Good Evening, As expected the FED did not raise rates. In her press conference Janet Yellen stated that a rate increase would be likely this year, but that it was still data dependent. A lot of folks were saying that the FED was vague in their statement. However, after listening to the statement release and watching the news conference, I really don’t see how they could be more specific. They pretty much said what they were going to do and how they were going to do it. Janet Yellen said that the timing of the initial and subsequent increases would be tied to the labor market and to inflation. She said that the FED target for inflation was 2% and the target for unemployment was in the 5% range. When questioned, she also admitted that any global developments that effected US markets could also influence the FED decision. She even laid out a projected time table for increases ending in 2017 at a rate of 2.75%. She indicated that the FED’s goal was to move rates to what they considered to be normal. I surmised from here projected rate of 2.75% in 2017 that 2.75% is what they consider to be normal.The rates are currently from 0 – 25%. Other than giving exact times and dates for each increase, she could not have been more specific. She also said that the media and traders were putting way too much emphasis on the initial increase which is what I have been saying as well. She stated that rates would not be raised all at once and that the FED would remain highly accommodative as they raise them. OK, that’s good enough for me.

The market responded be moving up about a half a percent and then backing off to finish with modest gains for the day. The post FED trading left us with the following results: Our TSP allotment finished flat at -0.012%. For comparison, the Dow added +0.17%, the Nasdaq +0.18%, the S&P 500 +0.20%. I thank God that there were no huge losses on the day. Perhaps now we can get back to business as usual provided the Greek issue doesn’t present a lot of resistance. You can read the latest on that in the news link below.

Stocks close mildly higher as Street digests Fed

The days action left us with the following signals: C-Neutral, S-Buy, I-Sell, F-Sell. We put out an alert this morning as the I Fund generated a sell signal. As of the close of business today, our new allocation is 30/C, 70/S. We’ll check our allocations balance again on the 25th. Any agreement between Greece and the EU could make the I Fund profitable once again. For now though, we’ll stand back and watch for a few days. Our allocation is now +4.13% on the year not including the day’s results. Here are the latest posted results.

| 06/16/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.745 | 16.809 | 27.9329 | 38.6812 | 26.1623 |

| $ Change | 0.0008 | 0.0266 | 0.1588 | 0.2153 | 0.0301 |

| % Change day | +0.01% | +0.16% | +0.57% | +0.56% | +0.12% |

| % Change week | +0.02% | +0.23% | +0.11% | +0.10% | -1.08% |

| % Change month | +0.09% | -1.07% | -0.42% | +0.81% | -1.42% |

| % Change year | +0.88% | +0.04% | +2.82% | +6.57% | +8.03% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7342 | 23.5775 | 25.6995 | 27.4458 | 15.6349 |

