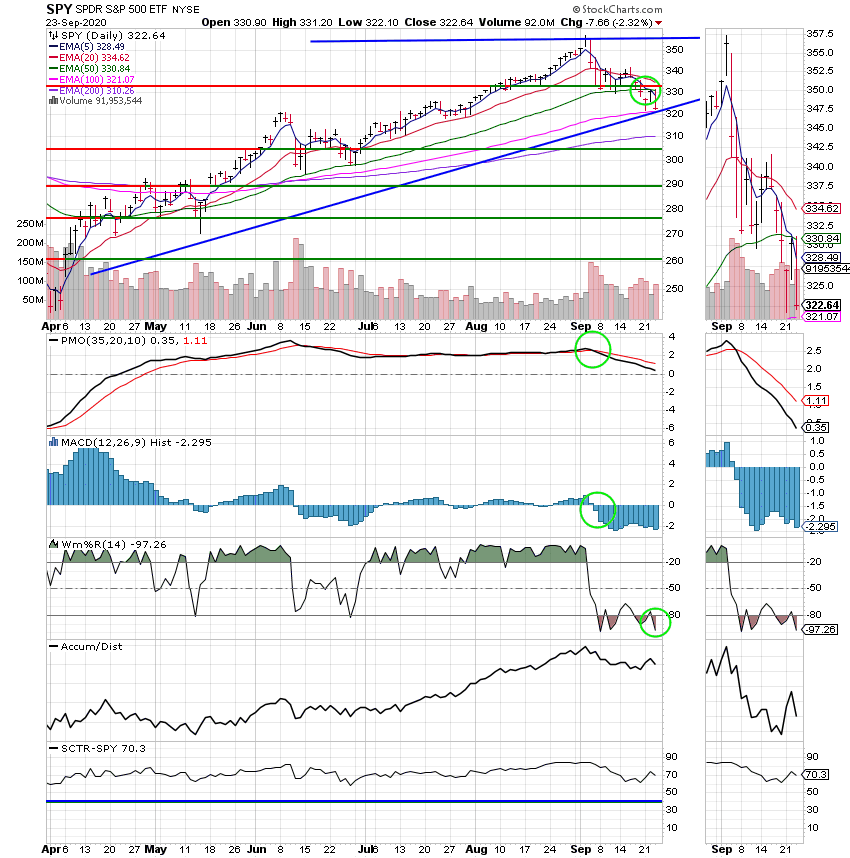

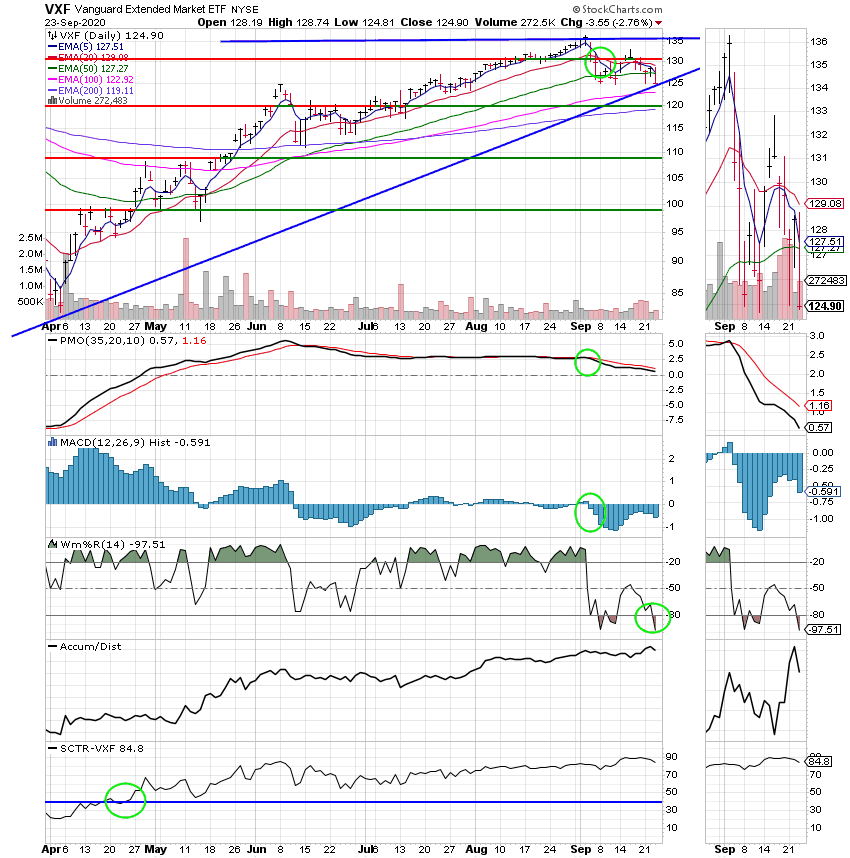

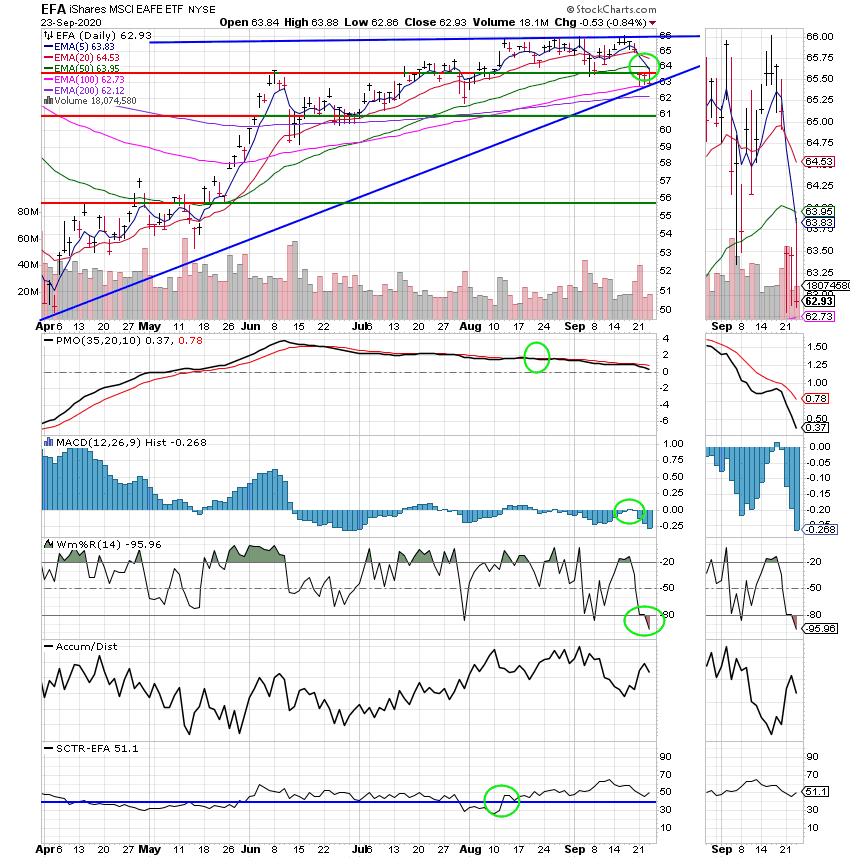

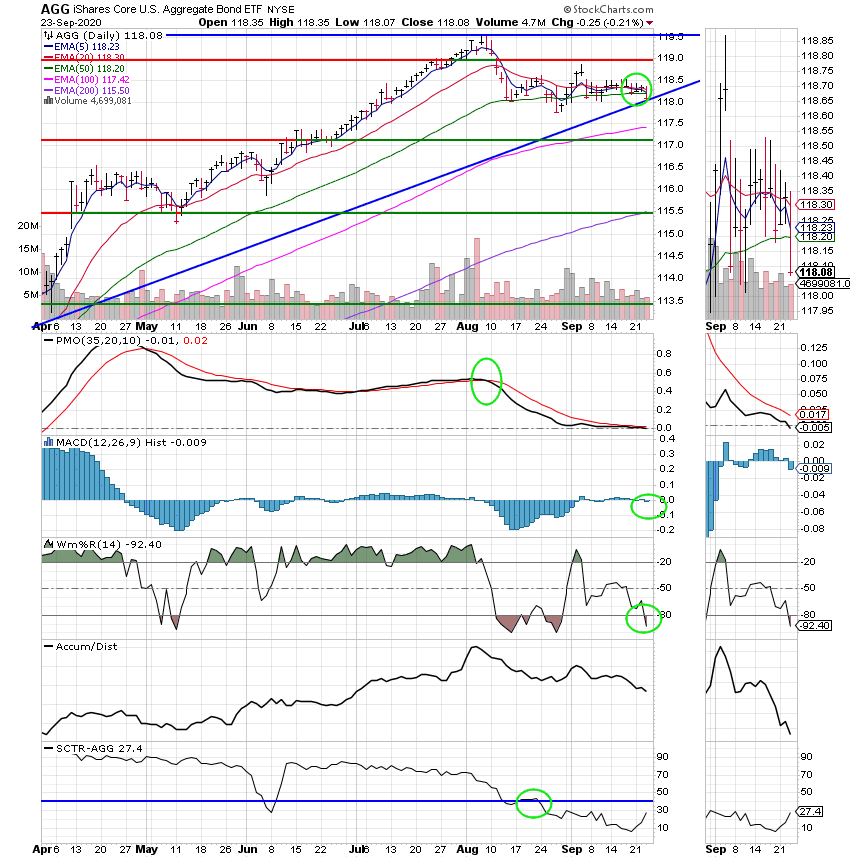

Good Evening, Today tech stocks continued to struggle dragging the broader market with them. Investors remain confused on whether or not to invest in big cap tech stocks with a high valuation or traditional value stocks such as industry, energy, or brick and mortar stores whose areas are considered to be mature. I would tend to describe them as long in the tooth. An example might be brick and mortar stores being replaced by online retailers. Todays consternation was caused by reports that the economy may be slowing down. Data from IHS Markit showed gains at factories were offset by a slowdown in the broader services sector in September, suggesting a loss of momentum in the economy at a time when concerns are rising about a potential surge in COVID-19 cases heading into the colder months. As you can see there’s an intricate web of issues that effect the market. However, they continue to be the same issues that we have been dealing with since the pandemic began. Today the negative news added up and obviously had the most influence on the direction of the market. Will there continue to be a negative influence as the Dow and the S&P approach correction territory (-10% or more)? The majority of my indicators though weaker still suggest this market can move