Good Evening, A surprise draw down on the oil supply and some positive action in healthcare broke the two day losing streak on Wall Street today. Stocks rose throughout the day closed at their highs after digesting the latest Fed minutes that were released at 2:00 PM ET. There was nothing really new there, but I guess that it must have been reassuring to investors that the Federal Reserve has their backs.

The days rally left us with the following results: Our TSP allotment gained +1.05%. For comparison, the Dow was up +0.64%, the Nasdaq +1.59%, and the S&P 500 +1.05%.

Wall Street rises with healthcare; oil rallies

The days action left us with the following signals: C-Buy, S-Neutral, I-Sell, F-Buy. We are currently invested at 100/C. Our allocation is now +2.45% on the year not including the days results. Here are the latest posted results:

| 04/05/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9916 | 17.5372 | 27.7497 | 34.5158 | 22.7632 |

| $ Change | 0.0007 | 0.0416 | -0.2842 | -0.3524 | -0.4451 |

| % Change day | +0.00% | +0.24% | -1.01% | -1.01% | -1.92% |

| % Change week | +0.02% | +0.32% | -1.31% | -1.73% | -1.81% |

| % Change month | +0.02% | +0.30% | -0.68% | -1.35% | -3.37% |

| % Change year | +0.51% | +3.43% | +0.68% | -2.04% | -5.53% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.8329 | 23.1556 | 24.9101 | 26.3397 | 14.8473 |