| $ Change | 0.0185 | 0.0538 | 0.0757 | 0.0937 | 0.0590 |

| % Change day | +0.10% | +0.23% | +0.30% | +0.34% | +0.38% |

| % Change week | -0.01% | -0.10% | -0.14% | -0.15% | -0.19% |

| % Change month | -0.09% | -0.28% | -0.35% | -0.37% | -0.42% |

| % Change year | +1.62% | +2.96% | +3.60% | +4.04% | +4.52% |

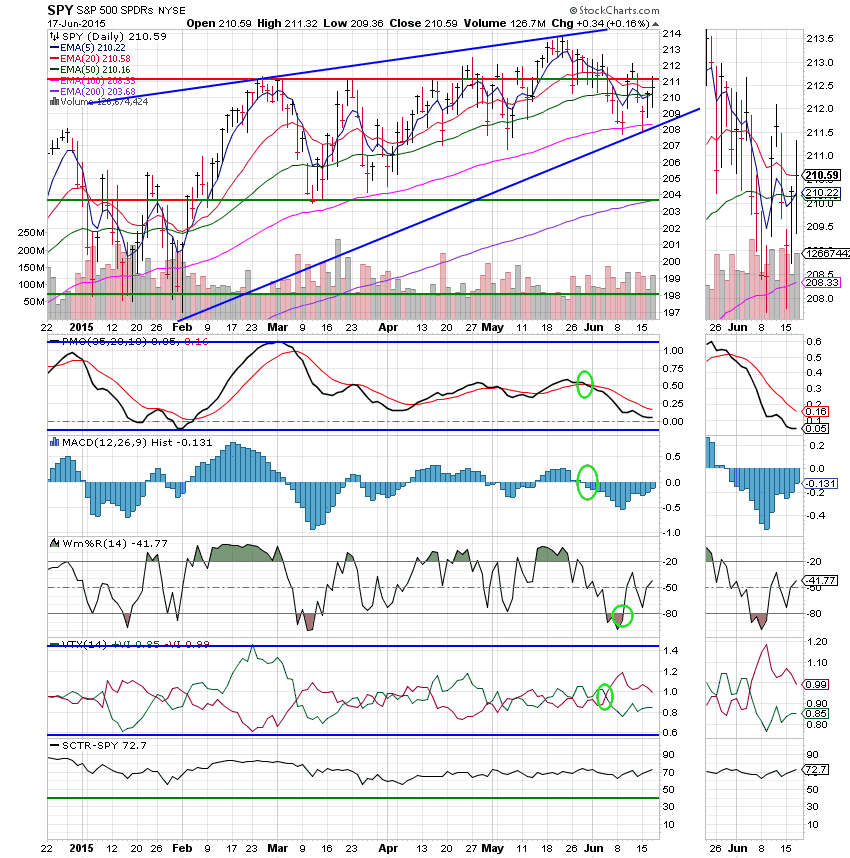

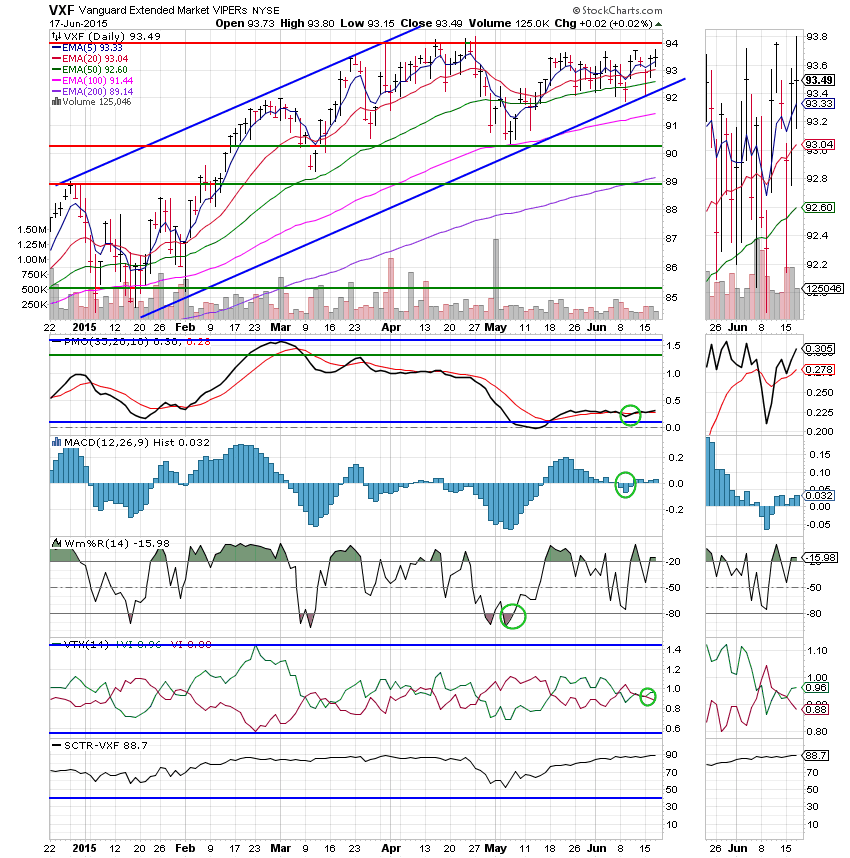

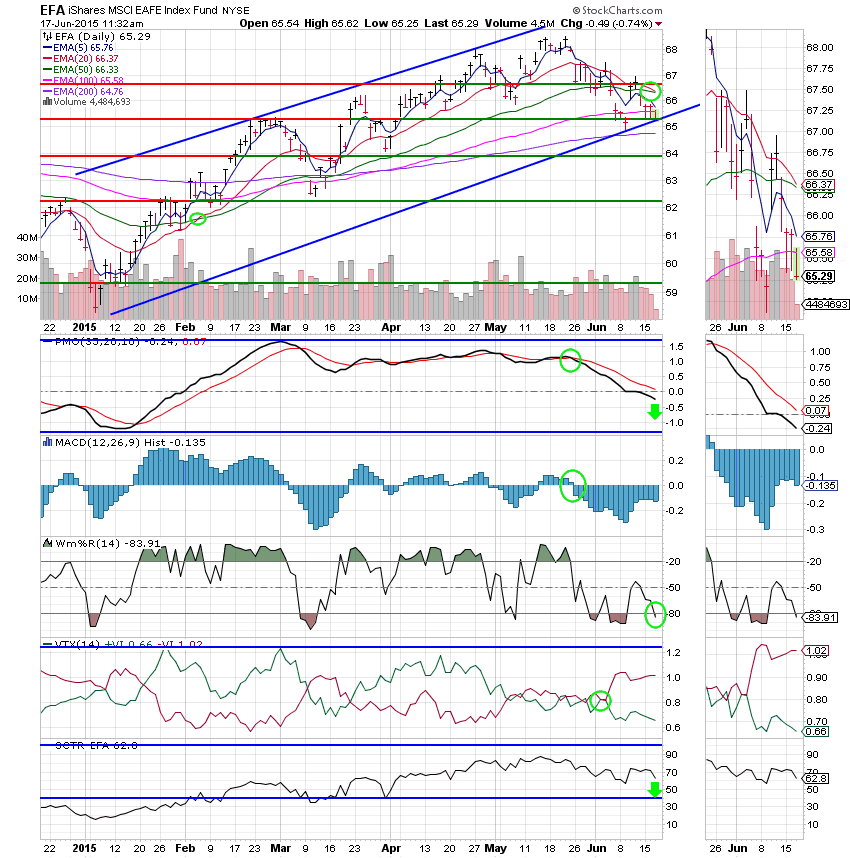

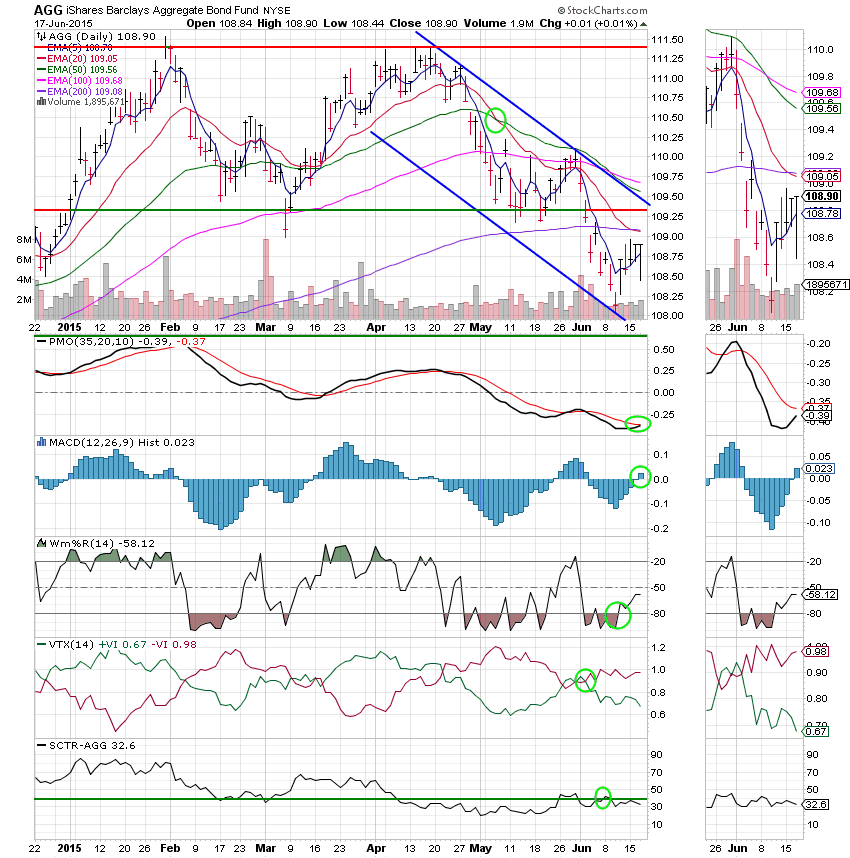

Lets take a look the charts. (All signals annotated with Green Circles)

C Fund: The C fund closed right on it’s 20 EMA today. The rest of our indicators were unchanged.

S Fund: The S Fund closed flat today, but that was enough to maintain it’s buy signal. All signals including price were unchanged.

I Fund: The I Fund generated a sell signal at approximately 11:00 AM this morning when the 20 EMA passed down through the 50 EMA and I immediately rebalanced our allocation to reflect the change. As you can see from the chart below price rebounded and the 20 EMA moved back above the 50 EMA where it finished the day. That said, I decided to let the sale go through anyway as the I Fund has been pressured of late by Greece and a strong dollar. This weakness is reflected by an SCTR of 62.8. We can easily pick the fund back up if it rebounds by the next time we rebalance our allocation. All indicators with the exception of price remain in negative configurations.

F Fund: Price finished flat. The MAC D crossed into a positive configuration and the PMO is threatening to do the same. While those are positive signals, this Fund remains on a sell signal and has a lot of work to do before it puts in a solid bottom.

We’ll see it business can resume as normal or if Greece get’s in the way tomorrow. Keep praying for our group! May God continue to bless your trades. Have a nice evening.