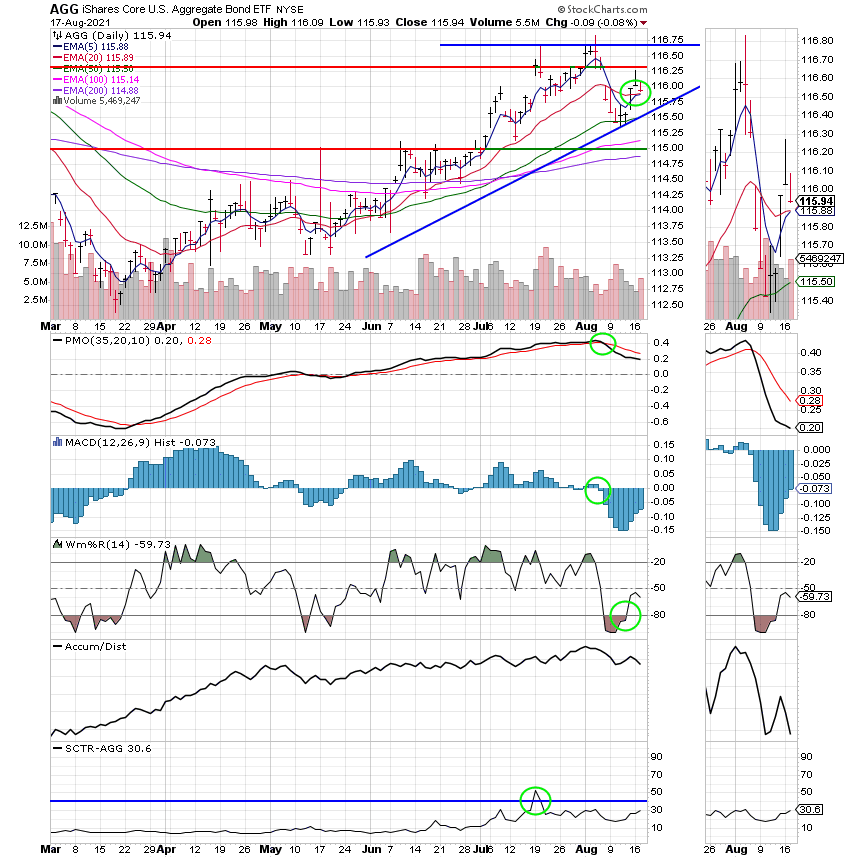

Good Evening, The market has been setting record after record as the major indices have continued to rise despite concerns about the global economic recovery and the delta strain of COVID 19. However, today markets took a double barreled shot with news that the worlds second largest economy China reported that retail sales in that country rose at an 8.5% clip year over year, which was slower than the 11.5% expectation and likely a reflection over fears about the Covid-19 delta variant. Adding to those concerns was a second report that said that Retail sales in the US declined 1.1% in July, a steeper drop than the 0.3% dip expected by economists surveyed by Dow Jones and a reversal from June’s 0.7% increase. Both reports raised concerns among investors about how global economic recovery is being affected by a rising number of cases of COVID 19 resulting from the delta variant. The important thing is that we’re in good shape right now, but as we mentioned in a couple of recent blogs there are storm clouds that have formed in front of us and the wind is starting to blow them a little closer. Our job is to monitor the market closely via our charts and not let things get out of hand if and when the selling starts in earnest. I do not believe a significant pullback will occur until September but that’s only a guess. The noise about the Fed starting to taper their monthly bond purchases is beginning to get louder. It is possible that they will announce some tapering as early as their September or October meeting. Recent employment reports have been strong and should they continue to improve at their current pace will likely result in the Fed making a move. As you know employment and inflation are two of the Feds main mandates. Inflation has already reached 3% which exceeds the Feds normal target for action of 2%, but as we have discussed many times lately they have agreed to let inflation run a little hotter than normal during the economic recovery from the pandemic. Fed Chairman Jerome Powell has stated many times recently that he believes that the inflation is transitory and will moderate at some time in the future. That is the reason that they have not raised interest rates heretofore. Employment is another story. Current unemployment is somewhere in the 5.4% range. I am not an economist but I think 5% unemployment is considered full employment, at least for the purpose of the Fed. So the closer we get to 5% the less need there is for economic stimulus. Thus, the Fed will taper soon if employment continues to increase at the current rate. I am already on record as saying that I believe the announcement of tapering will be the catalyst for the next major selloff. The main factors that can speed up or delay a decision to taper are economic reports like we had today. The bottom line is that if the Fed sees the rate of the economic recovery slowing for Covid 19 or any other reason they will not begin to taper. So to put it all in a nutshell the things that will determine what the Fed will do are the unemployment rate and the pace of the economic recovery. Keep an eye on those things and anything that effects them and you will pretty well know when the next selloff will be. It is important to keep your stops (selling points) tight in this type of market. We’ve had a good year and we want to keep as much of our profit as possible. REMEMBER “It’s not what you make that’s important. It’s what you keep!!!!”

