Good Morning, It’s a battle between market perception and reality. While the market is most often right, I’m not so sure about this time. After a horrendous September which by the grace of God we were able to sidestep, the market began to rally yesterday and continues strongly today. The markets perception is that world banks will begin to pivot from their hawkish policies to control inflation sooner than they said they would, but will they? Is that actually the case?? Is this rally built on solid rock or is it built on sand? The question we have to ask ourselves is what has changed? Remember, one or two days of buying doesn’t necessarily mean there is a new trend. That should be especially apparent to us in 2022 which I refer to as the year of the Fake Out. So what gives? How much can we really trust this rally. About as much as our charts tell us to and not a bit more. With Treasury yields falling, the dollar is now on course for it’s fifth consecutive daily loss against the basket of currencies to which it is commonly compared – its longest streak of declines since August 2021 – as investors begin to price in the possibility that tighter credit conditions will make the Federal Reserve tread more carefully. To me that’s a dangerous assumption considering the repeated statements the Fed has issued saying the will continue to tighten throughout 2022 and well into 2023. That is the exact reason that I don’t make investment decisions based on what I think might happen. News based on assumptions can be and often is misleading. While we’re on the subject let me say that just because I wrote this doesn’t mean I won’t buy back into stocks in the coming days and weeks. What I write here is what I think. I use these thoughts to prepare my game plan for the future. What will I do if the market moves in the way that I anticipated it would? Why do I do this if I’m going to follow the charts anyway? Because I firmly believe that failing to plan is planning to fail. I prepare myself to make that decision if the market proceeds in the way that I think it will, but I am always equally prepared to react to it if is does not. I wanted to say this because often after I write a blog folks get the impression that I am locked into that mindset and are surprised when I move in another direction that I had not telegraphed well in advance of the move. It is a dangerous policy to be so locked into what you think the market should do that you become inflexible. It is even more dangerous to be stuck in the mode that you must be right!! just like I told everyone the market would do this or that and now I have to stick to it until I’m right. Remember what God’s word says “Pride goes before destruction and a haughty spirit before a fall.” Folks if your in a hole then quit digging!!!! It is not and has never been about whose right and wrong. It is about managing risk. It is about giving yourself the highest probability of success. Which brings me to the point that ties this whole thing together and that is that nothing is 100%. Let me repeat that so it sinks in nothing is 100%!!! Carl Swenlin who I consider to be one of OG’s of technical analysis always said this “Technical Analysis is not a crystal ball. It’s more like a wind sock.” So let me elaborate, you go with the highest probability of success. For instance you have an 80% chance of success with a certain chart pattern, but in the same breath you also have a 20% chance of failure. If the market breaks in that direction then you go with it. In the end, most of the time you will be right but some of the time you will be wrong, You must be secure in knowing that you have gone with the highest mathematical based probability of success and not on an assumption. When I was in the Marine Corps they did not like that word (assume). If you would use it they would break it into three parts and tell you what those meant to you and them. I won’t repeat that here because this because this is a Christian web site but you can read between the lines and get the picture if you are so inclined…….I think the message was accurate. They wanted you to succeed and that is a dangerous thought pattern with regard to success! OK, so back to the current market…. Based and what I have observed I believe the the market will continue to be choppy and volatile moving forward. There are only two things that can reduce that and allow the market to move back up. The first I have been harping on for over a year and that is the rate of inflation. The closer the rate of inflation gets to the Fed Target of Two Percent the better the market conditions will get. I’ve written quit a bit on that already so I won’t elaborate here. The second is the upcoming election. Before I say what I am going to say I want to make my position totally clear here. I will leave nothing to question. Every time I comment on politics I end up getting attacked by one side or the other but most often by one side in particular. I try to remain neutral but it’s utterly impossible. Perhaps because this nation has become too divided? I don’t know… So here it is. You won’t have to question or criticize my personal beliefs either way. Jesus Christ is my king. He is the only One that I have faith in. When I vote I vote according to the Bible if any politician be it left or right is in conflict with this word as best as I can read and comprehend it I will not support him/her and that goes for political parties and their platforms as well. If they say something is OK and the Bible says it’s not I will not support them. Secondly, I am a Capitalist. I do not agree with Socialism in any way, fashion, or form. My Grandfathers fought against it, my Dad fought against it and I fight against it. Socialism and Capitalism don’t mix. Thirdly, I believe in the Constitution of the United States as written. It should never be changed. There is no one alive today that lived under the tyranny that our forefathers did. Therefore, there is no one that is qualified to change it. I am sworn twice to defend it and I will do so to my dying breath. Finally, I love everyone of you regardless of where you are on these issues. God’s word says that all have sinned all fallen short of the glory of God and All means All. I am not in this world to judge you so don’t judge me. When I comment on politics here it’s strictly on the basis of how it affects the market and our investments. That said here we go. The second thing that can change the trajectory of the market is the upcoming midterm elections. If politicians that are perceived by investors as market friendly are elected and/or retain power on November 3rd that could ignite a new longer lasting rally. Should the market form that opinion it will probably overlook a lot of the problems with regard to inflation in the hopes that under that elected leadership things will improve. To end it all I will say this. Pray for our nation daily. Pray for God’s peace and stability. It is what made us so great for the past two hundred or so years and is what will continue to sustain us.

