Good Morning, Only two more weeks left in 2023! I know it’s been a good year for some, but it was a year of adjustment for us. I feel like we are now set for the indefinite future. So I’m looking forward to what God has for us! 2022 and 2023 are over.

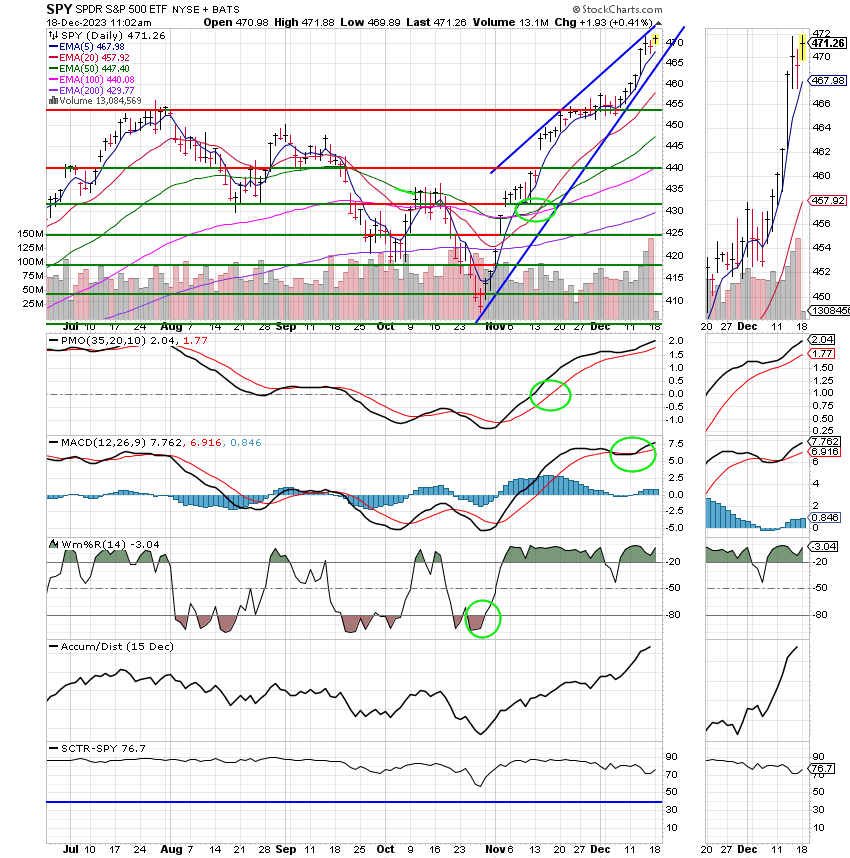

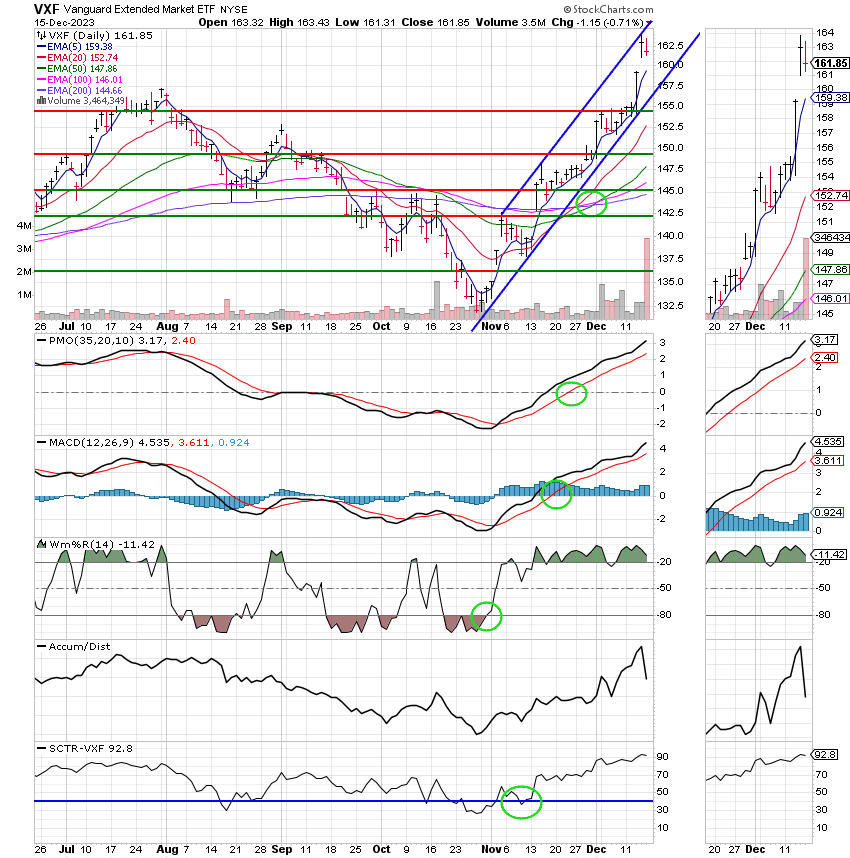

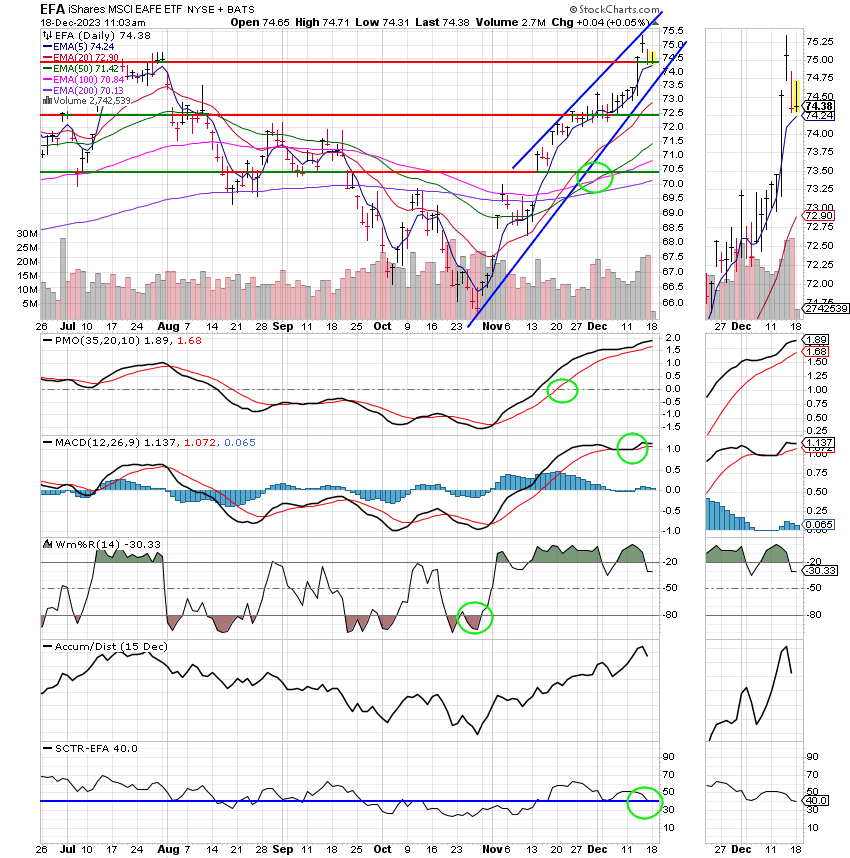

The market has posted gains now for seven consecutive weeks. The S&P 500 has posted the most consecutive gains since 2017 and is threatening to do so again this week. Given the generous nature of the Santa Rally we could well see that happen. So why did we get out of equities? First of all we don’t have a crystal ball. Carl Swenlin who I consider to be one of the fathers of modern technical analysis always says that technical analysis if more like a wind sock than a crystal ball. In this case our indicators are showing us that the market is extended and due for a pullback. Given what we already experienced in the first 6 months of 2023 we didn’t felt like it was better to be safe than sorry again. So we took some profit and moved to the sidelines to wait. Most often markets will move in one direction or the other a lot more than we think is reasonable. Another famous investor that I closely follow says this quite often and it it true more often than not. That has been the case since we got out. There was a time when I first started investing that I stayed in equities during the months of November and December no matter what and it worked reasonably well. Well I don’t do anything “no matter what now” . I mange risk and that is the reason that I took my profit early this time. Given the volatile nature of the market as the Fed designs policy to control inflation and the extended nature of the charts the risk of a modest correction is high at this time. As I have stated may times recently and throughout my investing career nobody ever got hurt taking a profit. It’s those that failed to take a profit that suffered losses. I know it looks like this market will move inevitably higher, but it will not. There is in fact one thing that is inevitable so to speak. The market will pause and reset. It will move lower. It is just a matter of when and by how much. A healthy bull market will pause before it’s next leg up. It will usually dip and occasionally will only move sideways. If the market is unhealthy it will move significantly lower and the correction will turn into a bear market. The thing you must realize if you are to successfully navigate all this is that the market will drop. That is what markets do. You have two choices which are to hold and let the market recover after the drop or to sell and try to take advantage of the lower stock prices created by the sell off. The latter is what we do. The former is what the buy and holders do. This is where we need to be perfectly clear. Neither system works 100% of the time. Anybody that tells you that they do is to put it mildly, not being truthful. That said, you can use the first system and take what the market gives you or you can try to beat the market. As I have explained many times, my strategy is to try and beat it……. So where does that leave us today?