higher but I would be amiss not to say that the VIX (Volatility Index) never reset from the bear market and continues to be at a high level at 28.56. My experience is that a health market generally maintains a level of 16 or below. The VIX never made it back to sixteen after the pandemic selloff. That should tell you everything you need to know. Add to all this the fact that it’s September which is not a market friendly month and todays action is no surprise. Normally I wouldn’t even be in the market with the VIX being so high but this has not been a normal year. We were forced to get back into stocks as the rest of our indicators all favored a higher market while the VIX simply never recovered. Thus, we were forced to ignore the VIX and invest. I have never seen this happen before, but so far it has not been a mistake. We made money. Nonetheless, we are feeling the pain of being in a market that flashes such a high VIX reading. Add the election uncertainty to that and it makes us feel like moving to a safe haven until things improve. All that said, we will make every endeavor we will do what we always do. Watch our charts and react to what we see. Right now their feeling a lot of pressure but haven’t moved to sell signals just yet. So we will try to be patient.

The days trading left us with the following results: Our TSP allotment fell -2.76%. For comparison, The Dow lost -1.92%, the Nasdaq -3.02%, and the S&P 500 -2.37%. It was a rough day to be sure.

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allocation is now +23.87% on the year not including the days results. Here are the latest posted results:

| 09/22/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4723 | 21.0908 | 49.1388 | 57.4905 | 30.3473 |

| $ Change | 0.0003 | 0.0103 | 0.5108 | 0.3882 | -0.0923 |

| % Change day | +0.00% | +0.05% | +1.05% | +0.68% | -0.30% |

| % Change week | +0.01% | +0.08% | -0.12% | -0.85% | -3.17% |

| % Change month | +0.04% | +0.17% | -5.19% | -4.26% | -3.02% |

| % Change year | +0.75% | +6.96% | +3.98% | +2.16% | -7.24% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.4713 | 10.3193 | 35.2372 | 10.4168 | 38.7975 |

| $ Change | 0.0257 | 0.0275 | 0.1124 | 0.0363 | 0.1469 |

| % Change day | +0.12% | +0.27% | +0.32% | +0.35% | +0.38% |

| % Change week | -0.27% | -0.63% | -0.77% | -0.85% | -0.92% |

| % Change month | -0.91% | -2.12% | -2.55% | -2.80% | -3.05% |

| % Change year | +1.35% | +3.19% | +1.10% | +4.17% | +0.96% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.4836 | 22.6542 | 10.6128 | 10.6128 | 10.613 |

| $ Change | 0.0423 | 0.0970 | 0.0546 | 0.0546 | 0.0546 |

| % Change day | +0.41% | +0.43% | +0.52% | +0.52% | +0.52% |

| % Change week | -0.99% | -1.06% | -1.29% | -1.29% | -1.29% |

| % Change month | -3.26% | -3.47% | -4.22% | -4.22% | -4.22% |

| % Change year | +4.84% | +0.76% | +6.13% | +6.13% | +6.13% |