| $ Change | -0.0427 | -0.1324 | -0.2022 | -0.2499 | -0.1611 |

| % Change day | -0.24% | -0.57% | -0.81% | -0.94% | -1.07% |

| % Change week | -0.27% | -0.67% | -0.95% | -1.12% | -1.28% |

| % Change month | -0.28% | -0.70% | -1.00% | -1.17% | -1.34% |

| % Change year | +0.34% | -0.23% | -0.61% | -0.87% | -1.19% |

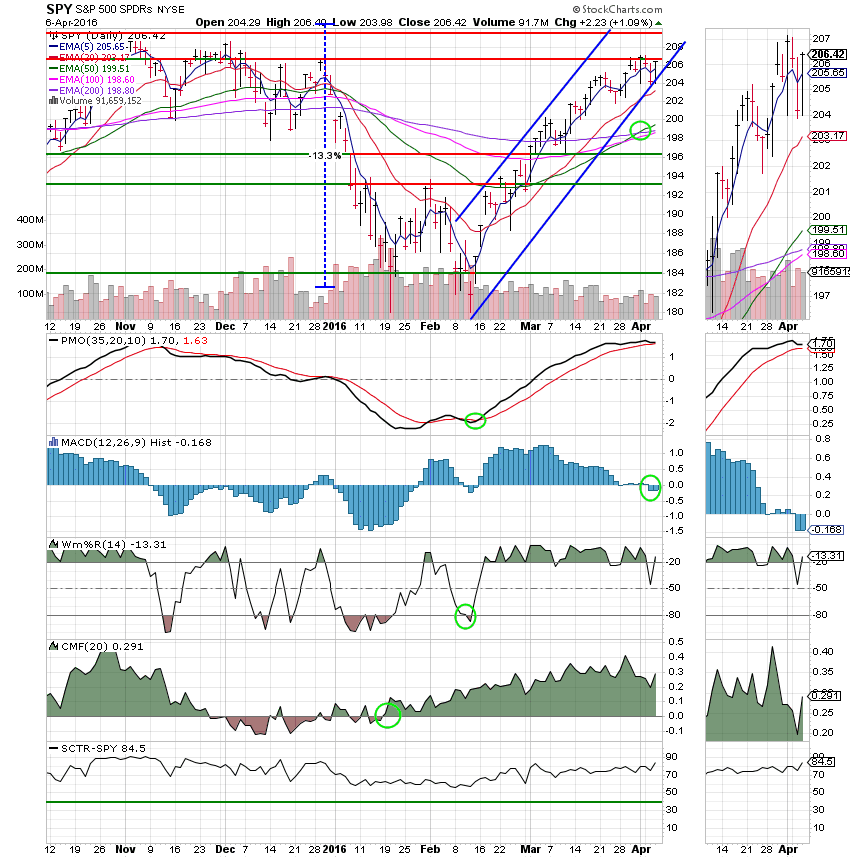

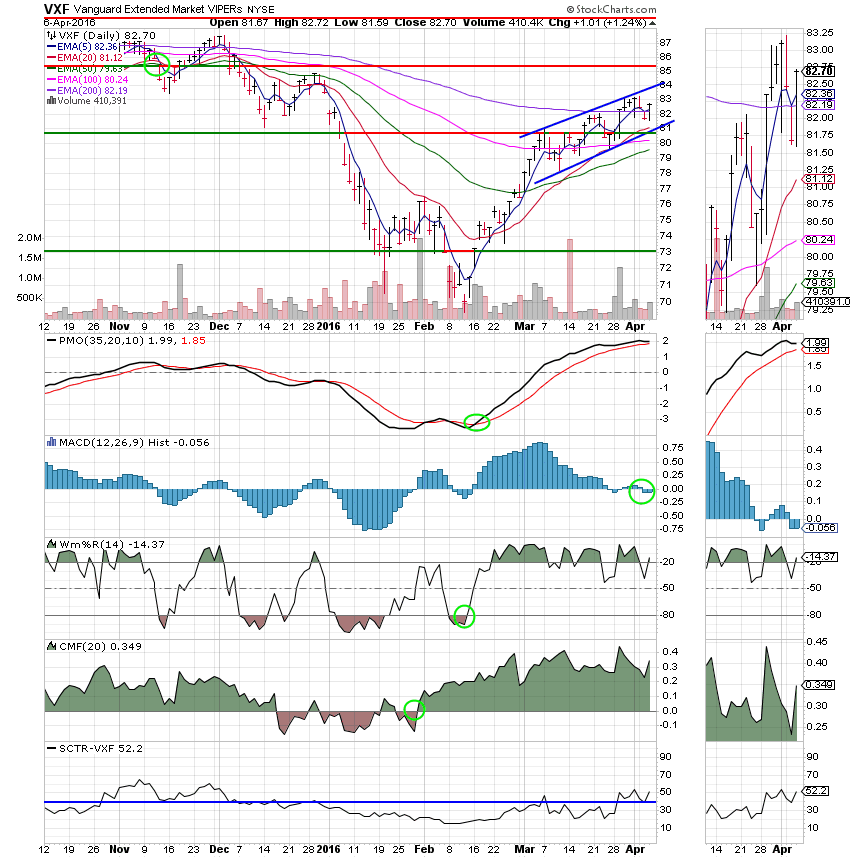

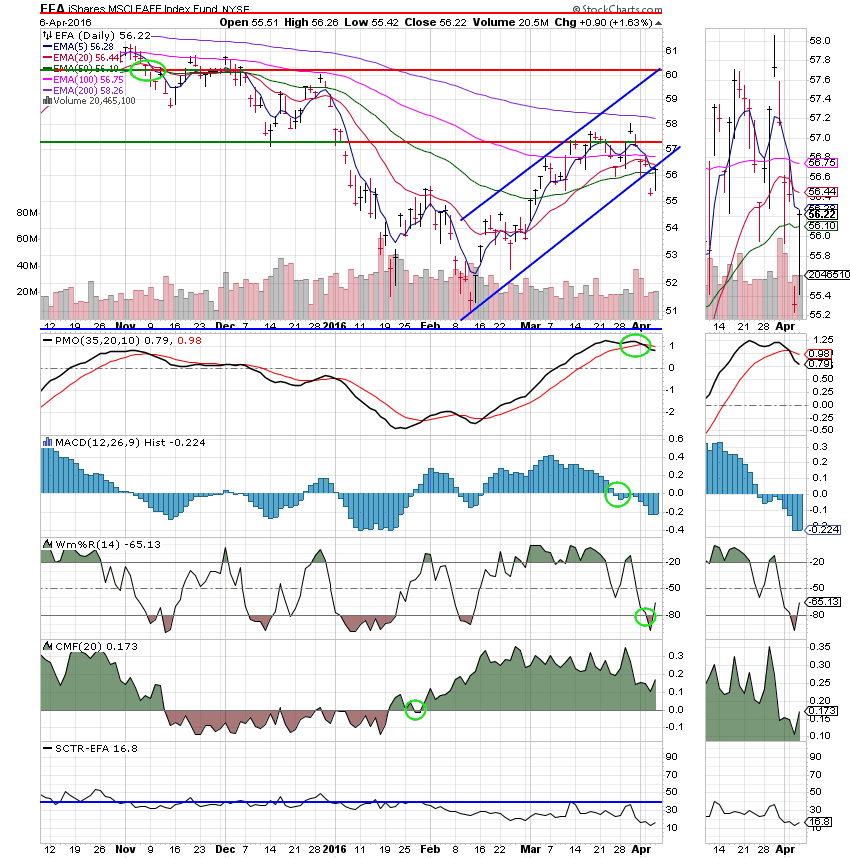

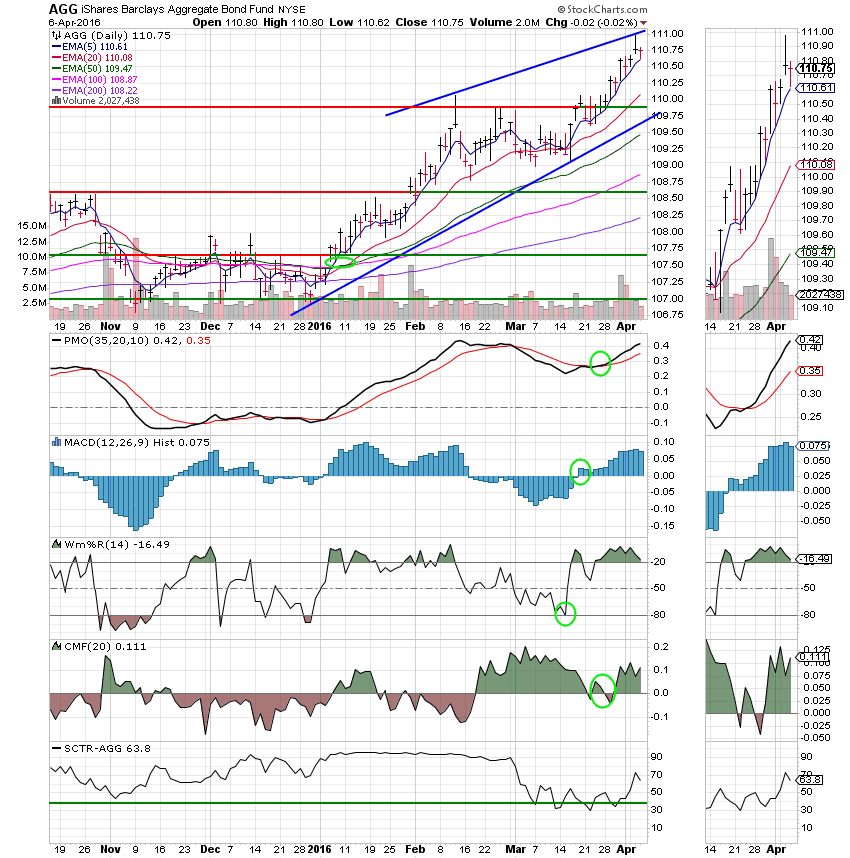

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: Price continues up it’s established ascending channel. The 100 EMA is close to a passing up through the 200 EMA. This is bullish. The SCTR is now a very healthy 84.5.

S Fund: Price continues up it’s newly established ascending channel. With todays advance it reclaimed it’s 200 EMA. However, with an SCTR of 52.2, it still has a little more damage to repair before we can put money to work here.

I Fund: Price met resistance at the lower trend line. Beware! The I Fund only has an SCTR of 16.8. That means that 83.2% of the funds in this category have better charts. Enough said!

F Fund: The F Fund continues to move slowly up it’s ascending channel. In the absence of a rate increase, this is a safe place to put your money. An SCTR of 63.8 suggests that there are better places to be……..

That’s all for tonight. Have a great evening and I’ll see you next time!