Good Morning, The theme for the market in 2022 remains the same. Inflation and interest rates. Make no mistake, if you watch those and nothing else you won’t be totally wrong. However there have been some secondary issues that have been able to move the market significantly at times which brings me to today. Our old friend COVID has started to rear it’s ugly head again. This past week China reported their first two COVID deaths in a significant period of time and that raise the concern of investors that China might retighten there zero Covid policy. This had investors worried that the supply line on many items needed to manufacture products would again be disrupted. I wonder if any of the companies such as Apple for instance thought that they might get caught up in something like this when the invested in a communist country in the first place. I said it before and I’ll say it again. Capitalism and socialism don’t mix. At any rate, the citizens in China started protesting against the draconian COVID policies of the PRC and that morphed into a protest for democracy. I wish them luck. They should have thought about that when Chairman Mao took over…. You all know what I think about that. Focusing once again, the widening protests worried investors that the supply chain could be even further disrupted by growing into a protest for freedom. This concern resulted in yesterdays sell off. The market is trying to recover today as the PRC had a press conference announcing that 65.8% of adults over the age of 80 had received booster shots against COVID and that there were no additional deaths to report at this time. This seemed to pacify investors this morning resulting in a flat opening. Now back to the real issue. Avoiding any large supply disruption in China, the real issue is , has been, and will be inflation and interest rates. All eyes are on the Fed after recent reports showed that the Feds interest rate increases might be starting to slow the rate of inflation. Two things to watch. Several Fed officials will be speaking starting with Fed Chairman Powell tomorrow. Investors will be closely following these speeches for hints about future rate increases, most notably the size of those increases. The minutes from last months Fed meeting indicated that a majority of the Fed Committee members felt that the rate increases were starting to have an effect on inflation and that reducing the rate of future rate increases might be appropriate, even as early as the next meeting in December. We will see. The majority of folks seem to think that the December increase will now be 0.5% instead of 0.75% as was previously expected. The thing to know here is that the market will probably rally if the increase is reduced to 0.5%. One word of caution on this scenario. While the Fed will most likely do this, their not going to say so. I really don’t expect Jerome Powell to say anything dovish. The Fed is still committed to lowering inflation to their targeted rate of 2% and their speech will follow this policy with a hawkish tone. This is were it gets complicated if your trying to figure out where the market is going. It’s more a case of watching what the Fed does instead of what they say that will determine the long term path of the market. What they say will effect short term trading. For instance, don’t be surprised if the market takes a dip on something hawkish that Powell says tomorrow and then rallies if the Fed only increases rates by .50% in December. You want to know why the market rises and falls so much in the current environment? Well there you have it. Like I’ve said for well over year now, you can throw all that stuff out the window if you want and just look a the rate of inflation. The closer it gets to two percent the better the market will get. If your one of those folks that says that’s simply too complicated for me or too much for me to do, then just keeping your eye on that is enough. Just understand that the higher the rate of inflation the more volatile the market will be. One more issue, I am aware that the I fund is doing exactly what I said it would do. In retrospect we should have invested in the I Fund instead of the S Fund when we made our move. However, I am now hesitant to make a change for two reasons. #1 The value of the dollar has been dropping and if that remains the case the I fund will not perform as well as it has. #2 The S Fund was the most beaten up of our TSP funds and stands the most to gain on the rebound. Tech and small caps will regain there competitive advantage as interest rates moderate. So right now I’m just not sure whether we will receive any long term gain by being invested in the I Fund. If we indeed believe that the market bottomed in October and I do, then it’s more important to be positioned well for the recovery whenever it comes. I will add one caveat to that. I reserve the right to change my mind. This has been a volatile and fluid market and things change and when they change we must adapt. It’s not about predicting what your environment will be, it’s about reacting to it!! Never forget above all to keep praying to the One that never leaves us no matter how volatile things get. He is our provider from whom all blessings flow. Give God all the praise for He is worthy!!

The days trading has left us with the following results so far. Our TSP allotment is currently up +0.24%. For comparison, the Dow is off -0.48%, and the S&P 500 is -0.59%. I don’t expect any moves one way or the other until Jerome Powell’s speech tomorrow.

S&P 500 opens flat as Wall Street struggles to recover from Monday’s sell-off

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/S. Our allocation is now -27.38% for the year not including the days results. Here are the latest posted results.