The days trading so far has left us with the following results: Our TSP allotment remains steady in the G Fund. For comparison, the Dow is currently up +2.58%, the Nasdaq +3.07%, and the S&P 500 +2.80%. Thank God for a day in the green!

Stocks rise as investors build on Monday’s rally, Dow jumps 700 points

Recent action has generated the following signals: C-Sell, S-Neutral, I Neutral, F-Neutral. We are currently invested at 100/G. Our allocation is now -27.54% on the year not including the days results. Here are the latest posted results:

| 10/03/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.0668 | 18.0522 | 56.1926 | 60.0482 | 29.3287 |

| $ Change | 0.0048 | 0.1527 | 1.4178 | 1.5169 | 0.6348 |

| % Change day | +0.03% | +0.85% | +2.59% | +2.59% | +2.21% |

| % Change week | +0.03% | +0.85% | +2.59% | +2.59% | +2.21% |

| % Change month | +0.03% | +0.85% | +2.59% | +2.59% | +2.21% |

| % Change year | +1.97% | -13.57% | -21.90% | -28.04% | -25.64% |

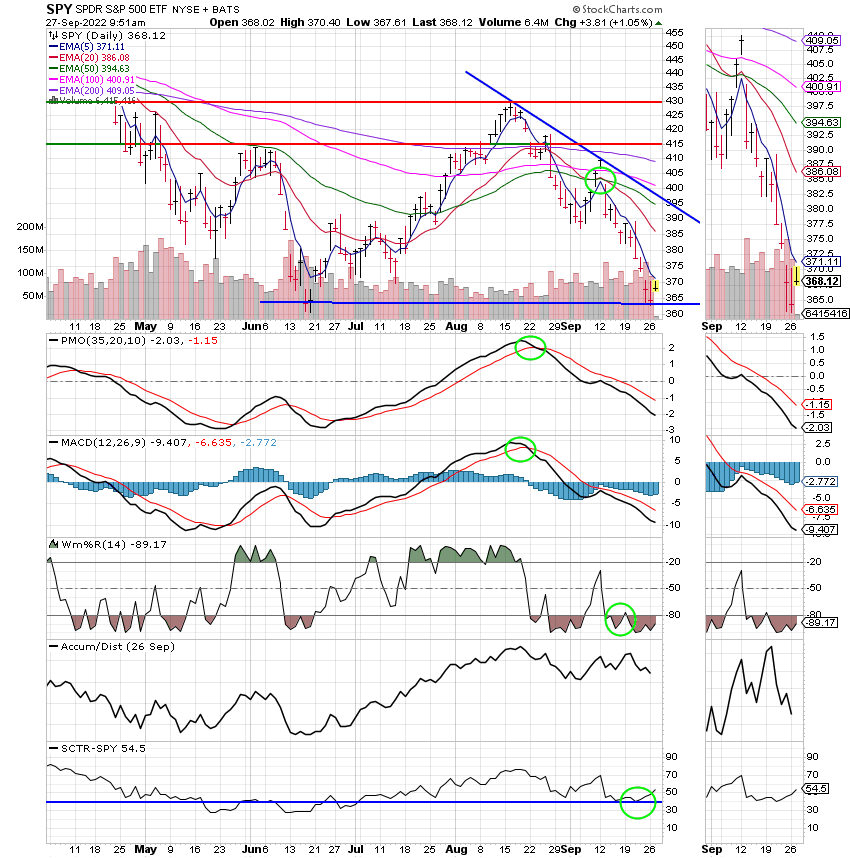

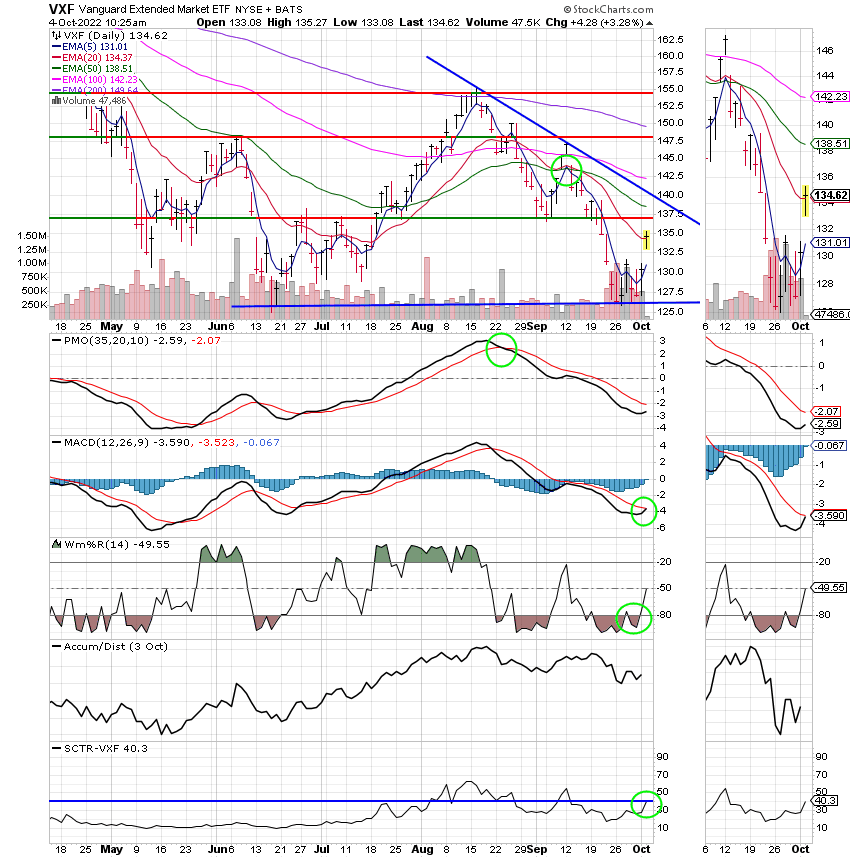

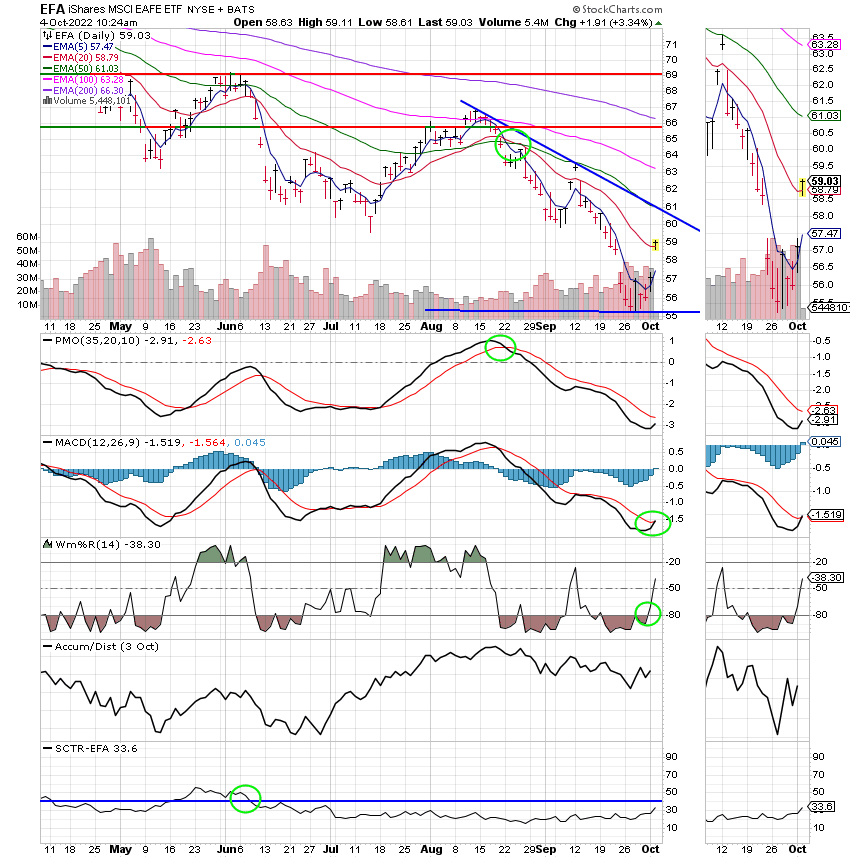