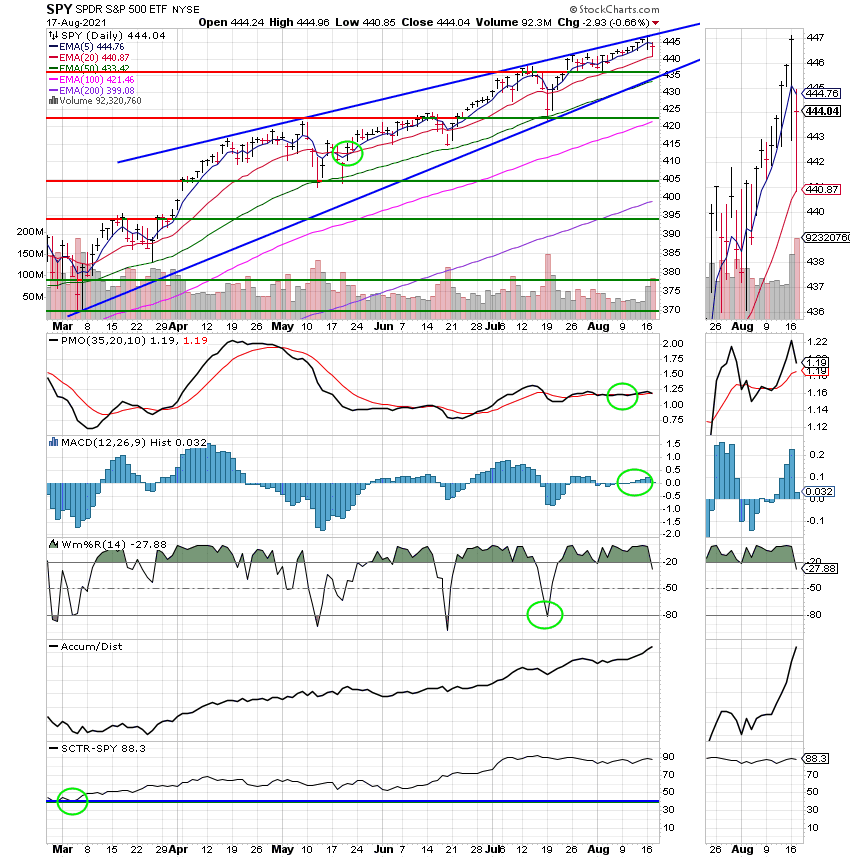

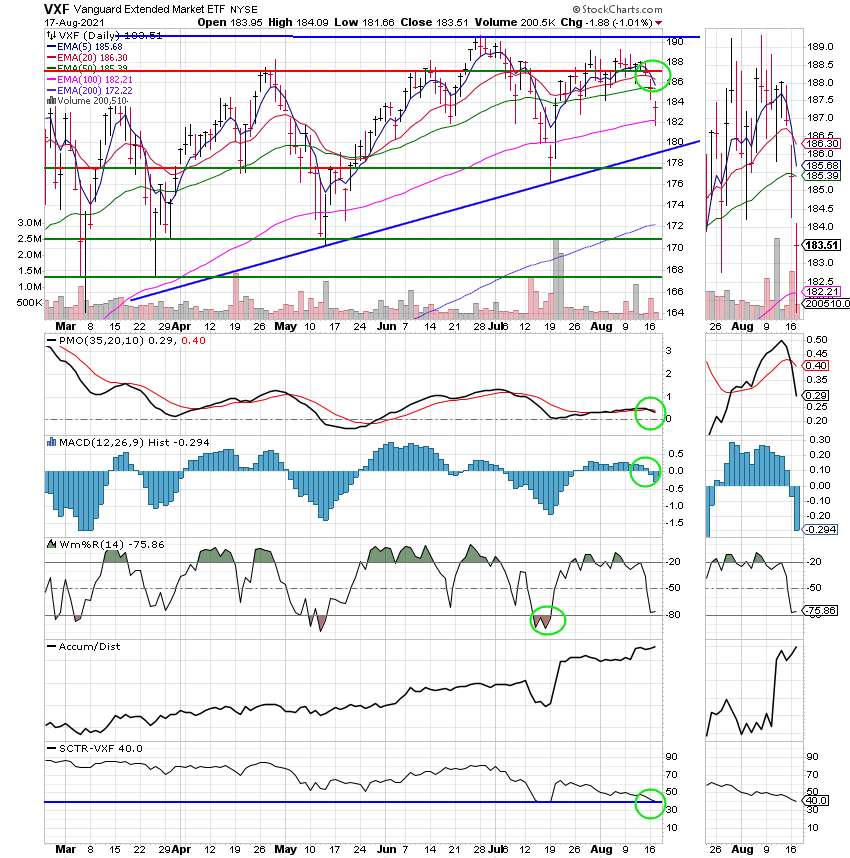

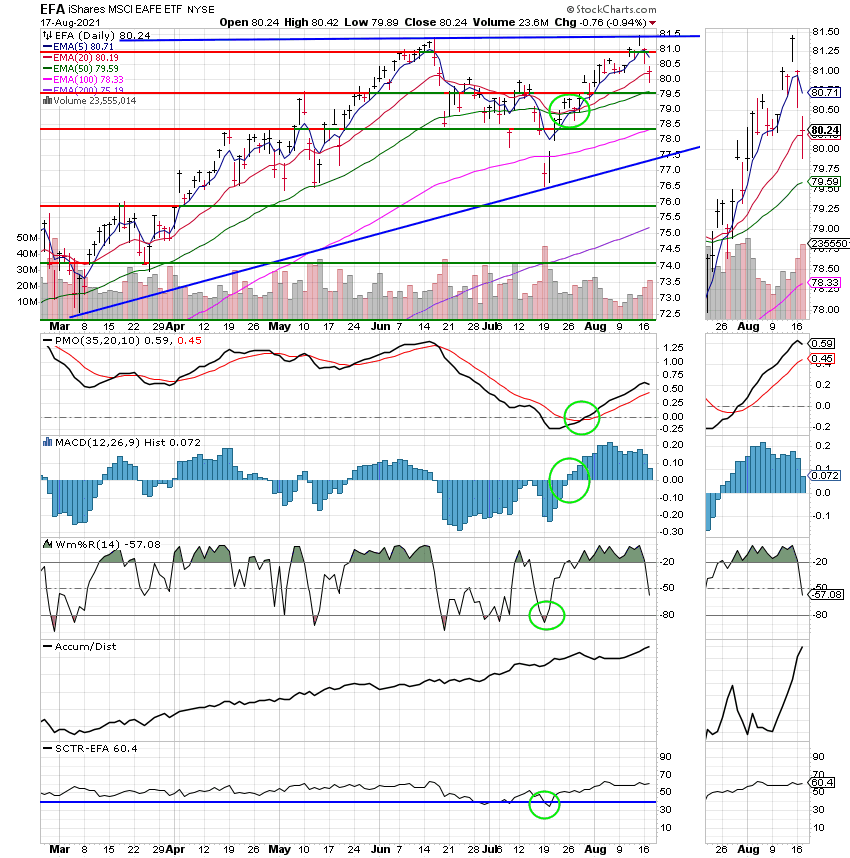

The days trading left us with the following results: Our TSP allotment fell -0.71%. For comparison, the Dow lost -0.79%, the Nasdaq-0.93%, and the S&P 500 -0.71%.

The days results left us with the following signals: C-Buy, S-Hold, I-Buy, F-Hold. We are currently invested at 100/C. Our allocation is now +17.82% for the year. Here are the latest posted results:

| 08/17/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.646 | 21.0618 | 66.8 | 83.2488 | 39.3236 |

| $ Change | 0.0006 | -0.0152 | -0.4708 | -0.8644 | -0.2667 |

| % Change day | +0.00% | -0.07% | -0.70% | -1.03% | -0.67% |

| % Change week | +0.01% | +0.03% | -0.44% | -1.90% | -1.34% |

| % Change month | +0.06% | -0.27% | +1.27% | -1.62% | +1.23% |

| % Change year | +0.83% | -0.63% | +19.47% | +12.19% | +11.12% |