Good Evening,

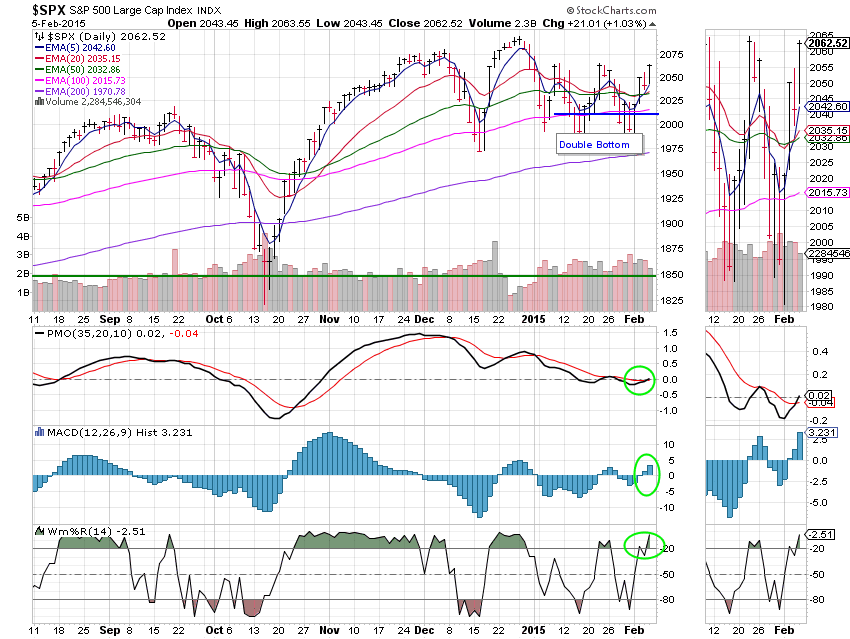

Today was a different sort of trading day than we have had since the first of the year. The action was straight up throughout the day and into the close. Absent were the wild inter-day swings that we have a had as of late. A lot of folks who got out due to the recent volatility were left standing on the sidelines and scratching there heads. The bears were squeezed and the under-invested bulls were left behind.

I’m not sure if this run will continue, but it sure puts me in mind of 2014. This type of action has the dynamic of leaving a lot people under-invested and the longer the market moves up, the more they want to get in. Don ‘t get me wrong, most of them are mistrustful of the market. Nevertheless, as the market moves up without them, it gets to the point that they just can’t stand to be out of the action anymore. So they start putting capital to work a little at a time as long as the market continues to rise. This fresh capital adds support and fuels the market even higher. It was this constant supply of money that fashioned so many V-Shaped bounces in 2014. While this market has a different feel, the under-invested bulls will still join the chase if they see themselves being left behind.

The day’s action left us with the following results. Both of our allotments made steady gains with TSP adding +0.52% and AMP gaining +0.66%. The AMP allotment has now risen four days in a row! At least for now, we have managed to reduce some of the volatility there. For comparison, the Dow rose +1.20% , the Nasdaq +1.03%, and the S&P +1.03%.

Of course, I probably didn’t have to tell you this, but today’s rally was led by the energy sector, which was fueled by a gain in the price of oil… Nothing new under the sun… So goes oil, so goes stocks in 2015! Now on to the Greek situation. Let’s get real– the Greek GDP is about the same size as Procter Gamble. Now tell me this: if Proctor and Gamble went broke would it have the same effect that the Greek situation has had on world markets? Guess it’s time for another ‘Greece is saved’ rally. Let’s see… which cycle are we on? Is it saved or lost? OK, that’s right, Greece was lost last time, so now it can be saved again. Time to make some more money!

Wall St. climbs with energy rebound, Pfizer deal

The day’s action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Buy. We are currently invested at 50/F, 50/S. Our allocation is now -0.65% on the year, not including the day’s results. Here are the latest posted results:

| 02/04/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6459 | 17.0826 | 26.9754 | 36.4274 | 25.0066 |

| $ Change | 0.0007 | -0.0076 | -0.1050 | -0.1306 | -0.0445 |

| % Change day | +0.00% | -0.04% | -0.39% | -0.36% | -0.18% |

| % Change week | +0.02% | -0.44% | +2.37% | +2.25% | +2.04% |

| % Change month | +0.02% | -0.44% | +2.37% | +2.25% | +2.04% |

| % Change year | +0.20% | +1.67% | -0.70% | +0.36% | +3.26% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.513 | 23.0218 | 24.9564 | 26.5467 | 15.0627 |

| $ Change | -0.0116 | -0.0379 | -0.0532 | -0.0654 | -0.0415 |

| % Change day | -0.07% | -0.16% | -0.21% | -0.25% | -0.27% |

| % Change week | +0.44% | +1.12% | +1.45% | +1.67% | +1.90% |

| % Change month | +0.44% | +1.12% | +1.45% | +1.67% | +1.90% |

| % Change year | +0.36% | +0.54% | +0.61% | +0.64% | +0.70% |