Good Evening,

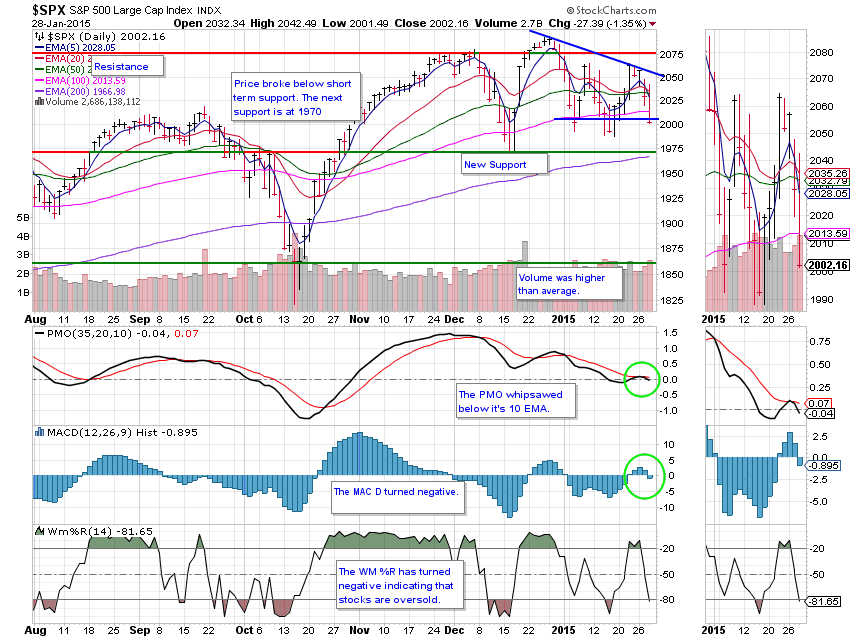

The Apple earnings pleased the market and drove it up early. Then it started to mark time until the 2:00 PM EST release of the FED minutes. So what did the FED say? In a nutshell, the Federal Reserve said it would remain “patient” on raising rates, but indicated that it saw the U.S. economy getting stronger. The statement completely dropped the phrase “considerable time” from its language referring to tightening. The result was the market decided to sell off.

You can debate on whether or not the FED will raise rates this year, but my take on the statement is that they definitely left the door open to do so, and maybe sooner than we thought. Either way, you just can’t argue with the pricing action. After the FED announcement, the action was down.

The selling left us with the following results: Our TSP allotment fell -1.415% and AMP dropped -0.629%. For comparison, the Dow lost -1.08%, the Nasdaq -0.93%, and the S&P -1.35%.

Wall Street ends lower after Fed statement, oil drop

| 01/27/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6395 | 17.0499 | 26.8042 | 36.3917 | 24.8437 |

| $ Change | 0.0009 | 0.0062 | -0.3628 | -0.2182 | 0.2073 |

| % Change day | +0.01% | +0.04% | -1.34% | -0.60% | +0.84% |

| % Change week | +0.02% | -0.02% | -1.08% | +0.48% | +1.64% |

| % Change month | +0.16% | +1.48% | -1.33% | +0.26% | +2.58% |

| % Change year | +0.16% | +1.48% | -1.33% | +0.26% | +2.58% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.485 | 22.949 | 24.8609 | 26.4351 | 14.9926 |

| $ Change | -0.0227 | -0.0647 | -0.0909 | -0.1124 | -0.0686 |

| % Change day | -0.13% | -0.28% | -0.36% | -0.42% | -0.46% |

| % Change week | -0.02% | +0.00% | +0.01% | +0.02% | +0.05% |

| % Change month | +0.20% | +0.22% | +0.22% | +0.21% | +0.23% |

| % Change year | +0.20% | +0.22% | +0.22% | +0.21% | +0.23% |