Good Evening, The market took a pause after three consecutive sessions of moving up. A rise in consumer confidence kept the selling reasonable so I guess you could say that it was more of a pause than a sell off. However, a lot of investors chose to lighten their load ahead of the Presidential debates later tonight. They definitely have the power to move the markets so some investors just weren’t willing to hold while they are taking place. Make no mistake, the market is focused on two issues right now. The presidential election and the stimulus package. Remember one thing. The market hates uncertainty and right now these issues are full of it. The market wants a clear winner in the election and with so many mail in ballets it may take a little linger than usual until we know who the winner is. Will the market kick the can down the road or will it sell off? The stimulus package is in congressional limbo. So far congressional leaders have been unable to agree on the size of the package with Democrats wanting to spend more and Republicans wanting to spend less although Democrats in the house introduced a bill that is significantly smaller than the last one they proposed and there is hope that the process will move forward. It should be noted the the Fed Chair Jerome Powell said that more stimulus would be needed to keep the economy going during it’s recovery from the pandemic. In the event that a stimulus bill is not passed you can look for a major selloff. That noted, if nothing rocks the boat too much we could get back into rally mode when the election is decided, but don’t expect investors to make any major bets until it is and don’t forget one thing. The more confusion there is, the more selling there will be.

Not that I’m surprised but my Email and message board have been jammed with messages that are basically one question and that is ‘Why did you do it?’ In other words why did you move to the G Fund? I especially received them after the market rose for three consecutive sessions. Ok, I won’t reinvent the wheel. I will repeat here what I said there. We decided move to the G Fund due to the the high risk atmosphere created by a rather nasty election, a doubtful stimulus package, and a resurgence of the Corona Virus. We already have a nice 20% profit made and can afford to be conservative. My experience is that greed will get you killed in the business. While Friday and Monday were really good market days, they are only two days in an otherwise dismal month. Yes we missed a couple of good days and we may miss more as we move toward November, but I would be amiss not to say that we also missed a 34% downturn in February and April. So we can afford to play it safe now. I may be willing to gamble with my personal money on the street but not with the other folks retirement money! I’m just not comfortable with the overall picture. The risk factors are still present. Nothing has changed. I’m just simply not comfortable with it. All that said, you have a trade to burn now and you’ll have two more in another day. You could make some money, so I’m definitely not going to tell you not to jump back in. You’ll just have to weigh the risk and decide whether or not you are comfortable with it. I am not and unless something really compelling takes place between now and the election I will be more than happy to observe things from the sideline. What’s the worst that can happen? I can make 20% in 2020 and all those 20’s are just fine with me! I praise God for another good year!!

The days trading left us with the following results: Our allocation was steady in the G Fund. For comparison, the Dow lost -0.48%, the Nasdaq -0.29%, and the S&P 500 -0.48%.