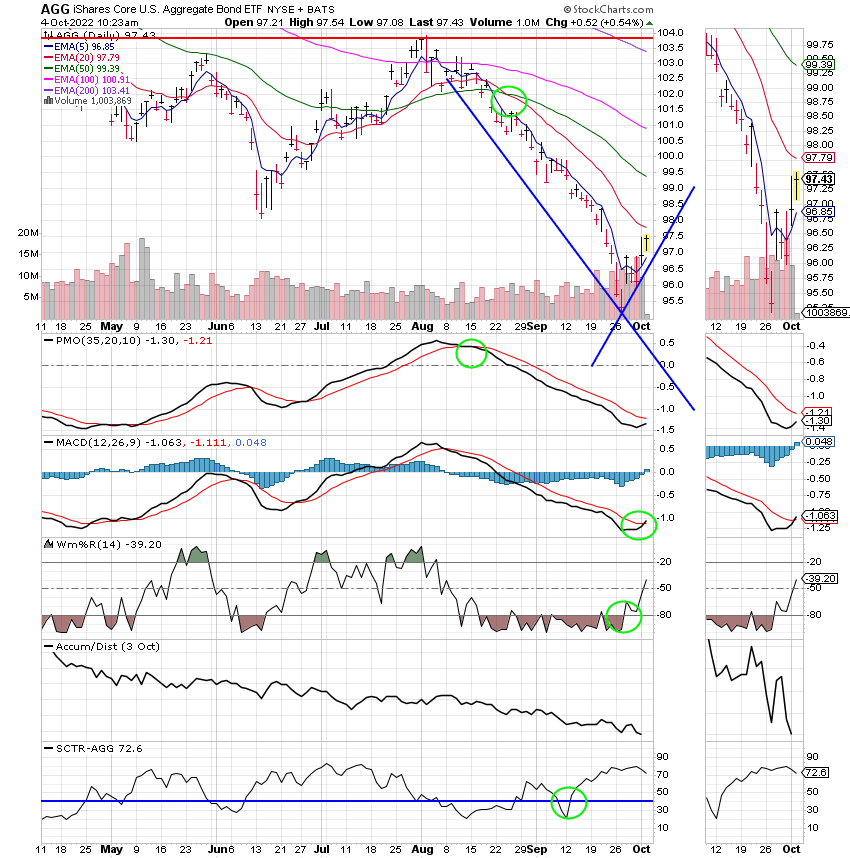

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

I currently do not have even one chart out of many charts that I follow that has generated a buy signal. That’s not to say that they aren’t moving in the right direction. A rally like we had yesterday and again today will tend to start things moving back up, but a lot more movement will be needed to correct all the technical damage that was done in the month of September. That’s all for today. Have a great afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.