| 11/28/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.1755 | 18.2852 | 60.7129 | 63.7509 | 33.6941 |

| $ Change | 0.0061 | -0.0223 | -0.9519 | -1.2541 | -0.5125 |

| % Change day | +0.04% | -0.12% | -1.54% | -1.93% | -1.50% |

| % Change week | +0.04% | -0.12% | -1.54% | -1.93% | -1.50% |

| % Change month | +0.33% | +3.46% | +2.54% | +0.30% | +10.80% |

| % Change year | +2.62% | -12.46% | -15.61% | -23.60% | -14.57% |

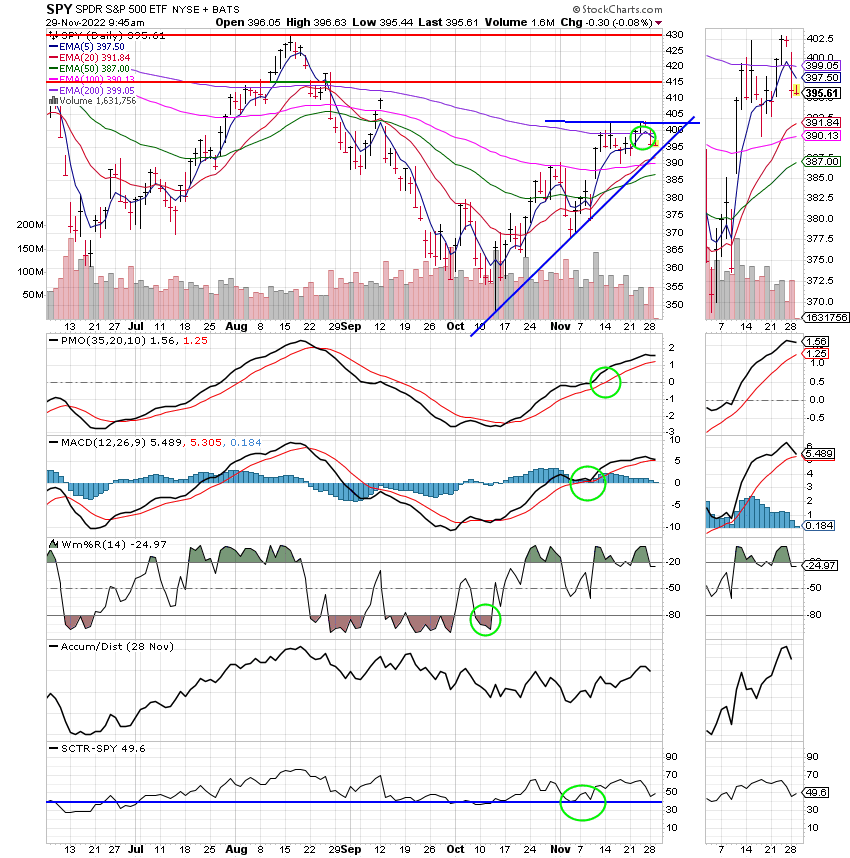