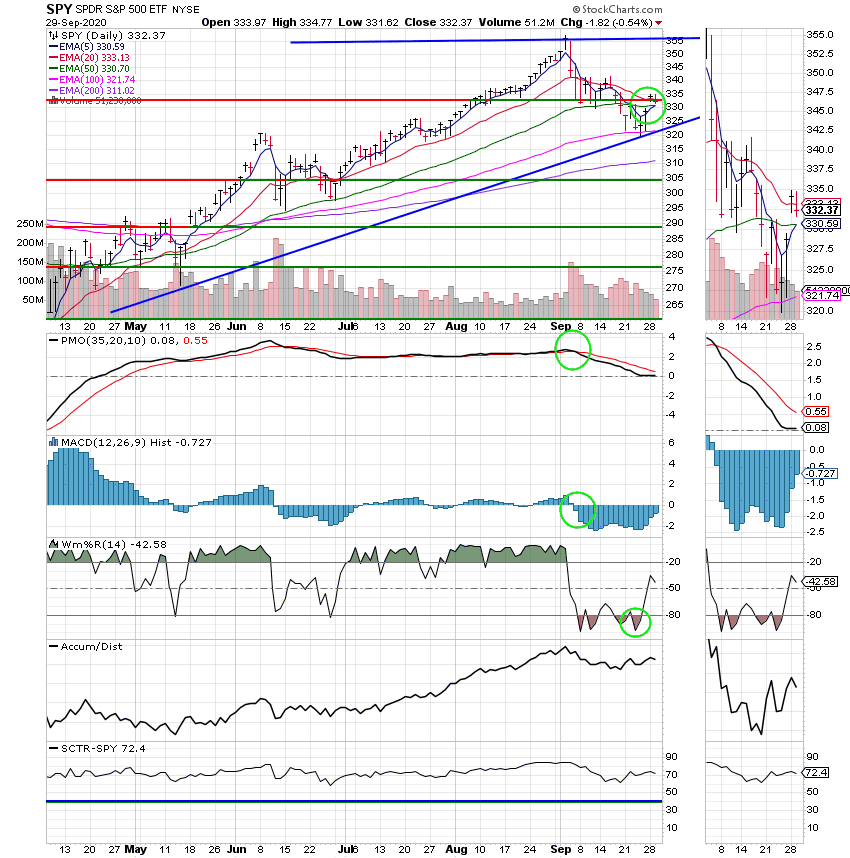

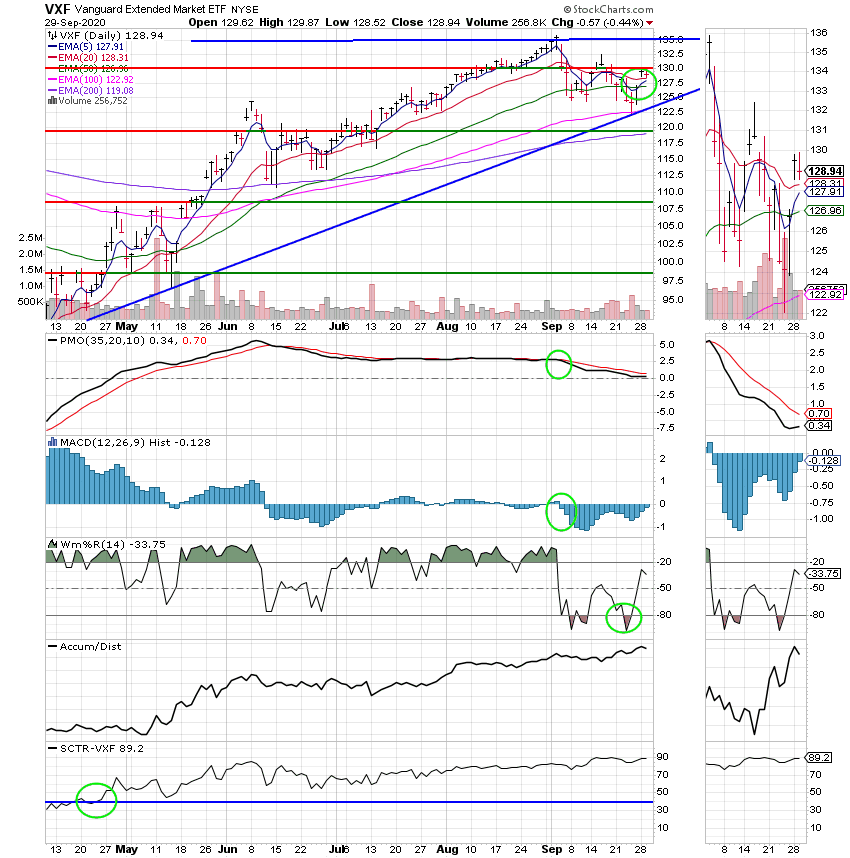

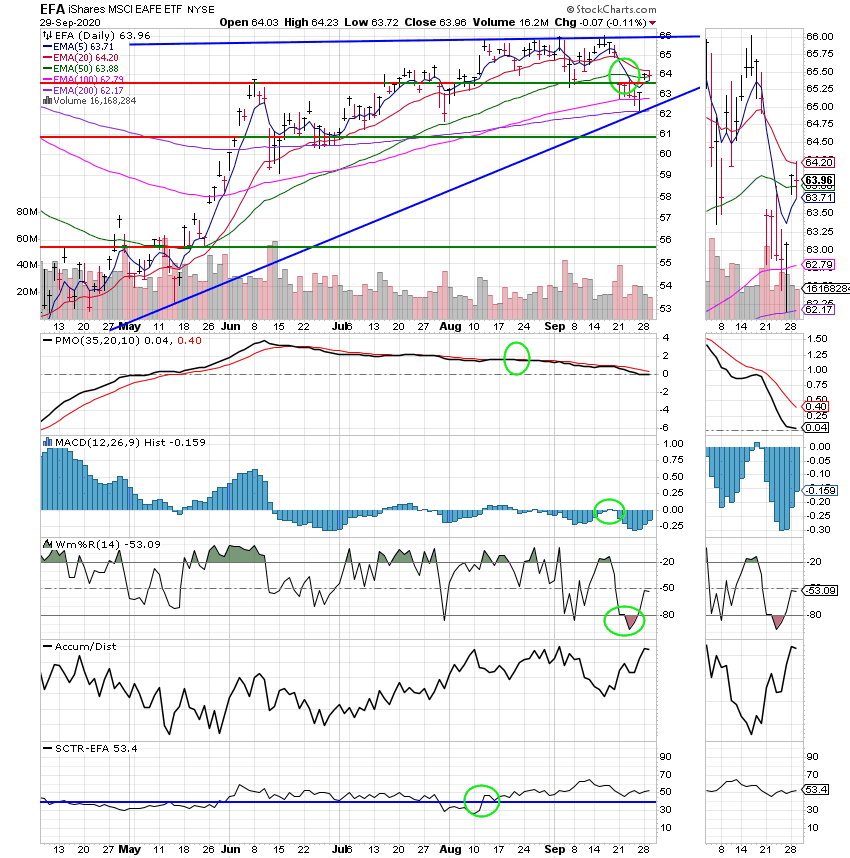

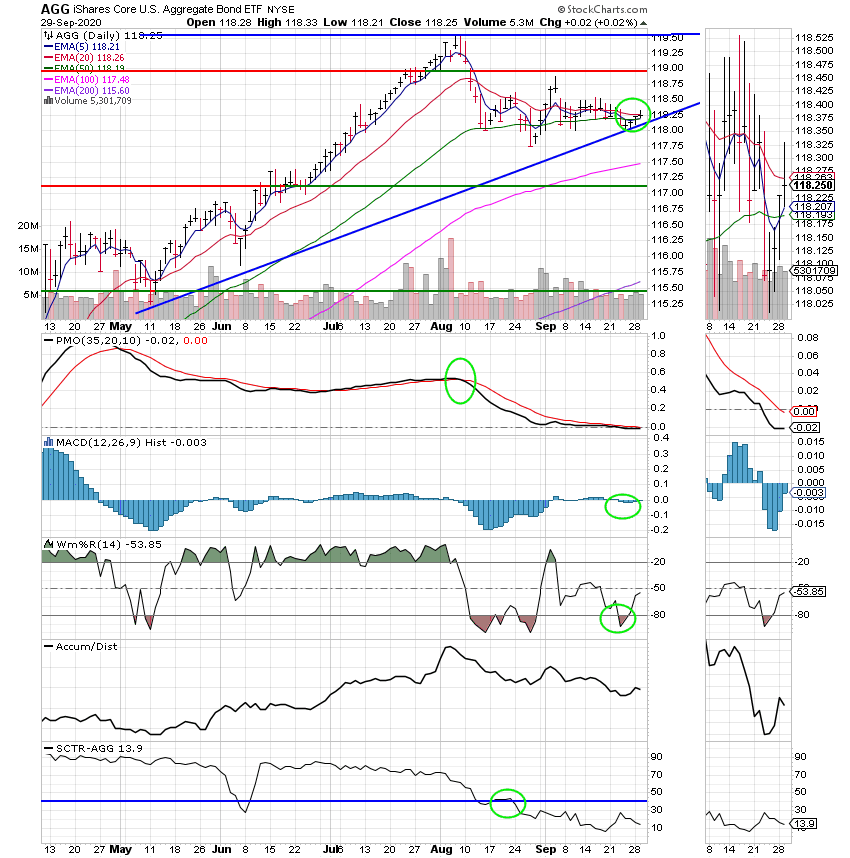

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/G. Our allocation is now +20.10% on the year not including the days results. Here are the latest posted results.

| 09/28/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4742 | 21.0551 | 49.6813 | 58.1233 | 30.5961 |

| $ Change | 0.0010 | 0.0005 | 0.7883 | 1.2076 | 0.5755 |

| % Change day | +0.01% | +0.00% | +1.61% | +2.12% | +1.92% |

| % Change week | +0.01% | +0.00% | +1.61% | +2.12% | +1.92% |

| % Change month | +0.05% | +0.00% | -4.14% | -3.20% | -2.23% |

| % Change year | +0.76% | +6.78% | +5.12% | +3.28% | -6.48% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.5202 | 10.3718 | 35.4514 | 10.486 | 39.077 |

| $ Change | 0.0859 | 0.0927 | 0.3801 | 0.1232 | 0.4989 |

| % Change day | +0.40% | +0.90% | +1.08% | +1.19% | +1.29% |

| % Change week | +0.40% | +0.90% | +1.08% | +1.19% | +1.29% |

| % Change month | -0.68% | -1.62% | -1.96% | -2.15% | -2.35% |

| % Change year | +1.58% | +3.72% | +1.72% | +4.86% | +1.69% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.5641 | 22.8393 | 10.7185 | 10.7186 | 10.7187 |

| $ Change | 0.1443 | 0.3320 | 0.1877 | 0.1877 | 0.1877 |

| % Change day | +1.38% | +1.48% | +1.78% | +1.78% | +1.78% |

| % Change week | +1.38% | +1.48% | +1.78% | +1.78% | +1.78% |

| % Change month | -2.51% | -2.68% | -3.26% | -3.26% | -3.26% |

| % Change year | +5.64% | +1.58% | +7.19% | +7.19% | +7.19% |