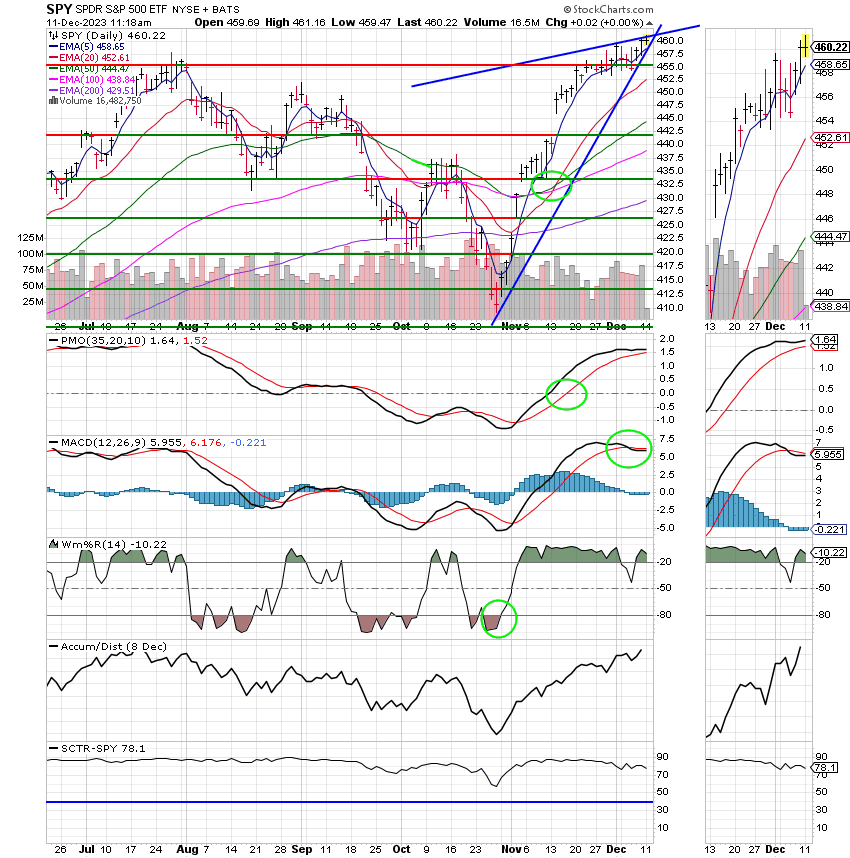

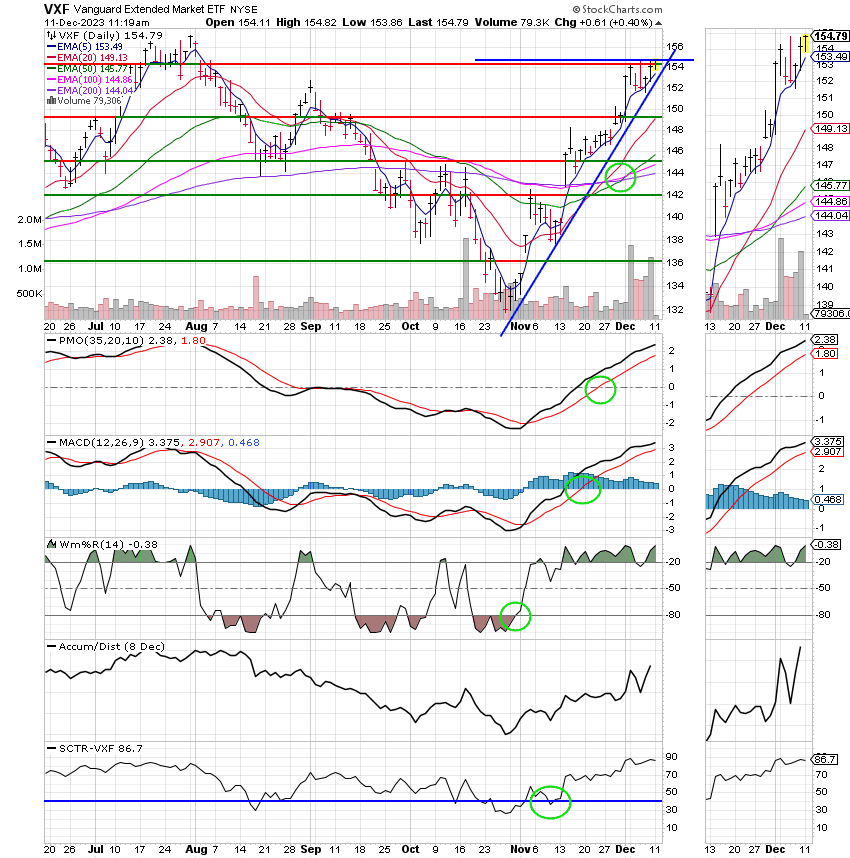

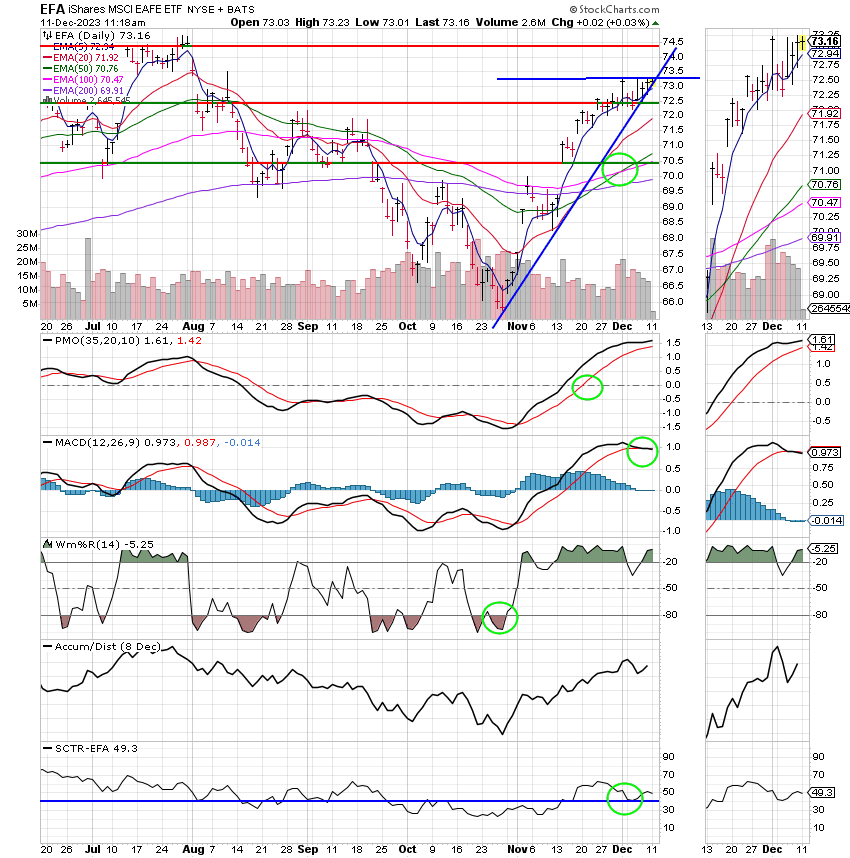

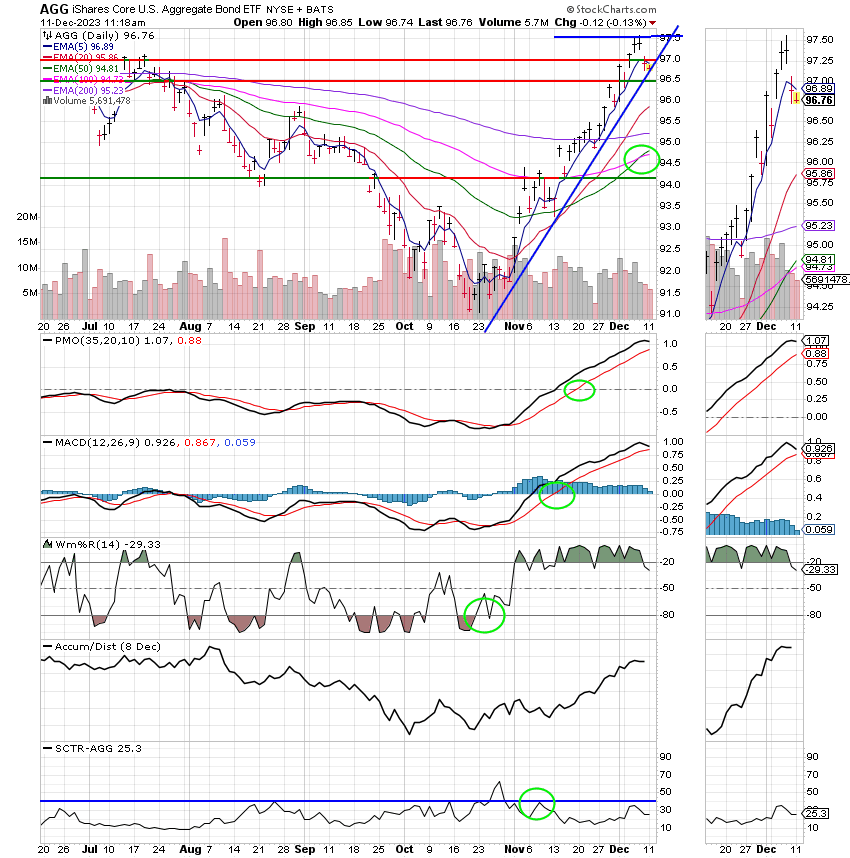

Good Morning, While the media considered last week mostly negative, as far as I was concerned for the most part it was sideways. It was not the pullback that we have been looking for. That noted, it is important to know that sometimes these setups resolve themselves in a sideways fashion. There are times when we can clearly see big downturn coming and there are times like this when the signals are not as strong. The important thing to remember here is that our #1 priority is to protect our capital and we do that be reducing or eliminating our exposure to the market when the risk of a pullback is elevated. As of today our charts are still calling for a modest pullback most likely in the 3-5% range and as long as that is the case we will remain in the G Fund. Even though our indicators are telling us that the market will continue higher after this dip we don’t want to jump in and give up 3-5% right off the bat. That is not a good way to start a trade. In this system it is important to be patient as the emphasis is on protecting our capital more that it is on making gaudy gains. It requires that we be patient as we wait for the next opportunity to safely make some money. The important thing to understand is that when the market is topping out and preparing for a reset as it is now that additional gains will be limited if they occur at all. Occasionally, the market will be sticky to the upside as it is now which can be frustrating as fellow traders will quickly let you know what you are missing. The important thing to remember here is that you already booked a nice gain that you will not lose. On the other hand had you stayed in equities and gained say another 3%, could you hang onto it when the market corrects? Most likely in our current trade the folks that got out and the folks that stayed in will end up in about