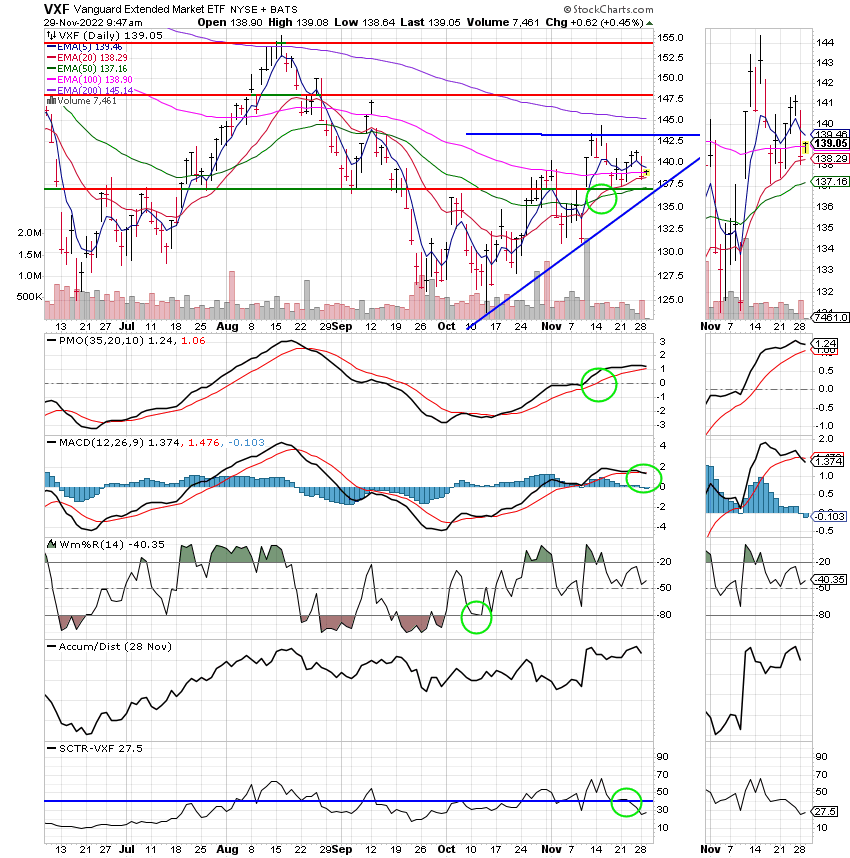

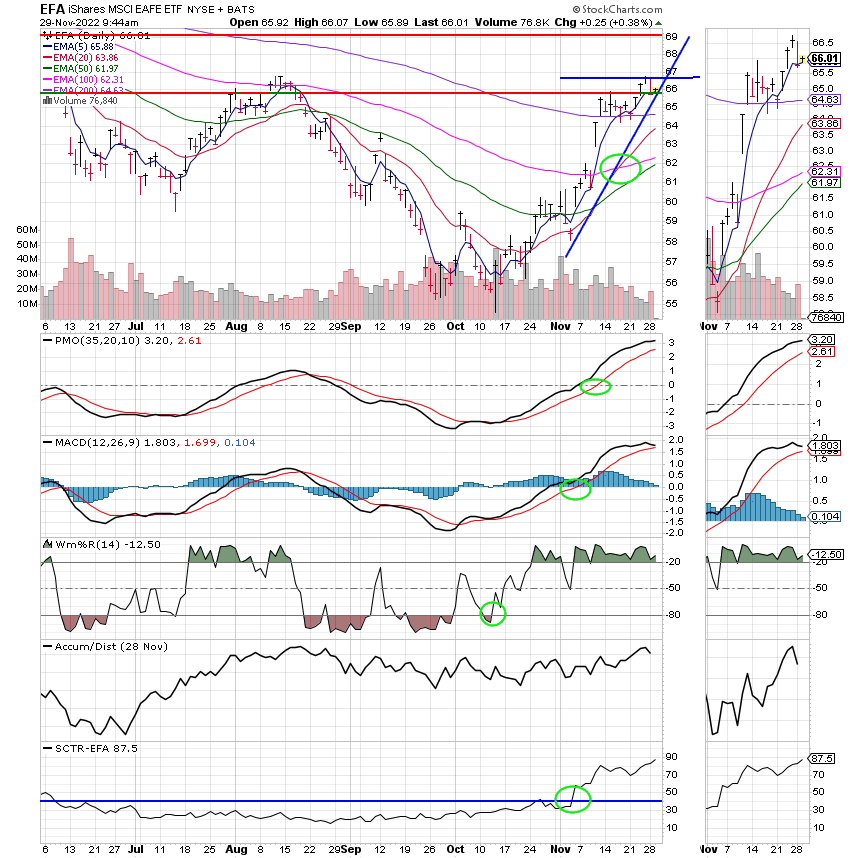

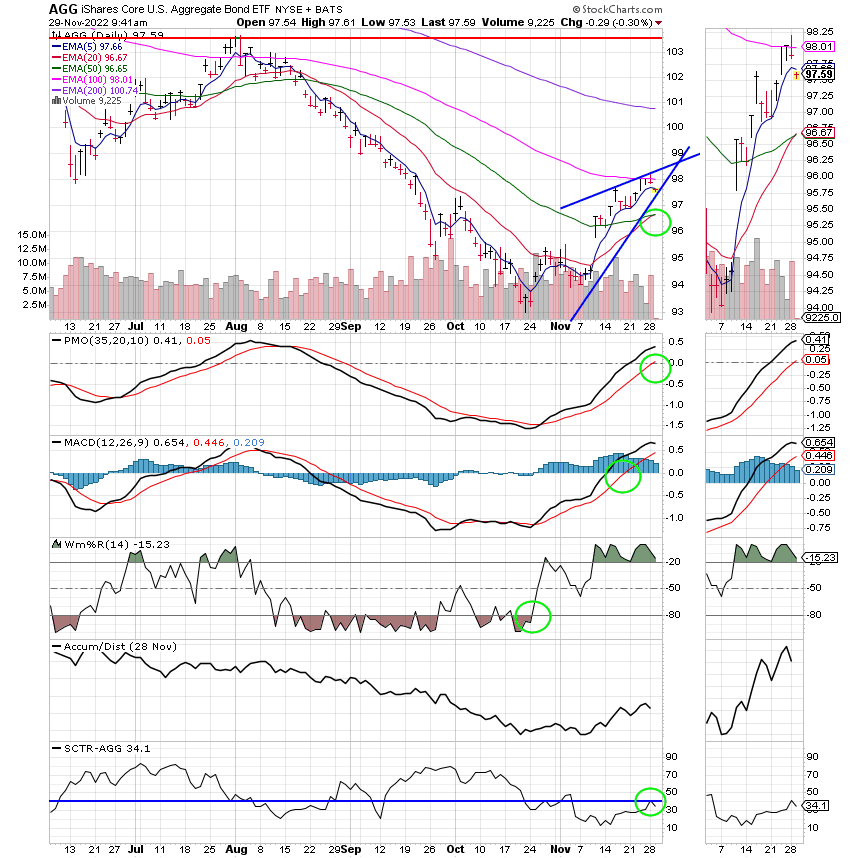

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

I pray that you all had a wonderful thanksgiving with your families. Now we can get ready for Christmas and celebrate the birth of our savior. That makes even a year like 2022 seem not so bad. That’s all for today. Have a nice afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.