Good Evening,

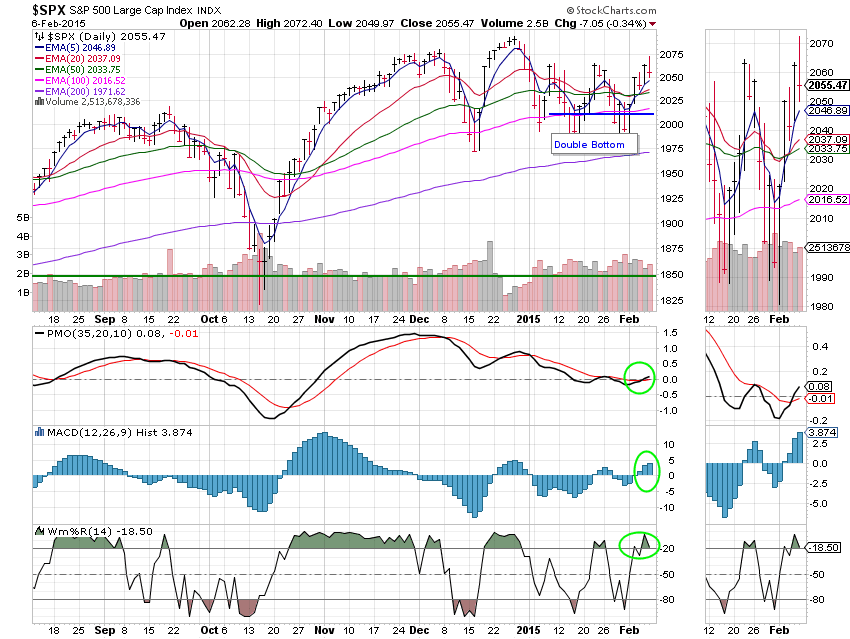

Recently, we have been discussing how the landscape of the market has changed since the great recession. Another aspect of that change was evident today. The market no longer trades on fundamentals. It now trades on rumors. Had we traded on the obvious news today (which was a good employment report), we would have made some nice gains on an improving economy… But no, that wasn’t good enough.

The rumor started going around that the FED would now increase interest rates in June based on their earlier statement in which they said that employment would be one of the factors that would influence their decision. Ok. So we’ll wait until the next FED meeting, or at the very least, until Janet Yellen says that a rate increase is now on the table and then we’ll take action. However that’s not the way the market trades these days. A bunch of market players run scared and sell at every rumor. They are afraid of their own shadow and worse than that, they program these blasted machines to do the same thing. The result of their assumptions is the type of action we had today.

The market started off having a nice day and then everything that could be affected by higher interest rates was unfairly sold off. After that, pretty much everything else was sold for good measure. Nevermind that they are posting record earnings on low interest rates… We’d better sell now or we might own a stock that has a bad report a year or two from now! Give me a break! All they managed to do was give the rest of us a bad day. Hang onto your low interest rate and low oil price plays. It’s all about the earnings and these companies are still going to make great profits. There is no way that they will fail to make money. This is a no brainer!

So what if interest rates do go up? So what! Say the FED raises the rate a quarter point. Am I missing something here? Rates will still be lower than they have been in years. Money will still be cheap! Stay the course and stick to your charts. Don’t get caught up in this baseless emotion. God is with us and He will guide our hand! We will deal with whatever comes our way, including this incompetent trading.

The day’s action left us with the following results: Our TSP allotment slipped back -0.385% and AMP dropped -0.403%. For comparison the Dow lost -0.34%, the Nasdaq -0.43% and the S&P was -0.34%. Here are a few more things to compare you results with: A lot of the older people in my area of the country buy and hold ATT (T) stock. I have found it to be a rock solid bellwether to use as a benchmark so I’m going to add its results here when time permits. In addition, I’m going to add a Kramer favorite, Alaska Air Group (ALK). Transportation has been a hot area with the low cost of oil and Alaska Air Group is one of the best of that group. I think it is always fun, as well as prudent, to compare your results with as many areas as you can. AT&T had an outstanding day today adding +0.96%. Maybe those old folks know a thing or two! Alaska Air came in at -1.35%. It basically got hammered with everything else.

Wall St. ends down on interest rate, Greece jitters

| 02/05/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6465 | 17.074 | 27.2589 | 36.9042 | 25.1895 |

| $ Change | 0.0006 | -0.0086 | 0.2835 | 0.4768 | 0.1829 |

| % Change day | +0.00% | -0.05% | +1.05% | +1.31% | +0.73% |

| % Change week | +0.02% | -0.49% | +3.44% | +3.59% | +2.78% |

| % Change month | +0.02% | -0.49% | +3.44% | +3.59% | +2.78% |

| % Change year | +0.21% | +1.62% | +0.34% | +1.67% | +4.01% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5483 | 23.1379 | 25.1202 | 26.7496 | 15.1926 |

| $ Change | 0.0353 | 0.1161 | 0.1638 | 0.2029 | 0.1299 |

| % Change day | +0.20% | +0.50% | +0.66% | +0.76% | +0.86% |

| % Change week | +0.64% | +1.63% | +2.12% | +2.45% | +2.78% |

| % Change month | +0.64% | +1.63% | +2.12% | +2.45% | +2.78% |

| % Change year | +0.56% | +1.04% | +1.27% | +1.40% | +1.56% |