the same place. However, that has yet to be determined. There are two things we know for sure. We will not lose the profit we gained in November and healthy markets always pause and reset. Yes I know that there are a lot of folks who are saying that is not the case right now. Those folks became conditioned to a market that for the most part just went straight up after the financial crisis of 2009. They got used to a market that went straight up with very few resets fueled by unprecedented government stimulus. That’s right, the government had never taken that type of action before. So the market went for the most part straight up. That is not to say there were no corrections, but they were few and far between. So what changed between then and now and what are the results of that change. The government stimulus stopped and the Fed is now selling off the bonds that they bou0ght since 2009. They refer to that as unwinding stimulus. The result is that the market now has normal and healthy corrections as it moves higher. How does that effect our trading? We see this as an opportunity. Our strategy is to reduce our exposure to equities during the rests and increase our exposure to them when the market is moving higher. This is what we did prior to the pandemic and that is what we will do now. As I mentioned last week, we don’t have success on every trade. We do have success on many of our trades and the fact that we protect the gains that we make more than offsets the trades in which we don’t come out on top. Again, our philosophy always has been and always will be that it’s not what you make that’s important. It’s what you keep! If you can’t spend it, it does you little good in retirement!!!

Looking at the market today it’s all about the Fed this week. The Fed begins the last meeting of the year tomorrow and concludes with Wednesday’s press conference at 2:00 PM EST. There are also two huge reports that the Fed will be looking at. On Tuesday, the Consumer Price Index or CPI will be released. That is the Feds favorite gauge of where the economy is at. On Wednesday the Producer Price Index or PPI will be released. It is also closely followed by the Fed. These will be the last two reports that the Fed will look at before they make their final policy decision of 2023. Right now it is expected that they will hold rates steady. Although, there is a growing group of investors that are expecting future rate cuts. The CME Group’s FedWatch tool is indicating that markets are pricing in a 45% likelihood in March that the Fed will lower rates by 0.25 percentage points. I think they are getting ahead of themselves. However, that is definitely something to watch for future trading. We will watch our charts closely over the coming days and see if a good entry point develops, but we will also make every effort to protect our capital. While that might not be everyone’s first priority, it is definitely ours….

Today’s trading is generating the following results. Our TSP allotment is steady in the G Fund. For comparison, the Dow is currently trading higher at +0.31%, the Nasdaq is off -0.10%, and the S&P 500 is up +0.15%. I don’t anticipate any big moves one way or the other prior to the Fed meeting.

S&P 500 is little changed to start the week as Wall Street awaits final Fed meeting of 2023: Live updates

Recent action has left us with the following signals: C-Hold, S-Hold, I-Hold, F-Sell. We are currently invested at 100/G. Our allocation is now -0.93% for the year and +0.10% for the month not including the days results. Here are the latest posted results:

| 12/08/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.9118 | 18.7198 | 71.729 | 72.0139 | 38.4741 |

| $ Change | 0.0022 | -0.0766 | 0.2943 | 0.4890 | 0.0612 |

| % Change day | +0.01% | -0.41% | +0.41% | +0.68% | +0.16% |

| % Change week | +0.09% | +0.14% | +0.24% | +0.61% | +0.04% |

| % Change month | +0.10% | +1.01% | +0.83% | +3.17% | +0.91% |

| % Change year | +3.93% | +2.81% | +21.77% | +17.04% | +13.35% |