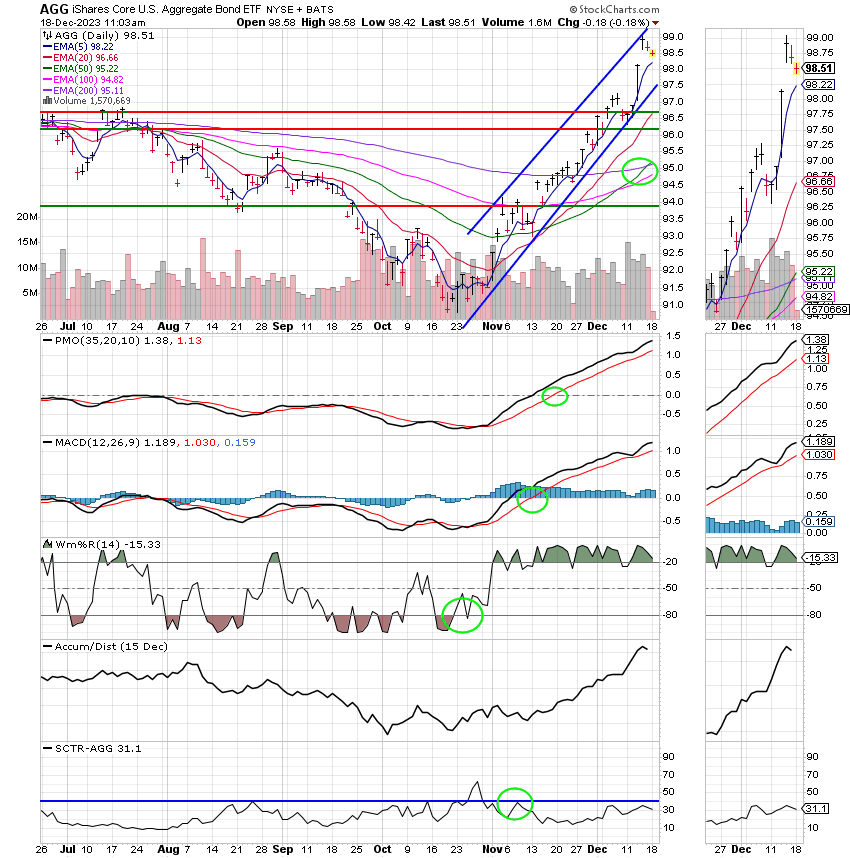

With the market rallying into the end of the year and our charts so extended, we chose not to chase this market higher. However, after a close review of our market wide charts we noticed that bond yields are moving lower and in turn causing bond prices to move higher. To do this analysis you must understand that bond prices and bond yields move in opposite directions. You must also understand that when interest rates move lower bond yields move lower and visa versa. Given that bond yields are currently moving lower I decided to move into bonds while we wait for the equity market to reset. Bonds are a conservative investment and are considered defensive in nature anyway which fits our current needs to a tee! My intention is to re enter the equity market when there is a dip that provide us with a good entry point. Until then why not try to make a little safe money in bonds.

The outlook of the market changed significantly last week when the Fed met. The Fed held rates steady which was no surprise, but at least to me what was a surprise, is that the Fed indicated that they would likely cut interest rates three times next year. That is what caused the market to rally and bond yields (which are tied to interest rates) to fall. Yes, the market is rallying. Yes it is rallying strongly! Yes we missed it. This time….. However, an extended market is becoming even more extended. Eventually, this market will move lower to pause and correct. Believe me when I tell you this. It will!!! For now I am satisfied with the profit I made and an opportunity to add somewhat safely to the bottom line of my portfolio with bonds (100% F Fund). For now, each economic report will be heavily scrutinized by investors to determined what effect if any it will have on the next Fed meeting. Basically, the focus has shifted from when the Fed will pause to when will they begin to cut rates. The conclusion of all this is that the market will remain at least somewhat volatile until the rate of inflation returns to the Fed target of two percent.

The market is currently generating the following returns. Our TSP allotment is off a little at -0.18%, but bear in mind it had a nice run last week and is likely consolidating before moving higher. For comparison, The Dow is flat at -0.02%, the Nasdaq is higher at +0.19%, and the S&P 500 is up at +0.26%. All in all the market is moving a little slow after last weeks big run.

S&P 500 rises Monday as market adds to seven-week advance: Live updates

Recent action has left us with the following signals: C-Hold, S-Hold, I-Hold, F-Buy. We are currently invested at 100/F. Our allocation is now -0.84% for the year and +0.19% for the month. Here are the latest posted results:

| 12/15/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.9274 | 19.1225 | 73.5404 | 75.6853 | 39.2546 |

| $ Change | 0.0023 | -0.0206 | -0.0027 | -0.4866 | -0.2583 |

| % Change day | +0.01% | -0.11% | +0.00% | -0.64% | -0.65% |

| % Change week | +0.09% | +2.15% | +2.53% | +5.10% | +2.03% |

| % Change month | +0.19% | +3.18% | +3.38% | +8.43% | +2.96% |

| % Change year | +4.02% | +5.03% | +24.85% | +23.00% | +15.65% |