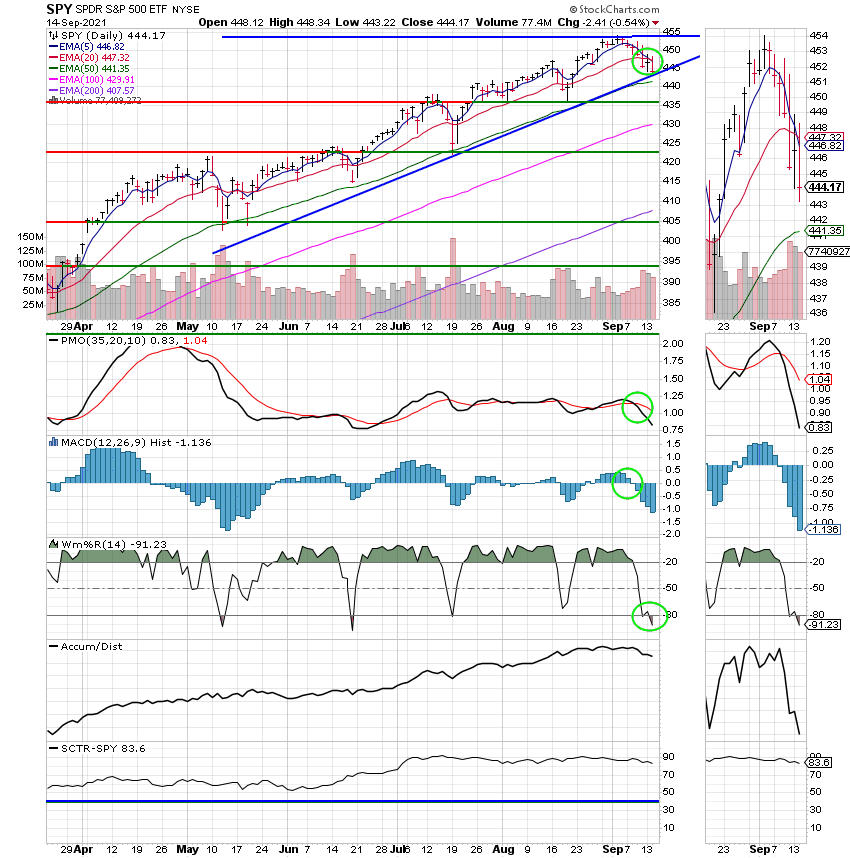

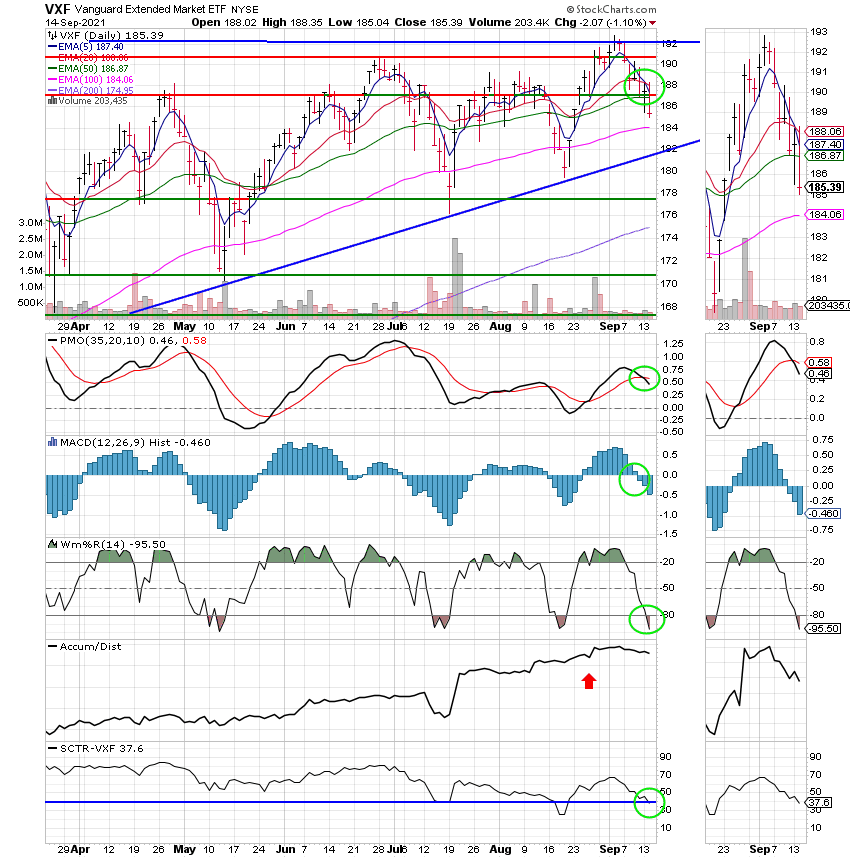

Good Evening, My 88 year old mother has been admitted to the hospital so I will keep this one short tonight. I covet your prayers for her. Those of you in the military will know what I mean when I say she was a good military wife. The market initially rallied in the morning session when the consumer price index came in less than expected by economists but fell in the afternoon session as has become a pattern in recent days. The choppy trading has been attributed by many as seasonal pressure since September is traditionally the worst month for stocks with an average decline of 0.56% in the month dating back to 1945, according to CFRA. There are many additional things leading to the choppiness as well such as the prospect of tax hikes by the Democrats and tapering of bond purchases by the Fed. Lets get straight to the point. I am watching the charts carefully and the current pressure as you well know is no surprise to us. We decided to stay the course with equities as the reaction to Fed Chairman Powell’s taper announcement was much milder than we had anticipated. The majority of our charts while calling for a dip in the short term are calling for the market to continue to rise in the long term. That said we are long term investors so we remain invested at 100/C. I will add one more thing though. We are closely watching the performance of the I fund and will consider adding some exposure there if the fund continues it’s current progress. We will see…..

The days trading left us with the following results: Our TSP allotment finished the day in the red at -0.57%. For comparison, the Dow dropped -0.84%, the Nasdaq -0.45%, and the S&P 500 -0.57%.

The days action left us with the following signals: C-Hold, S-Hold, I-Buy, F-Buy. We are currently invested at 100/C. Our allocation is now +14.51% for the year. Here are the latest posted results:

| 09/14/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6625 | 21.1552 | 66.8144 | 84.1786 | 39.945 |

| $ Change | 0.0006 | 0.0536 | -0.3693 | -0.8422 | -0.0858 |

| % Change day | +0.00% | +0.25% | -0.55% | -0.99% | -0.21% |

| % Change week | +0.02% | +0.40% | -0.32% | -0.81% | +0.40% |

| % Change month | +0.05% | +0.36% | -1.69% | -2.47% | +1.05% |

| % Change year | +0.93% | -0.19% | +19.50% | +13.45% | +12.87% |