Good Evening,

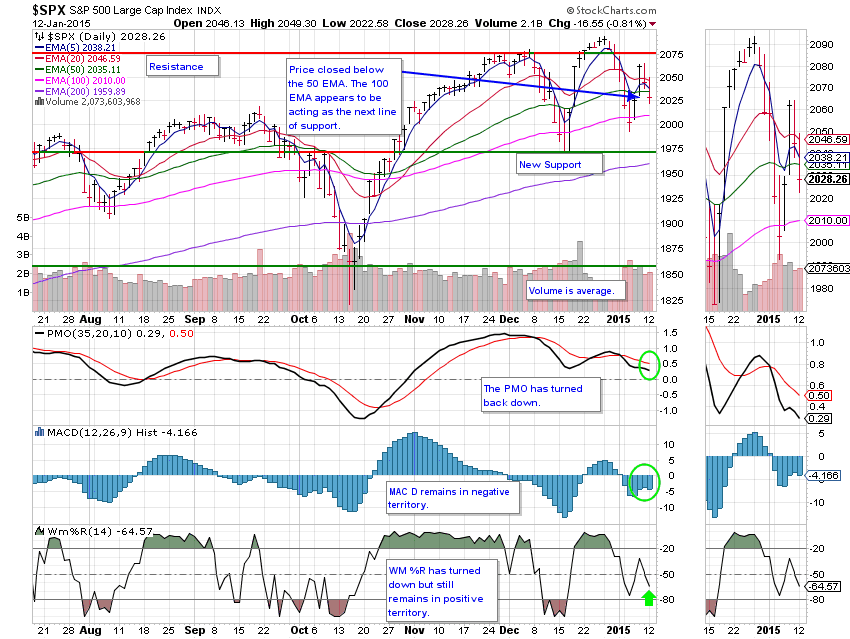

Oil went down again today and so did the market. I decided to short the remainder of my oil stocks and buy them back later as this oil market obviously hasn’t found the bottom. While the major indices were all down there were some things that were working out there, such as leisure, entertainment, retail, home builders and real estate. Things that work when gas prices and interest rates are low….. At any rate, there isn’t any real damage done to the market yet. To put things into perspective, the S&P 500 is only about 3% off of its all time highs. All it needs is a decent bounce and it’ll be right back at record highs. The bulls need to get to work soon though. Today’s trading left our TSP allotment down -0.585% on the day. AMP out-performed with a gain of +0.105% . For comparison the Dow lost -0.54%, the S&P -0.81%, and the Nasdaq -0.84%. AMP is doing very well on down days! Why do I post the AMP results? #1 Some of the folks that take the newsletter are now retired and have invested in AMP. #2 I would like those of you still invested in Thrift to see what we are doing in AMP.

Wall St. falls; energy shares dragged down further by oil

| 01/09/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6241 | 16.9424 | 26.9944 | 35.9343 | 23.7625 |

| $ Change | 0.0009 | 0.0342 | -0.2289 | -0.2834 | -0.0635 |

| % Change day | +0.01% | +0.20% | -0.84% | -0.78% | -0.27% |

| % Change week | +0.04% | +0.66% | -0.61% | -0.82% | -1.88% |

| % Change month | +0.05% | +0.84% | -0.63% | -1.00% | -1.88% |

| % Change year | +0.05% | +0.84% | -0.63% | -1.00% | -1.88% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4329 | 22.7934 | 24.652 | 26.1856 | 14.8278 |

| $ Change | -0.0216 | -0.0742 | -0.1048 | -0.1299 | -0.0830 |

| % Change day | -0.12% | -0.32% | -0.42% | -0.49% | -0.56% |

| % Change week | -0.11% | -0.45% | -0.61% | -0.71% | -0.84% |

| % Change month | -0.10% | -0.46% | -0.62% | -0.73% | -0.87% |

| % Change year | -0.10% | -0.46% | -0.62% | -0.73% | -0.87% |